B&N Second Quarter: Comp-Store Sales Up 1.8%

In the second quarter ended October 27, consolidated revenues at Barnes & Noble fell 0.4%, to $1.9 billion, and the net gain was $2.2 million compared to a net loss of $6.6 million in the same period a year ago. But after several dividend charges, the net basic loss was 4 cents a share, down from 17 cents a year earlier, but close to analysts' estimates of 3 cents a share. Analysts had also predicted flat revenue.

In the second quarter ended October 27, consolidated revenues at Barnes & Noble fell 0.4%, to $1.9 billion, and the net gain was $2.2 million compared to a net loss of $6.6 million in the same period a year ago. But after several dividend charges, the net basic loss was 4 cents a share, down from 17 cents a year earlier, but close to analysts' estimates of 3 cents a share. Analysts had also predicted flat revenue.

Sales at B&N stores open at least a year, excluding Nook products, rose 1.8% in the quarter. Sales at B&N College stores open at least a year fell 0.5%.

Revenues at B&N bookstores and B&N.com fell 3%, to $996 million, because of "flat comparable store sales, store closures and lower BN.com sales. During the quarter, the company began to cycle against the favorable impact of the Borders liquidation a year ago."

Sales at B&N College rose 0.4%, to $773 million, "led by new store growth."

Nook sales, including e-readers, e-books and accessories, rose 6%, to $160 million. Digital content sales, including e-books, digital newsstand and the apps business, rose 38%. The company continued to make high investments in product development and international expansion.

Commenting on business Thanksgiving weekend, B&N said sales at retail stores open at least a year, excluding the Nook, declined slightly "in line with company expectations." At the same time, Nook unit sales doubled, "driven by increased promotional activity at channel partners, particularly Walmart and Target."

CEO William Lynch noted that the company "completed the formation of our promising Nook Media subsidiary and closed our investment from Microsoft. We expect our two highly acclaimed new Nook products, and our Microsoft partnership on Windows 8 to further fuel the growth of our digital business, and are encouraged by the promising start to the holidays in our retail and digital businesses."

Amazon will launch Amazon Publishing in Europe next year from its European headquarters in Luxembourg. Vicky Griffith, publisher of the company's West Coast Group, is relocating from Seattle in the new year to head the division as Amazon begins hiring a team of editors and marketers overseas.

Amazon will launch Amazon Publishing in Europe next year from its European headquarters in Luxembourg. Vicky Griffith, publisher of the company's West Coast Group, is relocating from Seattle in the new year to head the division as Amazon begins hiring a team of editors and marketers overseas. Amazon plans to add a

Amazon plans to add a

Noting the "prevalence of smartphones and reading devices," Osnos cited data from Chinese firm Analysys International, which claimed the country has more than 400 million mobile Internet users; and Irish Times Beijing correspondent Clifford Coonan, who recently reported that "almost half of Chinese adults read books in different forms and about 25% of readers--some 220 million people read electronic media. Of these, almost 120 million people use their mobile phone to read. And almost 25 million people only use their cellphones to read books."

Noting the "prevalence of smartphones and reading devices," Osnos cited data from Chinese firm Analysys International, which claimed the country has more than 400 million mobile Internet users; and Irish Times Beijing correspondent Clifford Coonan, who recently reported that "almost half of Chinese adults read books in different forms and about 25% of readers--some 220 million people read electronic media. Of these, almost 120 million people use their mobile phone to read. And almost 25 million people only use their cellphones to read books."  The U.K.'s Advertising Standards Authority has

The U.K.'s Advertising Standards Authority has  "An Evening of Awesome," John and Hank Green's performance at New York's Carnegie Hall next month, has sold out--just 10 days after tickets went on sale. But don't be discouraged. For all you Nerdfighters out there, the brothers will livestream the performance, scheduled for January 15, at 7 p.m., via the

"An Evening of Awesome," John and Hank Green's performance at New York's Carnegie Hall next month, has sold out--just 10 days after tickets went on sale. But don't be discouraged. For all you Nerdfighters out there, the brothers will livestream the performance, scheduled for January 15, at 7 p.m., via the  BookPeople's Blog

BookPeople's Blog The Importance of Being Wicked

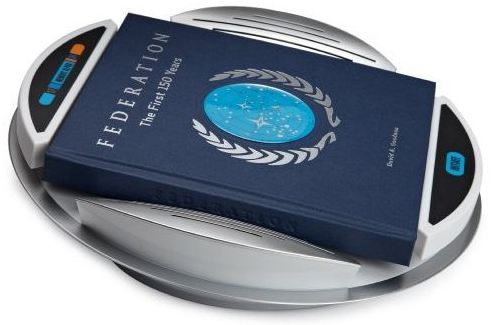

The Importance of Being Wicked Federation: The First 150 Years aims to impress Star Trek fans from the moment they take it out of the box: the book comes with its own pedestal, which contains a recorded message from Admiral Hikaru Sulu (George Takei) welcoming readers to this chronicle of the early years of the United Federation of Planets.

Federation: The First 150 Years aims to impress Star Trek fans from the moment they take it out of the box: the book comes with its own pedestal, which contains a recorded message from Admiral Hikaru Sulu (George Takei) welcoming readers to this chronicle of the early years of the United Federation of Planets.