Hastings's Full Year: Sales Down, Net Loss Up

In the fourth quarter ending January 31, revenues at Hastings Entertainment fell 3.7%, to $136.4 million, and net income rose 91.7%, to $2.3 million. For the full year, revenues fell 5.7%, to $436 million, and the net loss increased 9.7%, to $10.2 million.

In the fourth quarter ending January 31, revenues at Hastings Entertainment fell 3.7%, to $136.4 million, and net income rose 91.7%, to $2.3 million. For the full year, revenues fell 5.7%, to $436 million, and the net loss increased 9.7%, to $10.2 million.

Last week, Hastings announced that it hopes to be bought for $3 a share and merge with subsidiaries of National Entertainment Collectibles Association, all of which are controlled by Joel Weinshanker. In this morning's quarterly and annual report, the company didn't mention the deal.

During the quarter, sales of books at stores open at least a year fell 8.2%, mainly, the company said, because of "a weaker release schedule for new books and a decrease in trade paperback sales, as compared to the fourth quarter of fiscal 2012, which included higher sales from the Fifty Shades trilogy. Sales of digital hardware also decreased for the quarter as compared to the same period in the prior year."

The story was similar for the full year. Hastings said that sales of books at stores open at least a year fell 10.7% for the year, mainly because of "a weaker release schedule for new books and a decrease in trade paperback and hardback sales, as compared to fiscal 2012, which included strong sales from the Fifty Shades and Hunger Games trilogies. In addition, sales of digital hardware decreased significantly for fiscal 2013 as compared to fiscal 2012."

CEO and chairman John H. Marmaduke commented on the company's performance, in part: "As we have previously disclosed, one of our strategic initiatives is the introduction of new product categories which include consumer electronics, music electronics and accessories, vinyl, hobby, recreation and lifestyle and tablets." Most of those products are in the electronics and trends categories, which had sales gains in the fourth quarter of 5.2% and 25.1%, respectively.

On the other hand, Marmaduke noted, revenues for music, books and rental were all down and "continue to be impacted by the popularity of digital delivery, rental kiosks and subscription based services."

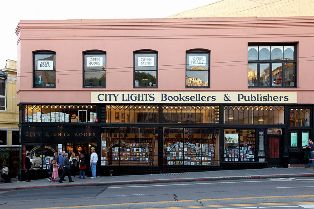

With the tagline "read, drink, converse,"

With the tagline "read, drink, converse,"

Michael Taeckens, marketing director at Graywolf Press, is moving back to North Carolina from Minnesota in May to run his own marketing and publicity business, working with authors, publishers and arts organizations. He will also continue to work with Graywolf on select projects on a freelance basis.

Michael Taeckens, marketing director at Graywolf Press, is moving back to North Carolina from Minnesota in May to run his own marketing and publicity business, working with authors, publishers and arts organizations. He will also continue to work with Graywolf on select projects on a freelance basis. Super-fan Val Alston (right) traveled from Mexico to attend Brandon Sanderson's signing for Words of Radiance (Tor) at the

Super-fan Val Alston (right) traveled from Mexico to attend Brandon Sanderson's signing for Words of Radiance (Tor) at the  Congratulations to

Congratulations to  Calling

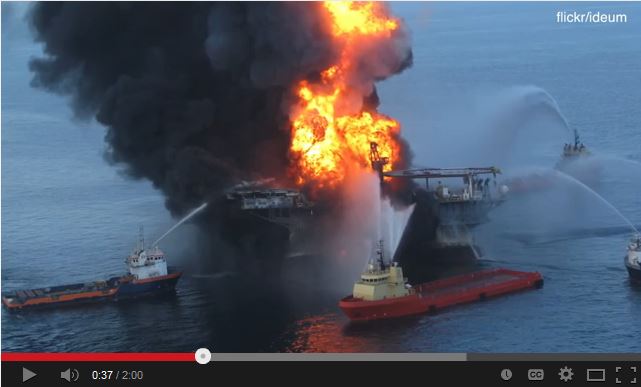

Calling  The Evolution of a Corporate Idealist: When Girl Meets Oil

The Evolution of a Corporate Idealist: When Girl Meets Oil

"Could Daenerys Targaryen's dragons be

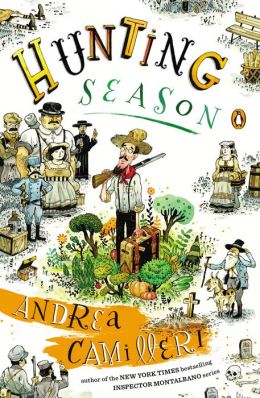

"Could Daenerys Targaryen's dragons be  On New Year's Day in 1880, a steam-driven packet boat from Palermo delivers a mysterious stranger to the little village of Vigata, where everyone knows each other's secrets. His presence greatly upsets 90-year-old Don Filippo, whose body is soon found in the surf, an apparent suicide. Then Don Filippo's mentally challenged son is found poisoned by mushrooms--even though he was a mushroom expert. Is it just a coincidence that, long ago, the new arrival's father had his throat cut in Vigata, a crime that was never solved?

On New Year's Day in 1880, a steam-driven packet boat from Palermo delivers a mysterious stranger to the little village of Vigata, where everyone knows each other's secrets. His presence greatly upsets 90-year-old Don Filippo, whose body is soon found in the surf, an apparent suicide. Then Don Filippo's mentally challenged son is found poisoned by mushrooms--even though he was a mushroom expert. Is it just a coincidence that, long ago, the new arrival's father had his throat cut in Vigata, a crime that was never solved?