BookExpo 2019: The Power of Retail

"The reason that we're interested in bricks-and-mortar stores is because they create A) experience, B) impulse and C) gifting at a completely different level than our online partners create it," said Dominique Raccah, publisher and CEO of Sourcebooks, last week at a BookExpo panel entitled The Power of Retail: Making Books, Authors and Building Community.

"The reason that we're interested in bricks-and-mortar stores is because they create A) experience, B) impulse and C) gifting at a completely different level than our online partners create it," said Dominique Raccah, publisher and CEO of Sourcebooks, last week at a BookExpo panel entitled The Power of Retail: Making Books, Authors and Building Community.

Also on the panel were Oren Teicher, CEO of the American Booksellers Association; Dennis E. Abboud, president and CEO of Readerlink; Tim Mantel, chief merchandising officer, Barnes & Noble; and Madeline McIntosh, CEO of Penguin Random House U.S. Lynn Neary, arts correspondent for NPR, moderated the discussion.

|

|

| (l.-r.) Mantel, Raccah, Abboud, McIntosh, Teicher (photo: BookExpo) | |

"What stores can do, and what so many of our members are able to do, is more than just sell books," said Teicher, commenting on the ability of independent bookstores in particular to offer personal shopping experiences and to create connections within a community. He reported that in the ABA's view, indies have "barely scratched the surface" of taking maximum advantage of that. On the subject of the localism movement, Teicher noted that while it does resonate with many consumers, particularly millennials, it does not resonate with everybody.

Mantel reported that according to B&N's own consumer insight work, the vast majority of the chain's customers come in with only a single book in mind. "But we certainly sell more than one book per transaction," continued Mantel. "So we know the environment we're creating is one in which people enjoy shopping, and they are discovering new content while they're in our stores." He added that for B&N stores to be successful, they absolutely have to know their local community and be given enough flexibility to cater to its tastes.

For Abboud, whose company specializes in providing books to retailers like Wal-Mart, Target and grocery and drug store chains, "books aren't particularly a destination item in the types of retailers that we serve." Some 77% of all book purchases in those channels are made on impulse, and he noted that though these stores can sometimes be many times larger than even the largest chain bookstores, they typically carry only 100 to 2,000 titles. As a result, inventories are heavily curated and "very data-driven."

When asked about the ways in which publishers and retailers have worked together to promote books, McIntosh answered that publishers generally used to see their role "as just delivering the books to your [retailers'] front doors," with the rest being up to retailers. But now, McIntosh continued, PRH sees itself as "in partnership all the way through the sales process." Some of the most important parts of that partnership are "still very meat and potatoes," such as "having extraordinary sales reps," while others are more data-driven and involve things like creating customized marketing campaigns for particular titles. She noted, too, that Penguin Random House "still invests huge amounts of money and our authors' time in author tours," and, pointing to books like those written by Celeste Ng and Amor Towles, forging personal relationships with booksellers can pay dividends.

On the subject of the relationship between national chains and independent booksellers, Teicher acknowledged that the two do have a "rather checkered past," but argued that consumers having more places to access books is "good for all of us." He pointed out too that in many cases, indies' best customers also shop in B&N, and vice versa. Mantel agreed that the more physical bookstores there are, the "better off we all are," and explained that while chains like B&N can "propel" authors to the next level, they "absolutely benefit" from indies rallying around debut authors.

Within the mass market channel, Abboud shared, the airport business is up about 2%-3%. He attributed some of that growth to airport bookstores stocking more varied and sophisticated titles than they perhaps would have in the past, in part because they've found that airport travelers are typically more affluent. While discussing airport stores, McIntosh added that along with independent bookstores, airports are "early heroes," and many recent, successful titles first "bubble up" in those two channels.

Asked about the future of physical book retailers, the panelists were optimistic. Raccah pointed out that "making an author" is still something that happens in physical stores, and added that in all the data she's seen, the most surprising result has been that YA remains a category that is about 75% physical. McIntosh said that according to PRH's own research, what millennial parents value is an in-person, trusted shopping experience, and they recognize the value in a physical objects.

At the same time, Mantel said, B&N is particularly encouraged about Gen Z, the demographic group younger than millennials, who are typically "way more inclined" to shop in a physical environment. And Teicher noted that compared to Western Europe, the U.S. is actually significantly "under-bookstored." He said: "We're absolutely confident that there is an opportunity for the physical book market--for the physical bookstore business--to grow." --Alex Mutter

IPC.0204.S3.INDIEPRESSMONTHCONTEST.gif)

Bonjour Books DC

Bonjour Books DC

The

The

The Book Industry Charitable Foundation has named the eight recipients who will receive a total of $29,500 in scholarships as part of the organization's 2019

The Book Industry Charitable Foundation has named the eight recipients who will receive a total of $29,500 in scholarships as part of the organization's 2019 IPC.0211.T4.INDIEPRESSMONTH.gif)

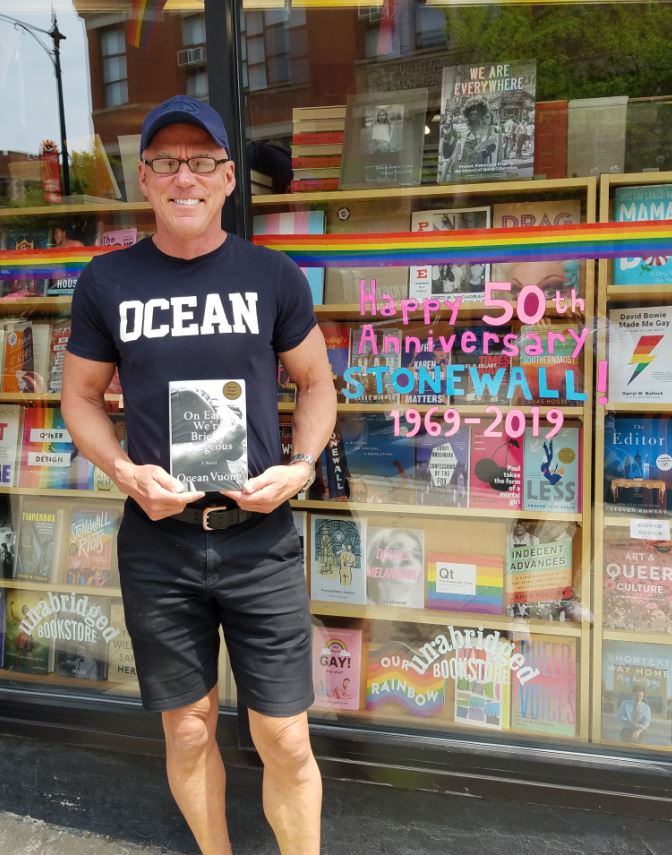

Ed Devereux, owner of Chicago's

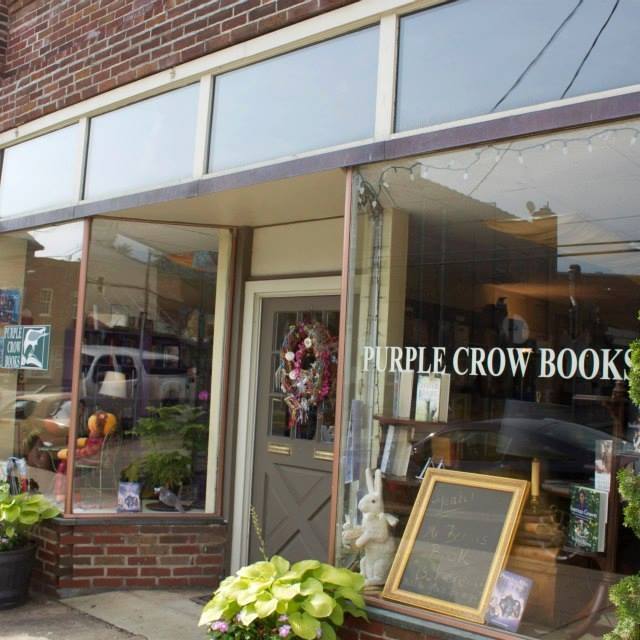

Ed Devereux, owner of Chicago's  Hillsborough, N.C., "might fly under the radar in comparison to its bigger neighbors, Durham and Chapel Hill, but its

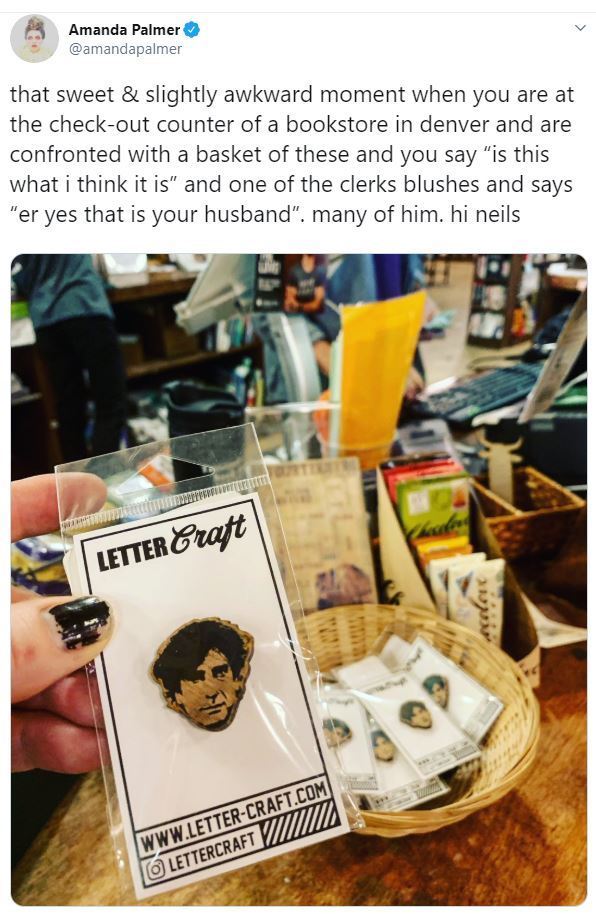

Hillsborough, N.C., "might fly under the radar in comparison to its bigger neighbors, Durham and Chapel Hill, but its  Singer, songwriter, musician, author and performance artist Amanda Palmer, who is married to Neil Gaiman, tweeted Sunday from Tattered Cover Book Store, Denver Colo.: "

Singer, songwriter, musician, author and performance artist Amanda Palmer, who is married to Neil Gaiman, tweeted Sunday from Tattered Cover Book Store, Denver Colo.: " Winners have been announced for the

Winners have been announced for the

Book you're an evangelist for:

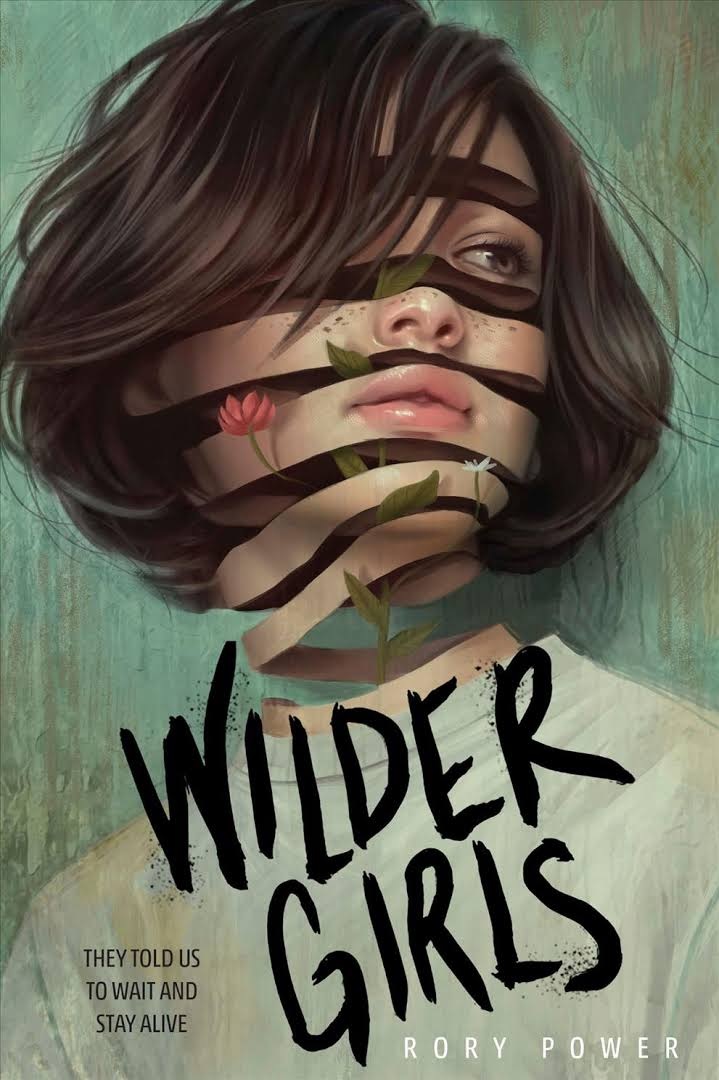

Book you're an evangelist for: It's been a year and a half since a mysterious illness called the Tox forced the navy to quarantine the island off the coast of Maine where the Raxter School for Girls is located. Per the declaration, "subjects [are] to remain on school grounds at all times, for safety and to preserve conditions of initial contagion." Only the Boat Shift--a group of Raxter girls chosen specifically for their strength, survival acumen and intelligence--is allowed out. Boat Shift ventures onto the island to pick up the weekly supply of rations and clothes left by the navy, which drops a pallet rather than come in contact with the afflicted. The Tox turns people into "sick, strange" victims with "things bursting out of [them], bits missing, and pieces sloughing off." Those infected face "flare-ups" that leave "their bodies too wrecked to keep breathing." Sometimes, it even manifests as "violence like a fever," turning the "girls against themselves."

It's been a year and a half since a mysterious illness called the Tox forced the navy to quarantine the island off the coast of Maine where the Raxter School for Girls is located. Per the declaration, "subjects [are] to remain on school grounds at all times, for safety and to preserve conditions of initial contagion." Only the Boat Shift--a group of Raxter girls chosen specifically for their strength, survival acumen and intelligence--is allowed out. Boat Shift ventures onto the island to pick up the weekly supply of rations and clothes left by the navy, which drops a pallet rather than come in contact with the afflicted. The Tox turns people into "sick, strange" victims with "things bursting out of [them], bits missing, and pieces sloughing off." Those infected face "flare-ups" that leave "their bodies too wrecked to keep breathing." Sometimes, it even manifests as "violence like a fever," turning the "girls against themselves."