Although Amazon's sales in the U.K. continue to grow--rising 20%, to $11.4 billion, in 2017--for the second straight year the company was able to halve the amount of corporate tax it paid, the Bookseller reported.

Although Amazon's sales in the U.K. continue to grow--rising 20%, to $11.4 billion, in 2017--for the second straight year the company was able to halve the amount of corporate tax it paid, the Bookseller reported.

According to filings at Companies House, while sales of Amazon's U.K. Services company--its warehouse and logistics arm that employs more than two-thirds of Amazon's 27,000 employees in the U.K.--rose nearly 36%, to £1.98 billion (about $2.57 billion), in 2017, it paid £4.6 million ($6 million) in U.K. corporation tax, down from £7.4 million ($9.6 million) in 2016 and £15.8 million ($20.5 million) in 2015.

Booksellers Association managing director Meryl Halls said: "It is extremely disappointing to note that, yet again, Amazon's tax announcement illustrates the online multinational giant--possessed of a huge market share and all the associated commercial bargaining power that goes with it--entrenching its substantial commercial advantage over its competitors in the U.K. book trade, and more widely."

Mills added that Amazon's network of companies "seemingly gives it the potential--should it wish to do so--to transfer assets and make inter-company charges in order to end up with a low profit in a high tax domain. Is Amazon using such a facility so as to pay such a miniscule tax bill?...

"We want to see a situation where U.K. booksellers are no longer forced to compete with one hand tied behind their backs and that we see the establishment of a level playing field, with the government recognising U.K. booksellers for the high street [main street] heroes they are, and, crucially, to bring forward the promised reform of the taxation of the digital economy so that U.K. booksellers are given a chance to compete."

An Amazon U.K. spokesperson said: "We pay all taxes required in the U.K. and every country where we operate. Corporation tax is based on profits, not revenues, and our profits have remained low given retail is a highly competitive, low-margin business and our continued heavy investment."

---

In a related story, Amazon pays £38 million (about $49.3 million) a year in business rates (taxes on commercial property) on its 189 sites in England and Wales, much less than bricks-and-mortar retailers, a Daily Mail investigation has found. Amazon's real estate in England and Wales include warehouses, offices and lockers at public locations.

The paper noted that the news "comes as Amazon faces accusations it is killing the high street by reducing its corporation tax bill to the lowest possible level and ruthlessly undercutting rivals. Bricks-and-mortar shops are being hammered with soaring business rates while the web giant enjoys low rates in out-of-town warehouses. The Mail is campaigning for business rates in Britain to be reformed."

The Daily Mail said calculations for the Amazon bill were "based on a public database of how much every property is required to pay and cross-referenced with sites owned by Amazon." An Amazon spokesperson called the research "misleading and inaccurate. Amazon pays millions of pounds more in business rates in England and Wales than suggested by the research and our business rates bill has increased significantly in 2018." As the paper remarked, however, the company declined to provide a different amount.

The Billings Bookstore Cooperative, which runs This House of Books in Billings, Mont., and former CEO and manager Gary Robson have settled their financial disputes, the Billings Gazette reported.

The Billings Bookstore Cooperative, which runs This House of Books in Billings, Mont., and former CEO and manager Gary Robson have settled their financial disputes, the Billings Gazette reported.

Although Amazon's sales in the U.K. continue to grow--rising 20%, to $11.4 billion, in 2017--for the second straight year the company was able to

Although Amazon's sales in the U.K. continue to grow--rising 20%, to $11.4 billion, in 2017--for the second straight year the company was able to

Last Thursday, the American Booksellers Association's e-newsletter edition of the Indie Next List for August was delivered to nearly half a million of the country's best book readers. The newsletter was sent to customers of 130 independent bookstores, with a combined total of 491,811 subscribers.

Last Thursday, the American Booksellers Association's e-newsletter edition of the Indie Next List for August was delivered to nearly half a million of the country's best book readers. The newsletter was sent to customers of 130 independent bookstores, with a combined total of 491,811 subscribers.

Congratulations to the

Congratulations to the  Just Breathe: Meditation, Mindfulness, Movement, and More

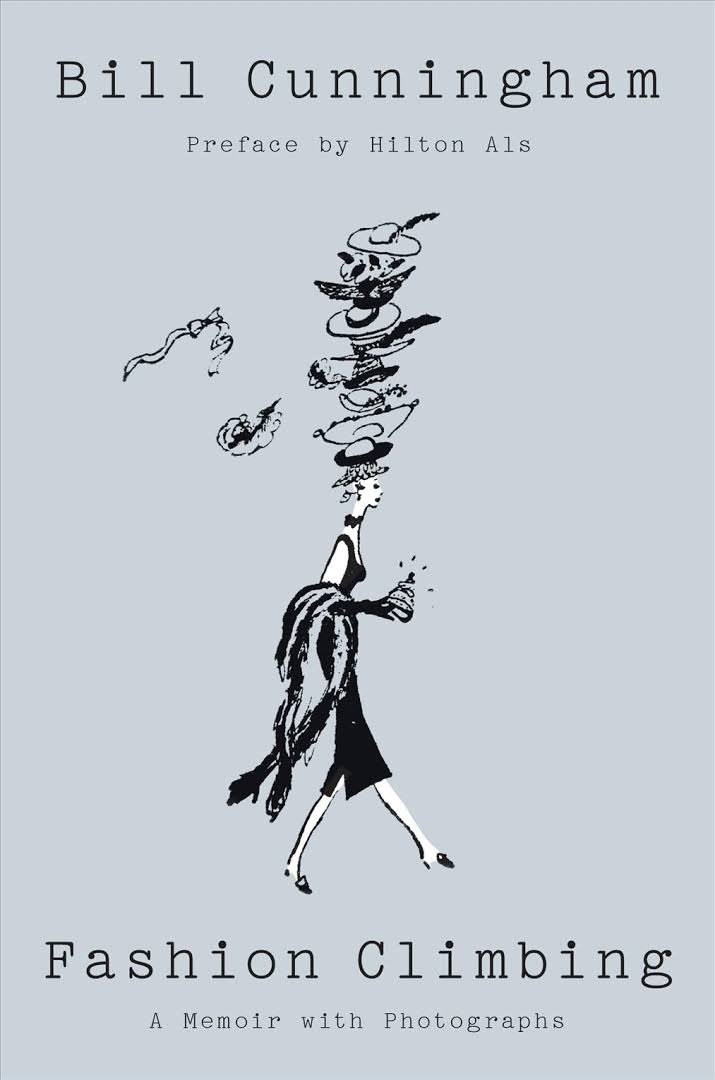

Just Breathe: Meditation, Mindfulness, Movement, and More Energetic enthusiasm, integrity, sharp perceptions and an ardent love of beauty in all forms seem to have defined the iconic New York Times photographer Bill Cunningham (Facades) since his childhood. During his life, he was a charming and influential public enigma in the fashion world, despite being the focus of a 2010 documentary. After his death, his family found this memoir, Fashion Climbing. It covers his early life in repressive 1930s-'40s Boston, his rise as a successful milliner in 1950s-'60s New York City, and the start of his second career as a fashion journalist. It is no tell-all, but there are plenty of juicy reasons why such a tactful, private person would have left it in a drawer for so long.

Energetic enthusiasm, integrity, sharp perceptions and an ardent love of beauty in all forms seem to have defined the iconic New York Times photographer Bill Cunningham (Facades) since his childhood. During his life, he was a charming and influential public enigma in the fashion world, despite being the focus of a 2010 documentary. After his death, his family found this memoir, Fashion Climbing. It covers his early life in repressive 1930s-'40s Boston, his rise as a successful milliner in 1950s-'60s New York City, and the start of his second career as a fashion journalist. It is no tell-all, but there are plenty of juicy reasons why such a tactful, private person would have left it in a drawer for so long.