Seattle Weekly's Nina Shapiro offers a long story called "The Perks, Pitfalls, and Paradoxes of Amazon Publishing," which delves into the advantages and disadvantages for authors of publishing with Amazon and includes these gems:

Seattle Weekly's Nina Shapiro offers a long story called "The Perks, Pitfalls, and Paradoxes of Amazon Publishing," which delves into the advantages and disadvantages for authors of publishing with Amazon and includes these gems:

After Amazon Publishing, headed by Larry Kirshbaum, had trouble signing big-name authors because Amazon's bookselling competitors stocked few of the imprint's titles in store, "Even Amazon Publishing's unusual solicitousness toward writers--sending flowers and chocolates on publication day, designating 'author relations' staffers to keep writers happy--could not overcome this handicap. Last year, Amazon founder Jeff Bezos' wife MacKenzie, a novelist, came out with a new book. Her choice of publisher: Knopf Doubleday."

The focus of Amazon Publishing changed suddenly after the bookstore blockade. " 'The East Coast editors were sort of whipsawed,' [a] former employee recalls. Not only did Amazon ask them to change the type of authors they were looking for, but the company insisted upon a different way of evaluating them. Going with your gut was out. Data was in. What kind of track record does the author have? The category of books? What type of people bought them?"

After recounting some good experiences her authors have had with Amazon, agent Jane Dystel said others "have had far less success with Amazon. In such cases, the company's marketing methods fell flat. In its haste to get a lot of books out quickly, Amazon 'might not have understood the market,' she says. 'Or the market might not have been as easily defined.' And when that happened, Amazon let the data make its next decision: It passed on the author's next book.

" 'All publishers do this,' Dystel acknowledges, 'but they aren't usually so aggressive in seeking out authors, building them up, and then almost spitting them out.' "

---

For its part, in a long piece titled "The War of the Words," Vanity Fair's Keith Gessen explored "how did Amazon--which was once seen as the book industry's savior end up as Literary Enemy Number One? And how much of this fight is even about money?"

For its part, in a long piece titled "The War of the Words," Vanity Fair's Keith Gessen explored "how did Amazon--which was once seen as the book industry's savior end up as Literary Enemy Number One? And how much of this fight is even about money?"

Among the points: "The Amazon-Hachette dispute mirrors the wider culture wars that have been playing out in America since at least the 1960s. On the one side, super-wealthy elites employing populist rhetoric and mobilizing non-elites; on the other side, slightly less wealthy elites struggling to explain why their way of life is worth preserving."

Agent Andrew Wylie commented that "like ISIS, Amazon is so determined to wreak havoc on the culture that unlikely alliances have been formed."

Gessen also wrote: " 'Book publishers had the longest time horizon to prepare for the digital transition,' [an] industry lawyer told me, 'and they were the least prepared.' From Amazon's perspective, demographics is destiny: people who read print are dying, while digital natives are being born. But in fact e-book adoption has been slower among young readers than among adults, and the growth in e-book sales overall has slowed considerably. And it is possible that Wylie was right, that the publishers were finally standing up for themselves. A less optimistic industry analyst wasn't so sure. 'The publishers are going to say, "Beyond this line we shall not cross," ' the analyst argued. 'Then a year later they'll say, "Actually, beyond this line we shall not cross." The question for publishers is "How long can we say yes and still have a business?" ' "

---

Amazon has tested using taxis for package deliveries in San Francisco and Los Angeles and may launch such a service on a broader basis, the Wall Street Journal reported.

Amazon has tested using taxis for package deliveries in San Francisco and Los Angeles and may launch such a service on a broader basis, the Wall Street Journal reported.

"Taxis represent Amazon's latest experiment to speed package shipments to compete more directly with brick-and-mortar retailers, and to seek alternatives to United Parcel Service Inc., FedEx Corp. and the U.S. Postal Service after shipping delays last Christmas," the paper wrote.

For the test, Amazon used Flywheel, the taxi-hailing mobile app, which competes with Uber and Lyft. "Amazon summoned cabs through the Flywheel app to mini-distribution centers before loading them with as many as 10 packages bound for a single ZIP code, paying about $5 per package for delivery within one hour."

The deliveries were usually done in the early morning when cabs had fewer customers. The Journal noted: "With taxis, Amazon also may be seeking to contain shipping costs, which have risen annually as a percent of sales, to 8.9% last year from 7.2% in 2009. Amazon in October posted its biggest quarterly loss in 14 years amid a 32% jump in shipping expenses."

Forrester Researcher analyst Sucharita Mulpuru told the Journal that Amazon may be developing a "same-day delivery algorithm," which would figure out which form of delivery is fastest and cheapest. But she added that same-day delivery isn't appealing to most customers. "The reality is, people generally aren't willing to pay enough for the service to make it worthwhile."

In one of our favorite comments about taxi delivery, Engadget.com called the service "sadly not nearly as cool as drones."

Politics and Prose Bookstore, Washington, D.C., is taking over the book operations at five current and future Busboys and Poets restaurants in the metro area. They include the locations at 5th and K streets in downtown Washington, in Hyattsville, Md., and in Shirlington, Va.--Politics and Prose will begin book operations at these stores next year. Politics and Prose will start the book operations at the two Busboys and Poets that are opening soon in the District neighborhoods of Brookland (next month) and Takoma (in January). The arrangement doesn't include the original Busboys and Poets, at 14th and V streets in the capital, which has a bookstore owned and operated by Teaching for Change.

Politics and Prose Bookstore, Washington, D.C., is taking over the book operations at five current and future Busboys and Poets restaurants in the metro area. They include the locations at 5th and K streets in downtown Washington, in Hyattsville, Md., and in Shirlington, Va.--Politics and Prose will begin book operations at these stores next year. Politics and Prose will start the book operations at the two Busboys and Poets that are opening soon in the District neighborhoods of Brookland (next month) and Takoma (in January). The arrangement doesn't include the original Busboys and Poets, at 14th and V streets in the capital, which has a bookstore owned and operated by Teaching for Change.

Alison Fryer, manager of the Cookbook Store in Toronto until it

Alison Fryer, manager of the Cookbook Store in Toronto until it

Seattle Weekly's Nina Shapiro offers a long story called "

Seattle Weekly's Nina Shapiro offers a long story called " For its part, in a long piece titled "

For its part, in a long piece titled "

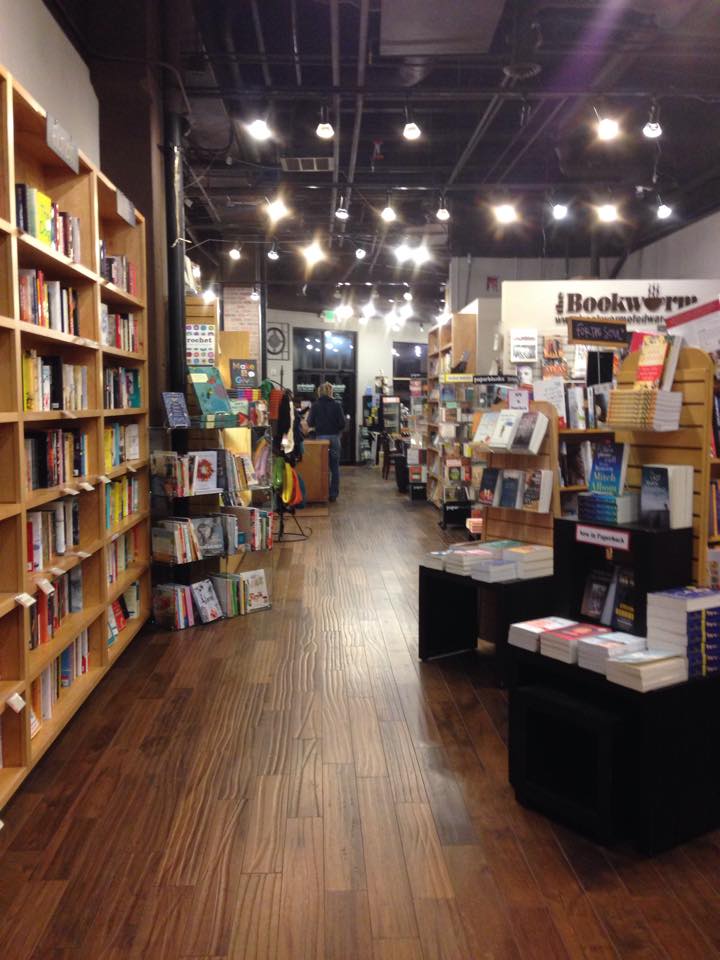

The Bookworm of Edwards also used this opportunity to create a mobile receiving station, so that receiving no longer has to be done at the register. The receiving station can be pushed against a wall to free up space when not in use, moved to different sections of the store, and can even be used as an information system for customers.

The Bookworm of Edwards also used this opportunity to create a mobile receiving station, so that receiving no longer has to be done at the register. The receiving station can be pushed against a wall to free up space when not in use, moved to different sections of the store, and can even be used as an information system for customers.  The renovation also coincides with a significant redesign of the store's website; Magistro hopes that the two experiences, online and off, will now feel much more complementary. Magistro decided not to celebrate immediately following the re-opening, but plans to have the store's annual Customer Appreciation party, scheduled this year for December 9, to be something of a new launch.

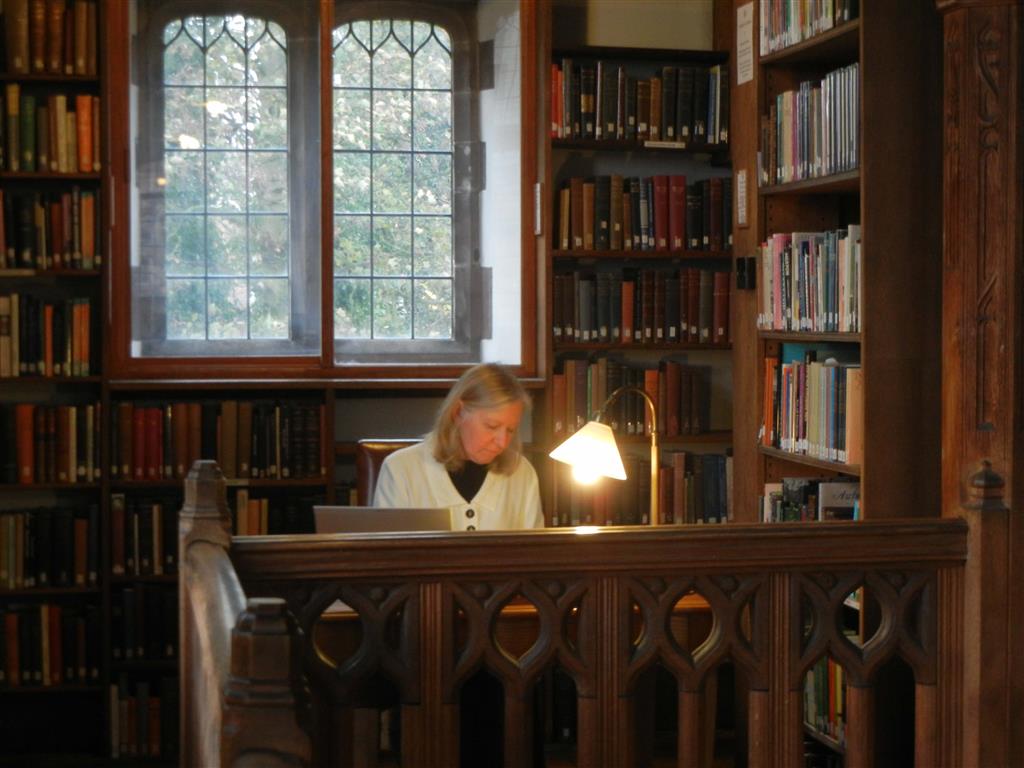

The renovation also coincides with a significant redesign of the store's website; Magistro hopes that the two experiences, online and off, will now feel much more complementary. Magistro decided not to celebrate immediately following the re-opening, but plans to have the store's annual Customer Appreciation party, scheduled this year for December 9, to be something of a new launch. At Shelf Awareness, we often run links to galleries of gorgeous libraries. Our readers enjoy them, but it's not often that they change someone's life. One of those images, of Gladstone's Library in Wales, caught the eye of

At Shelf Awareness, we often run links to galleries of gorgeous libraries. Our readers enjoy them, but it's not often that they change someone's life. One of those images, of Gladstone's Library in Wales, caught the eye of  Moscow's metro system is opening a digital library

Moscow's metro system is opening a digital library "For better or worse, when talk turns to how far women have or have not come in the last several decades, I like to take a moment to ponder famous women in history. I find endless fascination in women who were either born or married into power. And I never tire of reading about how they don't demure from doing what they have to do. In this month's Book Buyer's Pick, Victoria: A Life by A.N. Wilson, readers get a look at a powerful woman whose life has often been shrouded in secrecy.

"For better or worse, when talk turns to how far women have or have not come in the last several decades, I like to take a moment to ponder famous women in history. I find endless fascination in women who were either born or married into power. And I never tire of reading about how they don't demure from doing what they have to do. In this month's Book Buyer's Pick, Victoria: A Life by A.N. Wilson, readers get a look at a powerful woman whose life has often been shrouded in secrecy. Earth Is My Witness: The Photography of Art Wolfe

Earth Is My Witness: The Photography of Art Wolfe "I can't believe it," Snicket said "from an undisclosed location," according to Netflix. "After years of providing top-quality entertainment on demand, Netflix is risking its reputation and its success by associating itself with my dismaying and upsetting books."

"I can't believe it," Snicket said "from an undisclosed location," according to Netflix. "After years of providing top-quality entertainment on demand, Netflix is risking its reputation and its success by associating itself with my dismaying and upsetting books." One of the two interwoven plotlines in A Map of Betrayal, the seventh novel from National Book Award winner Ha Jin (Waiting; War Trash), is narrator Lilian's reconstruction of the life of her father, Gary Shang, the most important Chinese spy ever caught in North America. In the other plotline, Lilian's Caucasian mother has died, which frees Lilian, a 50-ish professor, to contact her father's Chinese mistress, a silver-haired broadcaster in Montreal who gives her his six-volume diary. In it, Lilian discovers that her father had a previous wife whom he was forced to leave behind.

One of the two interwoven plotlines in A Map of Betrayal, the seventh novel from National Book Award winner Ha Jin (Waiting; War Trash), is narrator Lilian's reconstruction of the life of her father, Gary Shang, the most important Chinese spy ever caught in North America. In the other plotline, Lilian's Caucasian mother has died, which frees Lilian, a 50-ish professor, to contact her father's Chinese mistress, a silver-haired broadcaster in Montreal who gives her his six-volume diary. In it, Lilian discovers that her father had a previous wife whom he was forced to leave behind.