Jeff Kinney's Unlikely Story

"What's the thing that everybody loves and treasures the most? It's a bookstore."

"What's the thing that everybody loves and treasures the most? It's a bookstore."

Books Inc. had a location in nearby San Jose that closed in the mid-1990s when a Barnes & Noble opened a block away. Later, a Borders opened in the spot Books Inc. vacated.

"We are excited to return to the community we served for so many years," Books Inc. co-owner and CEO Michael Tucker said. "It will be exciting to bring our customer expertise and events programming to a new generation of readers."

Acorn Books, Dover, Del., will close June 13 after three years in business, but owner Ginny Jewell told the Delaware State News she is looking for a new location: "We have a few leads, and wish we could have made a deal before announcing our closing, but we felt it was important to let people know in time to use their credits." She cited high rent and her own inexperience as primary reasons for the decision, but added: "Customer reactions are the best and worst part of this process. Some are encouraged when we remind them we are hoping to open in a new location, others tear up when we talk about leaving this store."

Acorn Books, Dover, Del., will close June 13 after three years in business, but owner Ginny Jewell told the Delaware State News she is looking for a new location: "We have a few leads, and wish we could have made a deal before announcing our closing, but we felt it was important to let people know in time to use their credits." She cited high rent and her own inexperience as primary reasons for the decision, but added: "Customer reactions are the best and worst part of this process. Some are encouraged when we remind them we are hoping to open in a new location, others tear up when we talk about leaving this store."

In her announcement on Facebook last week of the impending closure, Jewell wrote: "We thank our many loyal customers who have made a point of shopping locally, and we are sorry we are not able to sustain this location. It is our greatest hope that we will be able to re-open in another location at some point. We give deep thanks to our long serving staff, our vendors, and again, most of all, to our customers."

Recent news reports and informal messages from several publishers suggest that Amazon is taking more steps to wring money from its publisher suppliers. In the U.K., Amazon has notified many publishers that if they don't meet Amazon's delivery targets, they will be charged 3%-10% of the cost of goods, the Bookseller reported.

Recent news reports and informal messages from several publishers suggest that Amazon is taking more steps to wring money from its publisher suppliers. In the U.K., Amazon has notified many publishers that if they don't meet Amazon's delivery targets, they will be charged 3%-10% of the cost of goods, the Bookseller reported.

"Under the new rules, publishers will be charged 3% of the cost of the goods if fewer than 90% of shipped titles a month arrive to a fulfilment centre within the expected delivery window, or if fewer than 90% of collect orders are ready for pickup by Amazon during the expected ship window," the Bookseller wrote. "The 3% charge will be deducted only for the noncompliant units under the stated 90% threshold."

In addition, Amazon will charge 10% of the cost of goods "if below 95% of 'confirmed or back-ordered products' per month are not delivered before Amazon's system automatically cancels the items."

In a nicely timed twist, around the same time Amazon was notifying accounts about how it will penalize them, it was delaying payments to Advantage customers--those who sell to Amazon on consignment--causing a cash-flow disaster for some publishers. Amazon said this was the result of a technical glitch that has been corrected.

In Germany, Amazon subsidiary Audible, which has an estimated 90% of the German market for digital audiobooks, has told some smaller publishers that they must sell to Amazon on a flat-rate model, according to Der Spiegel. If they don't agree, their titles will be delisted from Audible.

A group of audio publishers are filing a complaint with the German cartel office, a complaint that the Boersenverein has said it would support.

In the U.S., at least one distributor recently received a notice from Amazon that it must lower the prices on several backlist books or Amazon "may reduce or discontinue ordering those items," the company wrote. The titles have been sold to Amazon at 20% and 25% discounts; the company is requiring new discounts ranging from nearly 30% to nearly 50%.

The Bookseller also reported that Amazon.co.uk and Penguin Random House U.K. "are in a dispute over terms" for a new contract. As is customary with these kinds of situations, neither side would discuss terms under negotiation, but Amazon spokesman Tarek El-Hawary wrote in an e-mail to Re/code, "I can say that we have long-term deals in place already with the other four major publishers and we would accept any similar deal with Penguin Random House U.K."

The negotiations do not include Penguin Random House in the U.S.

---

But sometimes Amazon has to cooperate with others. In a striking change in its approach to taxation in Europe, starting this month, Amazon has begun booking revenue on sales made in some countries--the U.K., Germany, Italy and Spain so far--in those countries rather than in its head European office in Luxembourg, where tax rates for the company are much lower, the Wall Street Journal reported.

The European Union and national governments have complained about and launched investigations of tax-avoidance structures used by several U.S. companies, including Amazon, Apple, Google and Starbucks. The U.K. recently passed a budget increasing taxes for companies that appear to be avoiding paying taxes.

The Journal commented: "Amazon's move marks a sea change in its approach to tax in Europe. Depending on how the company allocates costs, it could significantly boost the firm's tax bill in many EU countries. It could also put pressure on other companies to do the same."

In January, the E.U.'s antitrust office said in a preliminary finding that the tax deal Luxembourg gave Amazon in 2003 that has allowed it to pay much lower taxes on its European operations than otherwise expected appeared to amount to "unfair state aid."

Harlequin and HarperCollins are launching Harlequin Audio, an imprint that will produce audio versions of Harlequin books, with the first titles set to be released June 30. In conjunction with HarperAudio, Harlequin Audio will work directly with digital audio distributors to provide distribution to the retail and library markets, and will distribute CD versions of all titles through relationships with Blackstone Audio and Midwest Tape. In its first year, Harlequin Audio plans to release 200 titles.

Harlequin and HarperCollins are launching Harlequin Audio, an imprint that will produce audio versions of Harlequin books, with the first titles set to be released June 30. In conjunction with HarperAudio, Harlequin Audio will work directly with digital audio distributors to provide distribution to the retail and library markets, and will distribute CD versions of all titles through relationships with Blackstone Audio and Midwest Tape. In its first year, Harlequin Audio plans to release 200 titles.

Perseus Books Group and Turner Classic Movies are launching a series of books "inspired by the greatest movies from the origins of cinema to today," including books on genres of films, stars and filmmakers, as well as pop culture guides inspired by classic movies. Perseus's Running Press will publish the books, which begin this fall with Creating the Illusion: A Fashionable History of Hollywood Costume Designers by Jay Jorgensen and Donald L. Scoggins with a foreword by Ali McGraw and Fellini: The Sixties by Manoah Bowman with a foreword by the late Anita Ekberg.

Perseus's Running Press will publish the books, which begin this fall with Creating the Illusion: A Fashionable History of Hollywood Costume Designers by Jay Jorgensen and Donald L. Scoggins with a foreword by Ali McGraw and Fellini: The Sixties by Manoah Bowman with a foreword by the late Anita Ekberg.

Owned by the Turner Broadcasting System subsidiary of Time Warner, Turner Classic Movies shows classic films, uncut and commercial-free, hosted by Robert Osborne and Ben Mankiewicz, and includes interviews. It also airs original documentaries and specials and a range of series like the Essentials, hosted by Robert Osborne and Drew Barrymore, and Friday Night Spotlight; and annual programming events like 31 Days of Oscar in February.

TCM hosts events for fans, including the annual TCM Classic Film Festival in Hollywood, the TCM Classic Cruise and the TCM Classic Film Tour in New York City and Los Angeles. TCM produces books and DVDs about classic movies.

John F. Nash Jr., the Nobel Prize-winning mathematician who was best known to the general public as the subject of A Beautiful Mind, the bestselling book by Sylvia Nasar that was adapted into an Oscar-winning film, died Saturday in a taxi crash, the New York Times reported. He was 86. "The narrative of Dr. Nash's brilliant rise, the lost years when his world dissolved in schizophrenia, his return to rationality and the awarding of the Nobel... captured the public mind and became a symbol of the destructive force of mental illness and the stigma that often hounds those who suffer from it," the Times noted.

Twice a year, Macmillan sales rep Melissa Weisberg organizes a kind of traveling road show of sales reps in Michigan, Ohio and Tennessee. This past Wednesday Parnassus Books, Nashville, Tenn., hosted a gaggle of reps for a staff presentation. National Geographic provided a bountiful breakfast, and the reps provided a bonanza of books. Pictured: (l.-r.) Karen Hayes, buyer, Parnassus Books; Mary Ann Buehler, retired sales rep for Penguin Adult Hardcover; Jess Lyon, Random House; Toni Hetzel, Random House; Melissa Weisberg, Macmillan; Kate McCune, HarperCollins; staffer's neighbor's adorable puppy; Lindsay Wood, Penguin Adult; Whitney Conyers, Random House Juvenile.

Twice a year, Macmillan sales rep Melissa Weisberg organizes a kind of traveling road show of sales reps in Michigan, Ohio and Tennessee. This past Wednesday Parnassus Books, Nashville, Tenn., hosted a gaggle of reps for a staff presentation. National Geographic provided a bountiful breakfast, and the reps provided a bonanza of books. Pictured: (l.-r.) Karen Hayes, buyer, Parnassus Books; Mary Ann Buehler, retired sales rep for Penguin Adult Hardcover; Jess Lyon, Random House; Toni Hetzel, Random House; Melissa Weisberg, Macmillan; Kate McCune, HarperCollins; staffer's neighbor's adorable puppy; Lindsay Wood, Penguin Adult; Whitney Conyers, Random House Juvenile.

Tonight Will Walton, a bookseller at Avid Bookshop, Athens, Ga., will be the guest of honor for the "Hometown Book Launch" party for his debut novel, Anything Could Happen, released today by Scholastic's PUSH imprint.

Tonight Will Walton, a bookseller at Avid Bookshop, Athens, Ga., will be the guest of honor for the "Hometown Book Launch" party for his debut novel, Anything Could Happen, released today by Scholastic's PUSH imprint.

Walton spoke with the Athens Banner-Herald about the series of unlikely events that led to him working with author and Scholastic editor David Levithan: "David is a believer in those sort of 'everyday magic' things," Walton said, two years after a friend happened to meet Levithan at a book conference and gave him a copy of Walton's manuscript.

Bay Books, Coronado, Calif., "is the kind of place every reader dreams of making their home for an hour or two" and "offers the personal touch and time that avid readers have found themselves missing," eCoronado.com wrote in a profile of the store.

Bay Books, Coronado, Calif., "is the kind of place every reader dreams of making their home for an hour or two" and "offers the personal touch and time that avid readers have found themselves missing," eCoronado.com wrote in a profile of the store.

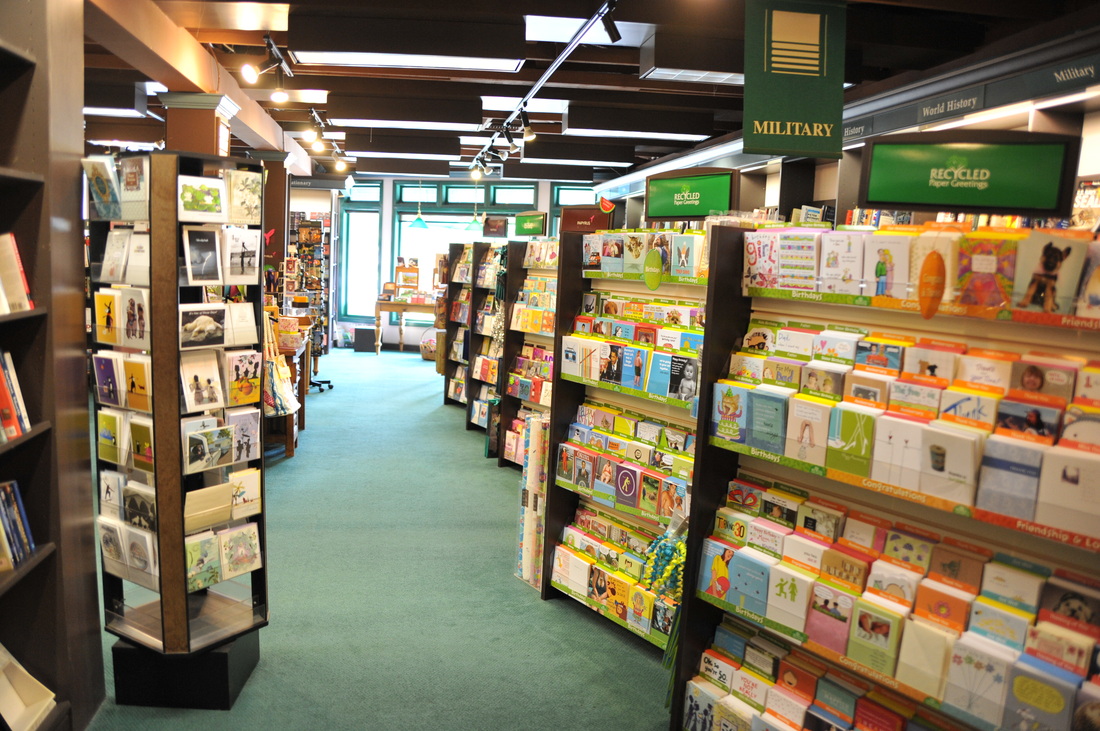

Co-owner Angelica Muller said Bay Books is "very fortunate to have a very supportive community. We have employees that have been with us for 25 years." In addition to its book selection, the shop offers "a section of high quality occasion cards from brands like Papyrus, gift items and children's items such as puzzles and craft supplies. In fact, children are a high priority for Bay Books," eCoronado.com noted.

"We try to encourage young readers from a very early age, and that is a very important part of our store," said Muller, adding that she appreciates Bay Book's customers for understanding the importance of independent bookstores: "If we lose independent bookstores, we lose a way of really learning about our society and about the culture of our community. You can buy a book for a dollar cheaper on Amazon, but then you lose the ability to browse and touch and see what you are buying and hear our recommendations from people who have read the books. I think that is something we need to preserve. Independent bookstores need to be preserved and cherished! We are very fortunate to have one of the few independent bookstores left in Southern California!"

This morning on the Today Show: Nick Offerman, author of Gumption: Relighting the Torch of Freedom with America's Gutsiest Troublemakers (Dutton, $26.95, 9780525954675).

---

Today on a repeat of the Meredith Vieira Show: Louise Roe, author of Front Roe: How to Be the Leading Lady in Your Own Life (Running Press, $25, 9780762456666).

---

Today on Live with Kelly and Michael: Jennifer Arnold and Bill Klein, authors of Life Is Short (No Pun Intended): Love, Laughter, and Learning to Enjoy Every Moment (Howard, $25, 9781476794709). They will also appear tomorrow morning on Fox & Friends.

---

Today on Fresh Air: Henry Marsh, author of Do No Harm: Stories of Life, Death, and Brain Surgery (Thomas Dunne Books, $25.99, 9781250065810).

---

Tonight on a repeat of Late Night with Seth Meyers: Chelsea Handler, author of Uganda Be Kidding Me (Grand Central, $16, 9781455599714).

---

Tomorrow morning on Good Morning America: Kara Richardson Whitely, author of Gorge: My Journey Up Kilimanjaro at 300 Pounds (Seal Press, $17, 9781580055598).

---

Tomorrow morning on VH1's Big Morning Buzz: Joey Graceffa, author of In Real Life: My Journey to a Pixelated World (Keywords Press/Atria, $16, 9781476794303).

---

Tomorrow on Diane Rehm: readers review Euphoria by Lily King (Grove Press, $16, 9780802123701).

---

Tomorrow on a repeat of the Wendy Williams Show: Rosie Perez, author of Handbook for an Unpredictable Life: How I Survived Sister Renata and My Crazy Mother, and Still Came Out Smiling (Three Rivers Press, $16, 9780307952400).

---

Tomorrow night on a repeat of Conan: Jon Cryer, author of So That Happened: A Memoir (NAL, $27.95, 9780451472359).

---

Tomorrow night on a repeat of Late Night with Seth Meyers: Willie Nelson, author of It's a Long Story: My Life (Little, Brown, $30, 9780316403559).

Noting that "in its bombastic and unsubtle love of 19th century Gothic literature, Penny Dreadful is one of the most interesting bookish television shows of all time," Electric Lit explored how the Showtime series "adapts multiple books at once."

"Has there ever been another TV show or film that was nearly adapting five literary works at once?" Electric Lit asked, adding that while "not all the characters are taken directly from literature, the show's DNA is formed from books," including Dracula, Frankenstein, The Picture of Dorian Gray, as well as some aspects of Dr. Jekyll & Mr. Hyde and Varney the Vampire.

An Empire on the Edge: How Britain Came to Fight America by Nick Bunker (Knopf) has won the 2015 George Washington Book Prize, recognizing the best new books on early American history and sponsored by the Gilder Lehrman Institute of American History, Mount Vernon and Washington College. The prize carries a $50,000 award.

The judges called An Empire on the Edge "a probing account of Great Britain's internal political and financial tensions on the eve of revolution. Drawing on a careful study of primary sources from Britain and the United States, Bunker crafts a compelling story of the deepening antagonism between England and her colonies, giving equal weight to the commercial as well as the political ambitions of the British Empire. Bunker's series of fully visualized scenes of familiar events like the Boston Tea Party and lesser-known episodes such as the Gaspee Affair, provides a nuanced description of the Anglo-American conflict."

---

Brigid Coady won the £1,000 (about $1,550) Romantic Novelists' Association's Joan Hessayon Award for new writers for her novel No One Wants to be Miss Havisham. The judges said they chose the winner for its "sheer originality and wide range of emotions," calling it "a great story, well written, fast paced and suspenseful. Great chemistry between hero and heroine."

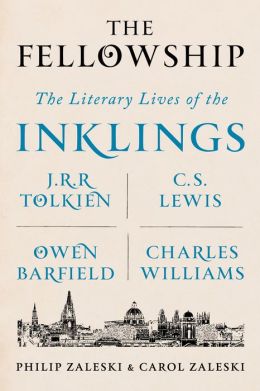

Fellowship: The Literary Lives of the Inklings: J.R.R. Tolkien, C. S. Lewis, Owen Barfield, Charles Williams by Philip Zaleski, Carol Zaleski (Farrar, Straus & Giroux, $35 hardcover, 9780374154097, June 2, 2015)

The four main Inklings were J.R.R. Tolkien, the Catholic; C.S. Lewis, the Anglican; Owen Barfield, the esotericist; and Charles Williams, the "magus." Others, including W.H. Auden and Dorothy L. Sayers, were loosely associated with them as well. The group's "great hope was to restore Western culture to its religious roots, to unleash the powers of the imagination, to re-enchant the world through Christian faith and pagan beauty."

Millions of readers know Tolkien's work. He loved Old English and medieval literature. His experiences in World War I were crucial to stirring his imagination to create "new languages, new images, new legends, and new mythologies." He began writing The Silmarillion, his prequel to The Lord of the Rings, in 1917. Shortly after joining the Inklings in 1930, he wrote The Hobbit. While writing his Ring trilogy he would bring each new chapter to test out on the group.

Tolkien unleashed a mythic awakening; C.S. Lewis spurred a Christian one. For the Zaleskis, Lewis is "arguably the bestselling Christian writer since John Bunyan." He caused heated discussions among the Inklings as he read to them missive after demonic missive from what would become The Screwtape Letters, but the club had disbanded by the time Lewis wrote the first book of his Chronicles of Narnia. Charles Williams became a regular member of the Inklings when he arrived in Oxford from London after World War II broke out, bringing with him Oxford University Press, for which he was the editor. Williams's novels (All Hallows' Eve, Descent into Hell) explored mysticism, the supernatural and the exotic. T.S. Eliot (often linked with the Inklings) called them pot-boilers, "but [Williams] always boiled an honest pot." Owen Barfield was the least known of the group but his book Poetic Diction made a strong impression on Tolkien. He was a very close friend to Lewis, who wrote The Lion, the Witch, and the Wardrobe for Barfield's daughter, Lucy.

The Zaleskis note that feminist critic Germaine Greer feared Tolkien would become "the most influential writer of the twentieth century." But as the authors beautifully demonstrate in this virtuoso book, the Inklings were instrumental in a "revitalization of Christian intellectual and imaginative life" while showing everyone the importance of a good story. --Tom Lavoie, former publisher

Shelf Talker: An all-encompassing, impeccably researched and beautifully written history of one of the most important writing groups of all time.

The bestselling self-published books last week as compiled by IndieReader.com:

1. Never Never by Colleen Hoover and Tarryn Fisher

2. Falling for My Boss by J. S. Cooper and Helen Cooper

3. The 20/20 Diet by Phil McGraw

4. Pucked by Helena Hunting

5. The Wilde Sisters Trilogy by Sandra Marton

6. Taken by a Trillionaire by Melody Anne, Ruth Cardello, J.S. Scott

7. Under the Influence by L.B. Simmons

8. Sacrificed to the Dragon: Boxed Set by Jessie Donovan

9. Unruly by Cora Brent

10. Fair Game by Monica Murphy

[Many thanks to IndieReader.com!]