B&N: Nook Download?; Holiday Sales

Barnes & Noble yesterday reported generally strong holiday sales, said it plans to report Nook results separately--and surprised the business by saying it is pursuing "strategic exploratory work to separate the Nook business."

Barnes & Noble yesterday reported generally strong holiday sales, said it plans to report Nook results separately--and surprised the business by saying it is pursuing "strategic exploratory work to separate the Nook business."

The spinoff of Barnes & Noble's digital business from the print and bricks-and-mortar part of the company is intended "to capitalize on the rapid growth of the Nook digital business and its favorable leadership position in the expanding market for digital content." Presumably B&N is dissatisfied with its stock price, which fell another 17% yesterday, to $11.24, near its 52-week low of $10.30, because the company now predicts higher losses than forecast.

B&N CEO William Lynch put the move this way: "We see substantial value in what we've built with our Nook business in only two years, and we believe it's the right time to investigate our options to unlock that value. We've established one of the world's best retail platforms for the sale of digital copyright content. We have a large and growing installed base of millions of satisfied customers buying digital content from us, and we have a Nook business that's growing rapidly year-over-year and should be approximately $1.5 billion in comparable sales this fiscal year."

But the move mystified many observers, in part because Barnes & Noble has maintained that the stores have been key in selling the Nook, particularly for hesitant customers, and in part because it would put the traditional part of B&N right back where it was several years ago: a national chain of bookstores without a digital strategy, eerily similar to the situation at longtime competitor Borders, which collapsed last year.

Several observers noted that the spinoff tactic is typical for John Malone, the cable titan who last year bought 16.6% of B&N and had two representatives of his company, Liberty Media, installed on the board. In an interview with the New York Times, Lynch said there is "increased appetite" from the board to increase the Nook's value. In addition, many have forgotten that B&N chairman and founder Len Riggio has a history of either buying or creating companies, spinning them off and then buying them back, including B&N College and B&N.com, as well as Gamestop and other game retailers.

Several observers noted that the spinoff tactic is typical for John Malone, the cable titan who last year bought 16.6% of B&N and had two representatives of his company, Liberty Media, installed on the board. In an interview with the New York Times, Lynch said there is "increased appetite" from the board to increase the Nook's value. In addition, many have forgotten that B&N chairman and founder Len Riggio has a history of either buying or creating companies, spinning them off and then buying them back, including B&N College and B&N.com, as well as Gamestop and other game retailers. In related news, B&N confirmed that it is "in discussions with strategic partners, including publishers, retailers, and technology companies in international markets, that may lead to expansion of the Nook business abroad."

In related news, B&N confirmed that it is "in discussions with strategic partners, including publishers, retailers, and technology companies in international markets, that may lead to expansion of the Nook business abroad."

---

During the nine-week holiday period, B&N store sales rose 2.5%, to $1.2 billion, and sales at stores open at least a year were up 3.4%.

B&N described book sales, which rose 4%--the first gain in five years (!)--as "strong overall, fueled by strength across multiple categories." Children's books were "exceptionally strong," led by The Hunger Games, Diary of a Wimpy Kid: Cabin Fever, Inheritance and The LEGO Ideas Book. There was also a "significant crossover between physical and digital book sales," including the books on which several major holiday movies were based: The Help, The Girl with the Dragon Tattoo and War Horse.

Toys and games rose 30%, following a 48% gain last year.

B&N said it "continues to benefit from a consolidating physical book market." It estimated that the sales gain from the closing of Borders is between $200 million and $230 million.

---

At the same time, Nook sales in the holiday season rose 70% over last year. The company said sales of the Nook Tablet "exceeded expectations, while sales of Nook Simple Touch lagged expectations, indicating a stronger customer preference for color devices."

Digital content sales--which include digital books, digital newsstand and apps--rose 113%. B&N predicted final digital content sales to be approximately $450 million.

Sales at B&N.com rose 43%, to $327 million, mainly because of the continued growth of Nook sales. At the same time, traditional book sales through B&N.com have declined.

Nook business throughout B&N rose 43%, to $448 million. "A substantial portion" of the Nook's sales increase came from non-B&N sellers, including Best Buy, Books-A-Million and other retailers.

---

B&N predicted that digital content sales this year will be $450 million and that consolidated sales will be between $7 billion and $7.2 billion. Sales at B&N stores should increase 1%, B&N College is expected to be flat and B&N.com sales should rise 40%-50%.

But the company predicted losses of $1.10-$1.40 a share, at least double its earlier forecast, leading to the precipitous stock drop yesterday.

SHELFAWARENESS.1222.S1.BESTADSWEBINAR.gif)

U.S. retailers "salvaged their December sales figures with deep discounts," but the aftereffects "could spell trouble for the coming year for both the industry and the economy at large," the New York Times reported. Thomson Reuters said

U.S. retailers "salvaged their December sales figures with deep discounts," but the aftereffects "could spell trouble for the coming year for both the industry and the economy at large," the New York Times reported. Thomson Reuters said

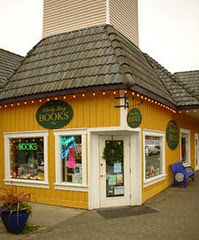

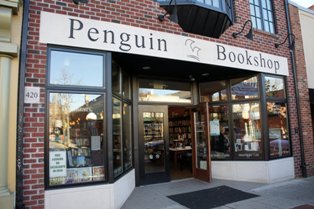

"We like to keep it local, and our bestselling books of the season were no exception," said Libby Cowles, community relations manager at

"We like to keep it local, and our bestselling books of the season were no exception," said Libby Cowles, community relations manager at  At

At

Although its sales results may not rival Amazon's Kindle or B&N's Nook, Kobo reported record numbers for the holiday season, increasing its e-reader customer base to 10 times the pre-holiday total, with "hundreds of thousands of devices" having been activated each day since Christmas Eve to fuel the highest e-book download rate in the company's history.

Although its sales results may not rival Amazon's Kindle or B&N's Nook, Kobo reported record numbers for the holiday season, increasing its e-reader customer base to 10 times the pre-holiday total, with "hundreds of thousands of devices" having been activated each day since Christmas Eve to fuel the highest e-book download rate in the company's history.  Calling it "a surprise development," paidContent reported that

Calling it "a surprise development," paidContent reported that  The Nebraska Book Company, which filed for Chapter 11 bankruptcy last year as part of an effort to restructure debt (

The Nebraska Book Company, which filed for Chapter 11 bankruptcy last year as part of an effort to restructure debt (

Rishel posed some "fundamental questions publishers need to give serious thought to," including: "Do you foresee a viable role for bricks-and-mortar bookstores? And do you see a continuing need for hardback and trade paperback books?... If a publisher is able to answer yes to these questions, then it needs to consider this one: What policies and distribution systems--and changes to current ones--are needed to maintain the economic well-being of bookstores?"

Rishel posed some "fundamental questions publishers need to give serious thought to," including: "Do you foresee a viable role for bricks-and-mortar bookstores? And do you see a continuing need for hardback and trade paperback books?... If a publisher is able to answer yes to these questions, then it needs to consider this one: What policies and distribution systems--and changes to current ones--are needed to maintain the economic well-being of bookstores?" Teicher addressed the issues raised by Rishel and observed: "We at ABA believe that readers and book buyers will continue to find in bookstores an unmatched venue for discovery, connection, and enjoyment--and that this will translate into sales for bricks-and-mortar stores. We have seen the inventory mix in bookstores continue to evolve--encompassing more gift and sidelines selections than a decade ago--but a bookstore's shelves are still an essential, and unduplicated, bridge between the unique creation of the writer's talent and a reader's inquiring mind.... This inventory evolution includes, for some of our member stores, the selling of e-books. The sales of e-readers, tablets, and e-books underscore that the era of digital content has arrived."

Teicher addressed the issues raised by Rishel and observed: "We at ABA believe that readers and book buyers will continue to find in bookstores an unmatched venue for discovery, connection, and enjoyment--and that this will translate into sales for bricks-and-mortar stores. We have seen the inventory mix in bookstores continue to evolve--encompassing more gift and sidelines selections than a decade ago--but a bookstore's shelves are still an essential, and unduplicated, bridge between the unique creation of the writer's talent and a reader's inquiring mind.... This inventory evolution includes, for some of our member stores, the selling of e-books. The sales of e-readers, tablets, and e-books underscore that the era of digital content has arrived." Chelsea Green Publishing has signed up five independent commission groups to represent its books to the trade. This is the first time since 2006 that the company has had independent trade representation. The in-house sales team has been reorganized by channel rather than territory and will manage and expand the consignment program, manage the commission staff and handle special sales and digital sales.

Chelsea Green Publishing has signed up five independent commission groups to represent its books to the trade. This is the first time since 2006 that the company has had independent trade representation. The in-house sales team has been reorganized by channel rather than territory and will manage and expand the consignment program, manage the commission staff and handle special sales and digital sales. The World of Downton Abbey by Jessica Fellowes (St. Martin's Press, $29.99, 9781250006349), a collection of photos and text that details both the trappings of life on a country estate in the Edwardian period and the efforts of the shows to create such an estate. Fellowes is a journalist, former deputy editor of Country Life and niece of Julian Fellowes, writer and creator of Downton Abbey.

The World of Downton Abbey by Jessica Fellowes (St. Martin's Press, $29.99, 9781250006349), a collection of photos and text that details both the trappings of life on a country estate in the Edwardian period and the efforts of the shows to create such an estate. Fellowes is a journalist, former deputy editor of Country Life and niece of Julian Fellowes, writer and creator of Downton Abbey. Lady Almina and the Real Downton Abbey: The Lost Legacy of Highclere Castle by the Countess of Carnarvon (Broadway, $15.99, 9780770435622) tells the story of the family that inspired the series. The character of Lady Cora Grantham (portrayed by Elizabeth McGovern) was patterned on Almina de Rothschild, whose American industrialist father married her off to the Earl of Carnarvon. In a typical money-for-title transaction, the impoverished Earl received a dowry large enough to maintain his ancestral home and fund his passion for archaeological digs and young Almina acquired the title "lady" and the social status that went with it. Their home, Highclere Castle, is the setting for Downton Abbey. The book is by the current Countess of Carnarvon and draws on the archives of Highclere Castle.

Lady Almina and the Real Downton Abbey: The Lost Legacy of Highclere Castle by the Countess of Carnarvon (Broadway, $15.99, 9780770435622) tells the story of the family that inspired the series. The character of Lady Cora Grantham (portrayed by Elizabeth McGovern) was patterned on Almina de Rothschild, whose American industrialist father married her off to the Earl of Carnarvon. In a typical money-for-title transaction, the impoverished Earl received a dowry large enough to maintain his ancestral home and fund his passion for archaeological digs and young Almina acquired the title "lady" and the social status that went with it. Their home, Highclere Castle, is the setting for Downton Abbey. The book is by the current Countess of Carnarvon and draws on the archives of Highclere Castle.

Book you've faked reading:

Book you've faked reading: A period of global economic turmoil may not the best time to read At Last, the final novel of Edward St. Aubyn's superb quintet of novels chronicling the sort of aristocratic dissolution that Britain is famous for. Can anyone these days really understand or care about the troubles of a family who "had a good run," lasting "six generations with every single descendant... essentially idle?" But strip away all the money, and St. Aubyn's fictional Melrose family--with its history of child abuse, rape, murder, addiction and bad marriage--still possesses a little something that touches almost everyone. It's just that the introspective, ironic, sensitive Patrick Melrose has had to bear all of it... and, well, he was bound to have a messy life.

A period of global economic turmoil may not the best time to read At Last, the final novel of Edward St. Aubyn's superb quintet of novels chronicling the sort of aristocratic dissolution that Britain is famous for. Can anyone these days really understand or care about the troubles of a family who "had a good run," lasting "six generations with every single descendant... essentially idle?" But strip away all the money, and St. Aubyn's fictional Melrose family--with its history of child abuse, rape, murder, addiction and bad marriage--still possesses a little something that touches almost everyone. It's just that the introspective, ironic, sensitive Patrick Melrose has had to bear all of it... and, well, he was bound to have a messy life.

Many of the communications from indies that hit my inbox during this holiday season were inviting their communities to buy e-books for new devices (and old, of course); to explore the new

Many of the communications from indies that hit my inbox during this holiday season were inviting their communities to buy e-books for new devices (and old, of course); to explore the new  Consider a digital ancestor of e-books. During the mid-1990s, Voyager introduced a collection of interactive multimedia CD-ROM products, ranging widely from

Consider a digital ancestor of e-books. During the mid-1990s, Voyager introduced a collection of interactive multimedia CD-ROM products, ranging widely from