Borders on the Edge

Borders Group, which has suffered several years of sales declines, layoffs, store closings, a revolving door at the executive level, a plummeting stock price and unsuitable ownership, hit a new low this past week: the company began delaying payments to some suppliers, including at least several major publishers. Many people in the industry fear that the bookseller and its 676 stores might close--and cause a nasty ripple effect on the book business, which overall had its first solid holiday season in at least three years.

Borders Group, which has suffered several years of sales declines, layoffs, store closings, a revolving door at the executive level, a plummeting stock price and unsuitable ownership, hit a new low this past week: the company began delaying payments to some suppliers, including at least several major publishers. Many people in the industry fear that the bookseller and its 676 stores might close--and cause a nasty ripple effect on the book business, which overall had its first solid holiday season in at least three years.

Borders confirmed the delayed payments, saying that it is trying to refinance its debt, something it apparently has been doing since at least early December. It stated there is "no assurance" that the refinancing effort will be successful and that without refinancing it may violate credit agreements and "experience a liquidity shortfall."

According to reports, several publishers and distributors, including National Book Network, have stopped shipping to Borders. Among the companies still shipping are Ingram Content Group and Sourcebooks.

Ominously, the Borders crunch occurred after the holiday season, when retailers are usually flush with cash. Wall Street reacted strongly: last Friday, Borders stock fell 22%, to 90 cents a share, nearing its 52-week low of 85 cents, hit last January. The stock rebounded slightly yesterday, rising 6.6%, to 96 cents a share, during the day, but late news about the departure of two top Borders executives knocked the stock down to 85 cents in after-hours trading.

As noted in SEC filings yesterday, on Sunday, Thomas D. Carney resigned as executive v-p, general counsel and secretary. He had worked at Borders since 1994, starting as v-p, general counsel and secretary. And yesterday D. Scott Laverty resigned as senior v-p, chief information officer. He joined the company in 2009 after 25 years of experience in information systems and retail, including stints at IBM, Deloitte Consulting, PricewaterhouseCoopers and Ernst & Young.

Borders told the Wall Street Journal that the departures were part of its effort to improve liquidity, saying, "We have evaluated our leadership structure and, as a result, some positions have been eliminated."

Borders executives, including president and CEO Mike Edwards, are meeting with publishers this week, Borders told the New York Times. Spokesperson Mary Davis said, "We value our relationships with [publishers], which is why we're engaging in discussions with them. We're committed to working with our vendors as part of our overall effort to refinance."

Borders executives, including president and CEO Mike Edwards, are meeting with publishers this week, Borders told the New York Times. Spokesperson Mary Davis said, "We value our relationships with [publishers], which is why we're engaging in discussions with them. We're committed to working with our vendors as part of our overall effort to refinance."

Yesterday Publishers Weekly reported that proposed new refinancing "includes new money from a new bank" and asks publishers to take "a note in exchange for the missed payment from Borders." In addition, the chain wants "a bigger financial commitment to Borders's debt service from Bennett Lebow," Borders's chairman and largest shareholder.

While Borders has not released holiday sales figures, its most recent quarterly report was disastrous and continued the company's downward trends (Shelf Awareness, December 10, 2010). In the third quarter ended October 30, sales at Borders fell 17.6%, to $470.9 million, and the net loss nearly doubled to $74.5 million. Comp-store sales were off 12.6%. At the end of the quarter, Borders's trade accounts payable amounted to $444.9 million. The company's short-term borrowings and the current portion of long-term debt totaled $298.4 million, long-term debt was $55.8 million and other long-term liabilities were $346.9 million.

According to Reuters, Standard & Poor's analyst Michael Souers downgraded Borders to "sell" from "hold," saying that even if Borders manages to restructure its debt, the new terms would be "onerous."

The general Wall Street view was summed up by the Motley Fool, which wrote: "Borders stock is merely a highly speculative play, and the notion of its eventual and outright failure isn't a stretch of the imagination. Investors should avoid this stock and put their money to work in a company with a far more secure future."

---

Publishers Marketplace first reported last Thursday that Borders was holding up payment to some suppliers. A Wall Street Journal followup story on Friday stated that Hachette Group is one of the affected publishers. Hachette CEO David Young told the paper that the company has not decided whether to ship more books to Borders.

In the same story, Dominique Raccah, CEO of Sourcebooks, told the Journal that her company had not been notified by Borders of any delay in payment. Yesterday she told us that Sourcebooks is still shipping to Borders and wants "to get more information from Borders to plan a 2011 strategy." She added, "We obviously would like them to survive."

Yesterday the Wall Street Journal reported that Rowman & Littlefield has temporarily stopped shipping titles to Borders. "When a customer of that size calls you up and says you aren't getting a check, that's a piece of information you have to act on," Rowman & Littlefield CEO Jed Lyons told the paper.

Titles by publishers distributed by National Book Network, Rowman & Littlefield's sister company, are also not being shipped. Lyons said that NBN had told client publishers a year ago that if they wanted their books shipped to Borders, they would have to take the risk of nonpayment. Most clients said they wanted to continue selling to Borders.

Another major supplier told Shelf Awareness off the record that the company has been paid on time and is continuing to ship, albeit cautiously.

Sales at Barnes & Noble stores open at least a year rose 9.7% in the nine weeks ended January 1 and B&N bookstores had the largest retail sales day ever on Thursday, December 23, the company announced. B&N attributed the gain in large part to the Nook line. The company will offer more holiday sales information this Thursday.

Sales at Barnes & Noble stores open at least a year rose 9.7% in the nine weeks ended January 1 and B&N bookstores had the largest retail sales day ever on Thursday, December 23, the company announced. B&N attributed the gain in large part to the Nook line. The company will offer more holiday sales information this Thursday. The

iPad and Kindle may be coexisting peacefully and profitably, according

to a recent survey of approximately 1,000 consumers by JP Morgan's

Internet team, which revealed that 40% of iPad owners also own a Kindle.

The

iPad and Kindle may be coexisting peacefully and profitably, according

to a recent survey of approximately 1,000 consumers by JP Morgan's

Internet team, which revealed that 40% of iPad owners also own a Kindle.

The

The  In honor of that great literary event--the publication today of A Shore Thing by Nicole "Snooki" Polizzi (Gallery, $24, 9781451623741)--

In honor of that great literary event--the publication today of A Shore Thing by Nicole "Snooki" Polizzi (Gallery, $24, 9781451623741)-- In an open letter December 31, Susan E. Walker marked the end of her tenure as executive director of the Midwest Booksellers Association, which began in 1987. "While it's hard to depart from my position, from all of you in the MBA region, and from the Midwest as well, I'm not retiring and not saying goodbye completely," she wrote. "I'll still be working in the book industry, and I look forward to new opportunities to connect with many of you to sell more books!"

In an open letter December 31, Susan E. Walker marked the end of her tenure as executive director of the Midwest Booksellers Association, which began in 1987. "While it's hard to depart from my position, from all of you in the MBA region, and from the Midwest as well, I'm not retiring and not saying goodbye completely," she wrote. "I'll still be working in the book industry, and I look forward to new opportunities to connect with many of you to sell more books!" Between today and January 10, Kaplan Publishing is staging its second free e-book promotion, this time allowing consumers to download more than 130 e-books, including legal, medical, nursing, general educational and test prep books. The titles can be found on

Between today and January 10, Kaplan Publishing is staging its second free e-book promotion, this time allowing consumers to download more than 130 e-books, including legal, medical, nursing, general educational and test prep books. The titles can be found on  Some people in the business took pity on ailing Borders (see story above), if with tongue in cheek.

Some people in the business took pity on ailing Borders (see story above), if with tongue in cheek.

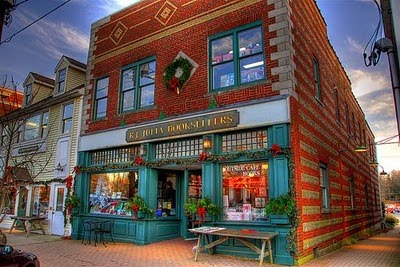

A week ago Monday, as much of the Northeast was digging out of a blizzard, R.J. Julia Booksellers, Madison, Conn., opened for five hours--"our hardy booksellers are strapping on their snowshoes," owner Roxanne Coady said in an e-mail--and offered other ways to browse: "If you would rather shop from the comfort of your fireside, we are offering a 15% Blizzard Discount on all online book purchases today only. Miss talking to our booksellers and getting personal book recommendations? Fear not, our intrepid twitterer, @rjjulia, can't wait to help you out!"

A week ago Monday, as much of the Northeast was digging out of a blizzard, R.J. Julia Booksellers, Madison, Conn., opened for five hours--"our hardy booksellers are strapping on their snowshoes," owner Roxanne Coady said in an e-mail--and offered other ways to browse: "If you would rather shop from the comfort of your fireside, we are offering a 15% Blizzard Discount on all online book purchases today only. Miss talking to our booksellers and getting personal book recommendations? Fear not, our intrepid twitterer, @rjjulia, can't wait to help you out!"

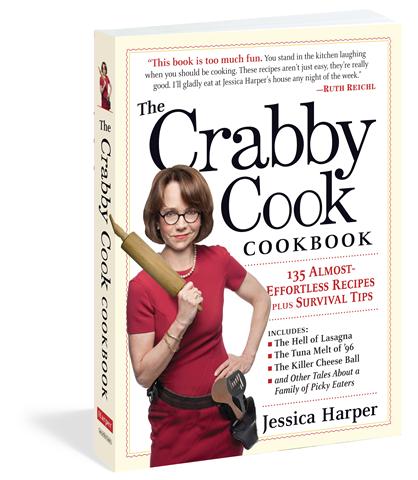

Like so many of us, actress

and author Jessica Harper made a big New Year's resolution--in her case, to be

a less crabby cook--which is especially challenging for her, considering that

she is the author of the new book

Like so many of us, actress

and author Jessica Harper made a big New Year's resolution--in her case, to be

a less crabby cook--which is especially challenging for her, considering that

she is the author of the new book  The recipe seemed simple enough, and I figured a big pot

would cover both the party and the family. But it turns out that peeling

butternut squash is like wrestling with a rock: it requires way too much upper

body exercise. I admit, I struggled to stay mellow. Midway through the second

squash, I stopped to rub my temples and speed-dial my masseuse.

The recipe seemed simple enough, and I figured a big pot

would cover both the party and the family. But it turns out that peeling

butternut squash is like wrestling with a rock: it requires way too much upper

body exercise. I admit, I struggled to stay mellow. Midway through the second

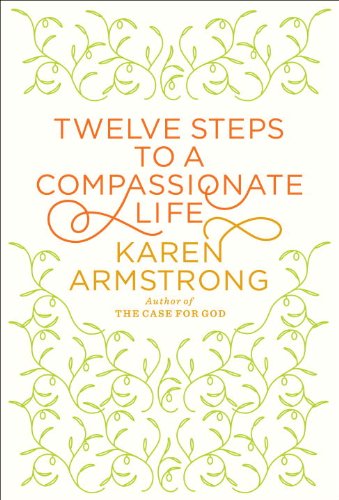

squash, I stopped to rub my temples and speed-dial my masseuse. January, the month of New Year's resolutions, has arrived. But this year, instead of heading to the gym or Weight Watchers, consider reading a book that may change fundamentally the way you regard the world and act in it. Former nun and distinguished historian of religion Karen Armstrong (A History of God) has written one that blends a sophisticated discussion of the concept of compassion in various faith traditions with elements of a conventional self-help manual.

January, the month of New Year's resolutions, has arrived. But this year, instead of heading to the gym or Weight Watchers, consider reading a book that may change fundamentally the way you regard the world and act in it. Former nun and distinguished historian of religion Karen Armstrong (A History of God) has written one that blends a sophisticated discussion of the concept of compassion in various faith traditions with elements of a conventional self-help manual.