Online Sales Tax Revision: Marketplace Fairness Act Introduced

A bipartisan group of 10 U.S. senators has introduced the Marketplace Fairness Act, which would grant states the authority to compel online retailers to collect sales taxes. The proposed legislation "seeks to both ensure that online retailers are collecting taxes while dealing with concerns raised by smaller e-tailers who claim they would be unfairly impacted by previously suggested regulations. The proposed law would exempt online sellers whose annual sales are less than $500,000," the Consumerist reported.

A bipartisan group of 10 U.S. senators has introduced the Marketplace Fairness Act, which would grant states the authority to compel online retailers to collect sales taxes. The proposed legislation "seeks to both ensure that online retailers are collecting taxes while dealing with concerns raised by smaller e-tailers who claim they would be unfairly impacted by previously suggested regulations. The proposed law would exempt online sellers whose annual sales are less than $500,000," the Consumerist reported.

During the summer, Illinois Senator Dick Durbin and several Democratic colleagues introduced the Main Street Fairness Act (Shelf Awareness, August 2, 2011), but it "went nowhere," the Seattle Times wrote, calling the new measure "compromise legislation" that includes five Republicans as co-sponsors. Although the proposed bill "seeks to preempt previous opposition from online auction site eBay by exempting small online vendors from collecting the taxes," eBay's initial response did not appear to be encouraging.

"This is another Internet sales tax bill that fails to protect small business retailers using the Internet and will unbalance the playing field between giant retailers and small business competitors," said Tod Cohen, the company's v-p for government relations. "It does not make sense to expand Internet sales tax burdens on small businesses at a time when we want entrepreneurs to create jobs and economic activity.”

Amazon, however, reacted positively. Paul Misener, the company's v-p, global public policy, said, "Amazon strongly supports enactment of the Enzi-Durbin-Alexander bill and will work with Congress, retailers, and the states to get this bipartisan legislation passed."

National Retail Federation president and CEO Matthew Shay also welcomed the introduction of the Marketplace Fairness Act: "In a 21st Century retail industry, we ought to have a 21st Century system to ensure uniform collection of sales tax.... With three bills offered in just over three months, Congress has gotten the message and is ready to act. As the industry that employs one out of every four Americans, we are determined to help make this goal become reality."

Amanda Hocking, author of the My Blood Approves series and the Trylle Trilogy, became the second self-published author--along with John Locke--to qualify for Amazon's Kindle Million Club. David Baldacci and Stephenie Meyer also joined the increasingly non-exclusive gathering of writers who have sold more than a million paid copies of their books on Kindle.

Amanda Hocking, author of the My Blood Approves series and the Trylle Trilogy, became the second self-published author--along with John Locke--to qualify for Amazon's Kindle Million Club. David Baldacci and Stephenie Meyer also joined the increasingly non-exclusive gathering of writers who have sold more than a million paid copies of their books on Kindle.  Beginning in 2012, the foundation plans to include the book industry as a whole in its efforts, starting with booksellers at "major book retailers and independent bookstores" nationwide. To reflect these changes, the group will be renamed the Book Industry Charitable Foundation (BInC), though it will operate under both names for the next 12 months.

Beginning in 2012, the foundation plans to include the book industry as a whole in its efforts, starting with booksellers at "major book retailers and independent bookstores" nationwide. To reflect these changes, the group will be renamed the Book Industry Charitable Foundation (BInC), though it will operate under both names for the next 12 months.  Taschen's newest "shop within a shop" is located in the

Taschen's newest "shop within a shop" is located in the  Last Saturday, Modern Myths, the comics and graphic novel store in Northampton, Mass., hosted a launch party for Broken by Susan Jane Bigelow (Candlemark & Gleam). Here (from l.), Candlemark & Gleam editor-in-chief Kate Sullivan, Modern Myths general manager Mike Gendreau and Bigelow.

Last Saturday, Modern Myths, the comics and graphic novel store in Northampton, Mass., hosted a launch party for Broken by Susan Jane Bigelow (Candlemark & Gleam). Here (from l.), Candlemark & Gleam editor-in-chief Kate Sullivan, Modern Myths general manager Mike Gendreau and Bigelow.

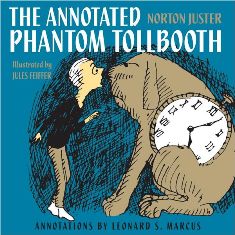

The collaborators met while taking out the trash in the Brooklyn brownstone that they both called home. They immediately discovered they were of like minds. Juster took a slight detour from his plan to become an architect, thanks to a grant from the Ford Foundation. He began writing a story littered with puns that evolved into The Phantom Tollbooth. He credits his father as the big influence on the punning. When he had about 50 pages, Feiffer's wife offered to give them to her editor--Jason Epstein. "Jules started drawing little pictures," said Juster. "They were so good, the publisher couldn't ignore them." Feiffer added, "Norman's book had a wit that seemed to be an extension of our normal conversation. It seemed to be a natural that I would play with it." Juster tried to stump Feiffer at times, forcing him to draw horses, which Feiffer felt he was not good at, and Feiffer got his revenge by drawing Juster as the weatherman. "It was a game within a game," Juster said.

The collaborators met while taking out the trash in the Brooklyn brownstone that they both called home. They immediately discovered they were of like minds. Juster took a slight detour from his plan to become an architect, thanks to a grant from the Ford Foundation. He began writing a story littered with puns that evolved into The Phantom Tollbooth. He credits his father as the big influence on the punning. When he had about 50 pages, Feiffer's wife offered to give them to her editor--Jason Epstein. "Jules started drawing little pictures," said Juster. "They were so good, the publisher couldn't ignore them." Feiffer added, "Norman's book had a wit that seemed to be an extension of our normal conversation. It seemed to be a natural that I would play with it." Juster tried to stump Feiffer at times, forcing him to draw horses, which Feiffer felt he was not good at, and Feiffer got his revenge by drawing Juster as the weatherman. "It was a game within a game," Juster said. Several independent bookstores nationwide will celebrate Veteran's Day with a Grove Press promotion offering free copies of indie favorite Matterhorn by Karl Marlantes. Beginning this Friday and continuing through the weekend, participating stores are displaying copies of What It Is Like to Go to War and Matterhorn. Customers who buy War will receive a free copy of Matterhorn.

Several independent bookstores nationwide will celebrate Veteran's Day with a Grove Press promotion offering free copies of indie favorite Matterhorn by Karl Marlantes. Beginning this Friday and continuing through the weekend, participating stores are displaying copies of What It Is Like to Go to War and Matterhorn. Customers who buy War will receive a free copy of Matterhorn.

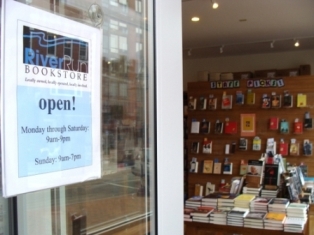

Inspired by the current challenges facing RiverRun Bookstore, Portsmouth, N.H.--as well as many other indies--Nichole Bernier has proposed a monthly

Inspired by the current challenges facing RiverRun Bookstore, Portsmouth, N.H.--as well as many other indies--Nichole Bernier has proposed a monthly  We don't want to pirate from purchases that would be made at folks' own local indies. But well, don't the people who read this blog probably buy more than one book a month, and books as gifts? What if on the 15th of the month, we bought book from that store, long-distance, and urged others to do it, too?"

We don't want to pirate from purchases that would be made at folks' own local indies. But well, don't the people who read this blog probably buy more than one book a month, and books as gifts? What if on the 15th of the month, we bought book from that store, long-distance, and urged others to do it, too?" The Fort Lauderdale-Hollywood International Airport has partnered with Broward Country Library to offer

The Fort Lauderdale-Hollywood International Airport has partnered with Broward Country Library to offer  Jake Abel (The Lovely Bones; I Am Number Four; Percy Jackson and the Olympians: The Lightning Thief) is the "frontrunner" to play one of the two male lead roles in a movie version of Twilight author Stephenie Meyer's

Jake Abel (The Lovely Bones; I Am Number Four; Percy Jackson and the Olympians: The Lightning Thief) is the "frontrunner" to play one of the two male lead roles in a movie version of Twilight author Stephenie Meyer's  "

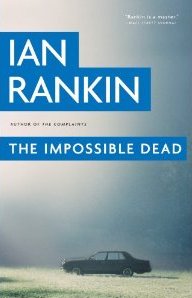

" Inspector Malcolm Fox of the Complaints (aka Internal Affairs) of the Edinburgh police department is sent to nearby Kirkcaldy to conduct what at first appears to be a straightforward investigation of police misconduct. Three members of the Kirkcaldy force may have conspired to hide evidence concerning the comings and goings of a fellow officer later found to have been, in general, a bad, bad cop. Inspector Fox and two colleagues are to provide a report of their findings in quick order to the Kirkcaldy police department, whose own Complaints crew has not been given the assignment due to various conflicts of interest. The existence of such conflicts is the first red flag to the team from Edinburgh.

Inspector Malcolm Fox of the Complaints (aka Internal Affairs) of the Edinburgh police department is sent to nearby Kirkcaldy to conduct what at first appears to be a straightforward investigation of police misconduct. Three members of the Kirkcaldy force may have conspired to hide evidence concerning the comings and goings of a fellow officer later found to have been, in general, a bad, bad cop. Inspector Fox and two colleagues are to provide a report of their findings in quick order to the Kirkcaldy police department, whose own Complaints crew has not been given the assignment due to various conflicts of interest. The existence of such conflicts is the first red flag to the team from Edinburgh.