G Asset Management Makes Another B&N Offer

On Friday, G Asset Management, which has made several offers to buy parts of Barnes & Noble, made another overture, saying it wanted to buy 51% of the company for $22 a share or buy 51% of Nook operations for $5 a share. The offer caused B&N stock to rise initially about 10%, but because of doubts about the relatively unknown G Asset's funding and seriousness, B&N's price fell and closed on Friday at $17.69, up 5.4%.

On Friday, G Asset Management, which has made several offers to buy parts of Barnes & Noble, made another overture, saying it wanted to buy 51% of the company for $22 a share or buy 51% of Nook operations for $5 a share. The offer caused B&N stock to rise initially about 10%, but because of doubts about the relatively unknown G Asset's funding and seriousness, B&N's price fell and closed on Friday at $17.69, up 5.4%.

Under the offer, B&N would be valued at about $1.3 billion. G Asset said that in November it had made an offer for B&N for $20 a share, which neither it nor the company made public. In February 2012, G Asset indicated that it had bought a 5% stake in B&N. The next month it offered to buy 51% of B&N's college bookstore division, a move that went nowhere.

Besides financial roadblocks for G Asset, B&N has several major shareholders whose agreement would be required. Chairman Len Riggio owns an estimated third of the company, and Liberty Media owns 16.6%. In addition, Microsoft and Pearson own significant stakes in the Nook division.

Last year, Riggio ended a possible purchase of B&N's bookstore operations, and the company has cut back its Nook division and no longer talks about spinning off either the bookstore or Nook divisions.

After 31 years in business, the

After 31 years in business, the SHELFAWARENESS.1222.T1.BESTADSWEBINAR.gif)

Last week, our

Last week, our  Now we can reveal the Trust Fall title: The Martian by Andy Weir (Crown), which is currently ranked high on both the IndieBound and New York Times bestseller lists. At Fiction Addiction, "So far we've netted 62 copies of The Martian, most of which were done through the Trust Fall promotion," said Hendrix. "We've had one return by one of my older female customers who is also a minister's wife. I was expecting that return and possibly one other from the moment the customers purchased."

Now we can reveal the Trust Fall title: The Martian by Andy Weir (Crown), which is currently ranked high on both the IndieBound and New York Times bestseller lists. At Fiction Addiction, "So far we've netted 62 copies of The Martian, most of which were done through the Trust Fall promotion," said Hendrix. "We've had one return by one of my older female customers who is also a minister's wife. I was expecting that return and possibly one other from the moment the customers purchased."  A group of

A group of  In 1942, Socorro Ramos and her husband, Jose, opened a small bookstall in an old section of downtown Manila. "Who opens a bookstore during a war?" asked Mitch Albom in a Detroit Free Press

In 1942, Socorro Ramos and her husband, Jose, opened a small bookstall in an old section of downtown Manila. "Who opens a bookstore during a war?" asked Mitch Albom in a Detroit Free Press  The

The  The Hugo Marston novels

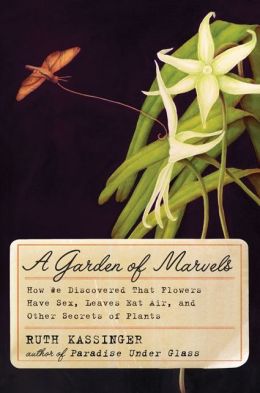

The Hugo Marston novels Ruth Kassinger (Paradise Under Glass) was frustrated by the kinds of mishaps with which many amateur gardeners are familiar: failures to thrive, unexplained deaths, mysterious midseason droopings. So she did what any reasonable science writer would do: research. How do plants really work? In hunting for a simple, layperson's guide to botany, however, she came up short. Particularly in seeking "the story of the first discoverers of the basic facts of plant life"--that is, a history of botany--she could find only scholarly texts for which "Botany 101 is definitely a prerequisite." From these frustrations was born the masterful, engaging A Garden of Marvels.

Ruth Kassinger (Paradise Under Glass) was frustrated by the kinds of mishaps with which many amateur gardeners are familiar: failures to thrive, unexplained deaths, mysterious midseason droopings. So she did what any reasonable science writer would do: research. How do plants really work? In hunting for a simple, layperson's guide to botany, however, she came up short. Particularly in seeking "the story of the first discoverers of the basic facts of plant life"--that is, a history of botany--she could find only scholarly texts for which "Botany 101 is definitely a prerequisite." From these frustrations was born the masterful, engaging A Garden of Marvels.