Once again, Jack McKeown's presentation of the Verso Digital survey of consumer purchasing behavior was a highlight of the Winter Institute and reinforced the sense among indies that there are plenty of opportunities for bricks-and-mortar bookstores in the post-Borders, digital era. This year, the survey benefited from having data from the previous two years for comparisons.

Once again, Jack McKeown's presentation of the Verso Digital survey of consumer purchasing behavior was a highlight of the Winter Institute and reinforced the sense among indies that there are plenty of opportunities for bricks-and-mortar bookstores in the post-Borders, digital era. This year, the survey benefited from having data from the previous two years for comparisons.

McKeown, who is Verso's director of business development and was also at the Winter Institute as a bookseller--he is president of Books & Books Westhampton Beach, Westhampton Beach, N.Y.--emphasized that many in the business like to use Darwinian metaphors for what's happening in the book world, implying that the growth of e-books and e-book readers is a zero-sum game pitting print against digital and that the book business will follow the course of the music world, where most bricks-and-mortar music retailers have vanished.

But the findings of the Verso survey suggest a different model, McKeown said, one of symbiosis mirroring the situation of species who "depend on each other for survivability."

Among the findings:

- bookstores remain an important place for readers to discover new books

- indies' market share continues to lag behind indies' popularity

- most Borders customers were casual shoppers and are still "up for grabs"

- readers of all kinds split purchases between a variety of retailers, including indies, chains, big boxes and online

- e-reader device owners intend to buy almost as many printed books as e-books

- e-book purchases are increasingly across a range of categories, more and more resembling sales for printed books, and are less focused on certain categories such as mysteries and romance

- some readers are quite open to buying some kind of indie-branded e-reader device

- half of all readers do not want to use any kind of e-reader and there is no sign of a "killer" device--like the iPod in music--that would break through this resistance

Avid readers--those who purchase 10 or more books a year--tend to be older, female, wealthier and better educated--and represent 30.2% of the U.S. adult population, about 70 million people. "They are the market that's a driver for our industry," McKeown said. These avid readers buy books for a variety of reasons, including entertainment/relaxation (32%), education and self-improvement (22%) and for gifts (14%).

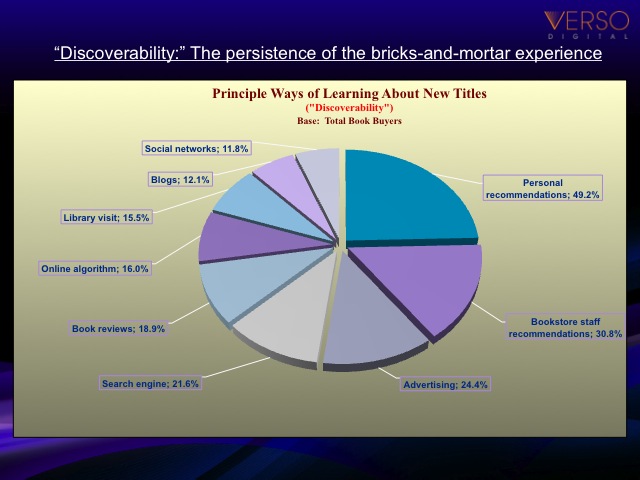

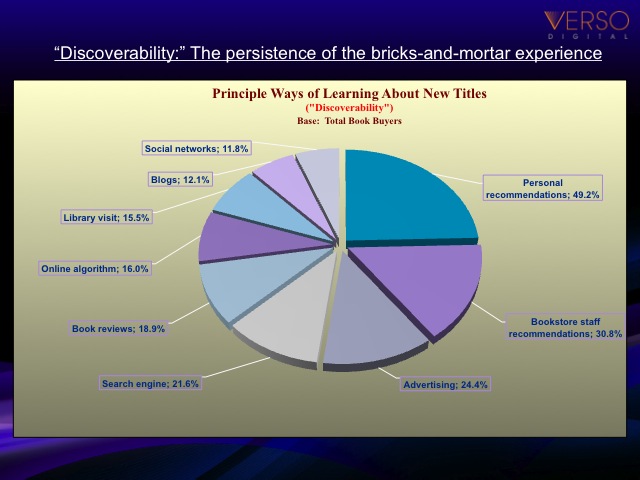

Readers find out about books mostly through personal recommendations (49.2%), bookstore staff recommendations (30.8%), advertising (24.4%), search engine searches (21.6%) and book reviews (18.9%). Much less important are online algorithms (16%), blogs (12.1%) and social networks (11.8%). These results "reaffirm the power and necessity of bricks-and-mortar stores and traditional marketing efforts," McKeown commented.

Another important finding that echoes previous Verso surveys is that the preferred places to shop for books are at independent bookstores (23%), chain bookstores (22%), online (21.1%) and big box stores (11.7%). At the moment, however, indies' greater "mind share" does not translate into equivalent market share, McKeown noted. (Indies' market share is usually estimated at about 8%.)

Among the reasons for that disconnect are that many readers have a habit of splitting their purchases between a variety of retailers and sometimes buy online after seeing a book in a store. All book buyers buy their books, in order, online (49%), at chain bookstores (42.7%), local indies (36%) and big box retailers (24.3%). Avid readers tend to buy even more online (65.5%) although avid readers buy almost as often at indies (47.5%) as at chain bookstores (51.4%).

A contributing problem is that only 44.9% of all readers live or work within 10 miles of an indie bookstore compared to 56% who live or work within 10 miles of a chain bookstore. This obviously "depresses visits to indies," McKeown noted.

Yet the situation offers independents opportunities, the biggest of which is for indies to focus on what McKeown called "the next sale." Because consumers' splitting of purchases between various retailers has become "ingrained behavior," indies should focus less on making readers indie-exclusive customers and more on converting some of the customers' purchases to indies--or the "next sale." "I contend that one reason Small Business Saturday [on the Saturday after Thanksgiving] was so effective was because it was geared to that next sale," McKeown said, adding that an "enormous payoff" can come from "changing a marginal pattern of behavior." Such efforts can be done at the local or national level.

A large section of the survey concerned Borders shoppers, whose loyalties are far from set. Some 60% of all book buyers shopped at Borders, and a majority of them were "occasional shoppers," with only 10.1% of them visiting Borders 10 or more times a year. Of those who have bought more at other places since Borders closed, they have shopped more online (36.1%), at other chain stores (27.2%) and indies (23.1%). But 60.7% of former Borders shoppers have not increased visits to other shopping locations, and are "in play," as McKeown put it. "The battle for market share for Borders customers is a battle for the occasional book shopper. Again it's all about the next sale opportunity."

He noted that business from former Borders customers will be disproportionately felt around such "gift-buying opportunities" as Christmas, graduation, Mother's and Father's Days and was likely a major factor in the boom in holiday sales at indies. McKeown recommended that indies "tie in with local event calendars" for these customers and offer special Saturday promotions.

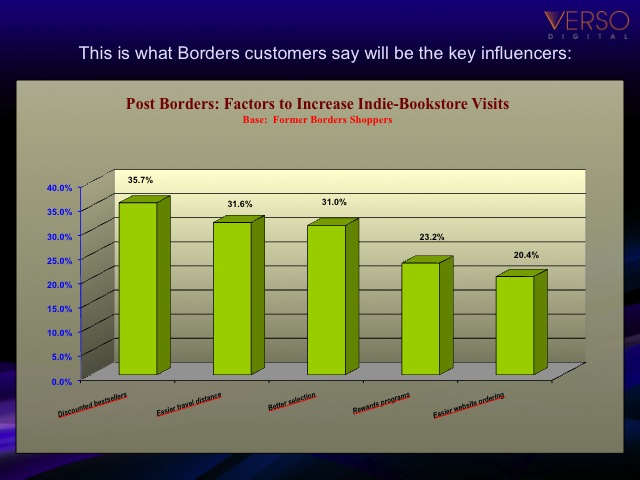

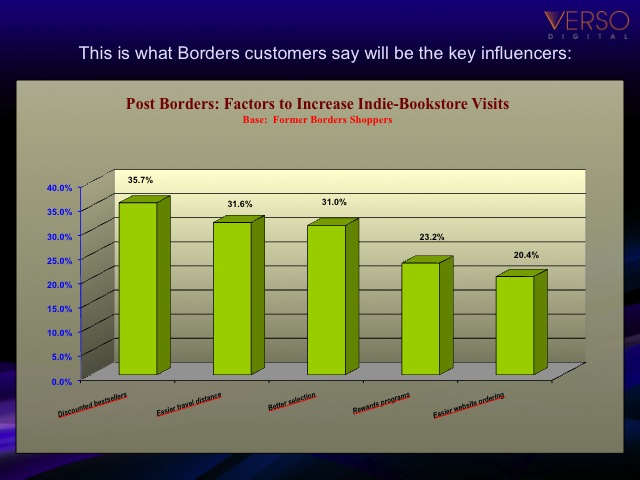

Former Borders customers also indicated that they would visit indies more often if indies offer discounted bestsellers (35.7%), have a better selection (31%), have rewards programs (23.2%) and offer easier website ordering (20.4%).

Perhaps the most important section of the survey had to do with e-books and e-reading devices--which again included findings that make the digital changes of the past several years appear more like an addition to the book world rather than a revolution that will destroy all non-digital parts of the business.

The survey, conducted before Christmas, found that 15.8% of readers already own an e-reader device, up from 7.9% a year earlier and 2.9% two years before. Some 16.3% of readers are either very likely or somewhat likely to buy an e-reader. But strikingly a majority--51.8%--of readers are "not at all likely" to buy an e-reader, up slightly from 49% a year earlier and from 40.2% two years before. This indicates a strengthening of resistance to e-readers and may foretell a plateauing of growth in e-reader device sales (which McKeown said could be 25%-30% in three years). Among avid readers, 22.3% already own an e-reader and 49.7% of them are not interested in buying an e-reader.

Following earlier technological adoption patterns, the e-book reader world has gone from innovator and early adopter stages into the early majority state, McKeown said. Now "the battle is what happens with the late majority and laggards." Usually what makes such people adopt new technology is a new device that "increases the relative advantage to them so it's no longer worth their while to resist." In the music world, that device was the iPod. "Is there such a device looming for e-readers?" McKeown asked. "Perhaps some kind of virtual reality device, but I don't see it happening."

In e-book sales, fiction "still dominates," but "we're starting to see nonfiction categories rising," and they are increasingly beginning to mirror sales in printed books. "We can no longer say that e-books are primarily a fiction or genre fiction market," McKeown said. "This is further confirmation that we're out of the early adopter phase."

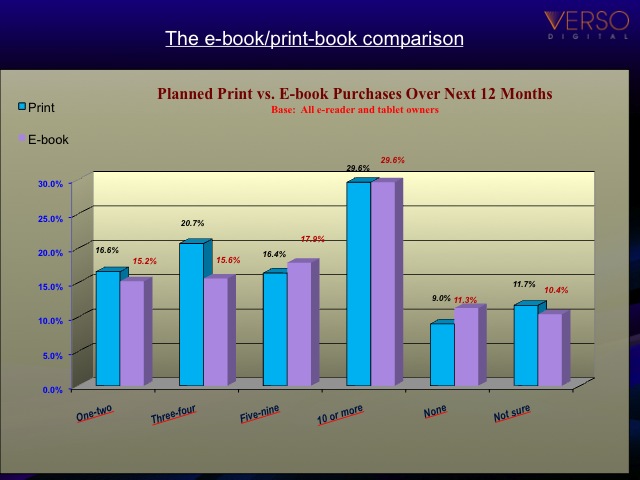

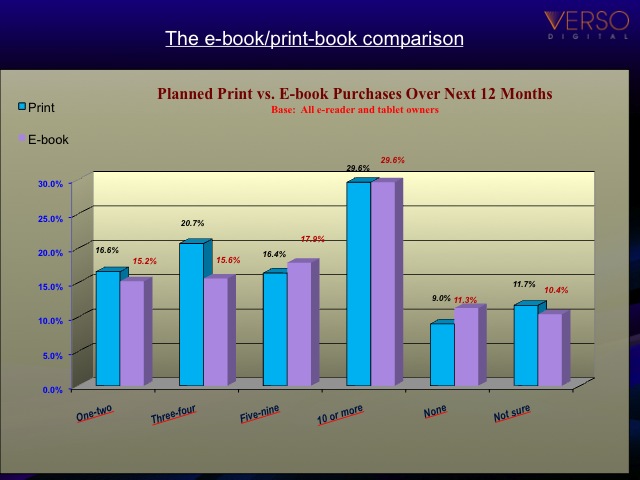

Among e-reader device and tablet owners, 29.6% plan to buy 10 or more e-books in the next year, mimicking the plans of avid readers. Interestingly 24.9% of the same group plan to buy 10 or more printed books in the next year. And among avid readers who own an e-reader device or tablet, 42.8% plan to buy 10 or more printed books (while 47.6% of such owners plan to buy 10 or more e-books).

"These are split purchasers," McKeown stated. "They will not be dictated to. They like both formats, which are not mutually exclusive." He called the situation "very nuanced," one that indicated a strong hybrid market.

Survey respondents also indicated an interest in an indie-brand e-reading device. Of all readers, 9.5% were very likely to buy such a device and 18.3% were somewhat likely to do so. 33.1% of women over 44 are likely or very likely to buy such a device. Some 40% would pay up to $100 for such a device and 32% would pay between $100 and $130.

The survey was conducted November 30 through December 4 and had 2,200 respondents. To see the survey, click here. --John Mutter

Congratulations to Idlewild Books, founded in 2008 in New York City by David Del Vecchio: the travel guide and literature store has opened a second location, in Cobble Hill, in Brooklyn, where it is selling foreign-language books only--mainly literature and children's books in French, Spanish and Italian--and holding language classes, some of which are its first for children.

Congratulations to Idlewild Books, founded in 2008 in New York City by David Del Vecchio: the travel guide and literature store has opened a second location, in Cobble Hill, in Brooklyn, where it is selling foreign-language books only--mainly literature and children's books in French, Spanish and Italian--and holding language classes, some of which are its first for children.

In April,

In April,

There

There  Once again, Jack McKeown's presentation of the Verso Digital survey of consumer purchasing behavior was a highlight of the Winter Institute and reinforced the sense among indies that there are plenty of opportunities for bricks-and-mortar bookstores in the post-Borders, digital era. This year, the survey benefited from having data from the previous two years for comparisons.

Once again, Jack McKeown's presentation of the Verso Digital survey of consumer purchasing behavior was a highlight of the Winter Institute and reinforced the sense among indies that there are plenty of opportunities for bricks-and-mortar bookstores in the post-Borders, digital era. This year, the survey benefited from having data from the previous two years for comparisons.

Lennertz emphasized that publicity is important to the program. "I don't care about national media, but I want 100 local news stories" because "when the public hears message, they get it right away." He said he envisioned many events across the country.

Lennertz emphasized that publicity is important to the program. "I don't care about national media, but I want 100 local news stories" because "when the public hears message, they get it right away." He said he envisioned many events across the country.

In Audrey Schulman's (The Cage) ingeniously plotted novel, we read two stories, happening 100 apart, that come together in a most unexpected way.

In Audrey Schulman's (The Cage) ingeniously plotted novel, we read two stories, happening 100 apart, that come together in a most unexpected way.