At Children's Institute last week in Milwaukee, Wis., Brenna Connor of Circana Books (formerly NPD) shared some insights into the state of the children's book market.

At Children's Institute last week in Milwaukee, Wis., Brenna Connor of Circana Books (formerly NPD) shared some insights into the state of the children's book market.

Giving a recap of 2022, Connor reported that print book sales were down 6% compared to 2021, which she noted was the "best year in BookScan history." Despite that decline, annual volume in 2022 was still the "second highest" that "we've ever seen," and historically it was a "pretty good year overall."

|

| Brenna Connor |

Going into more detail on 2022, Connor said adult fiction was the only supercategory to post gains over 2021, while all other categories declined. Romance was the "leading driver" behind adult fiction growth, while manga, suspense, and fantasy were also growth categories. Adult nonfiction, meanwhile, saw the steepest decline in 2022, with only travel seeing gains last year. Kids' fiction and nonfiction posted declines as well, and YA was "essentially flat."

Touching on format share, Connor added that print books made up about two thirds of overall sales, with the rest split between e-books and audiobooks. While the e-book format currently has a slight lead, they are "very close," and Connor said she thinks audiobooks will eventually surpass e-books "in the coming years." And within the audio category, adult titles have a higher share, but kids' audio is an area "ripe for growth."

Looking at 2023 so far, sales are down about 2% compared to 2022. Those declines have been led by adult nonfiction and kids, while adult fiction and YA are two segments "posting gains." Elaborating on YA, Connor said 2023 looks like it will be a "great year" for the segment, as it posted its highest Q1 volume in BookScan history, at around 8 million units. Sales are up 56% compared to the 2019, pre-pandemic benchmark, with the elevated volume being led by "authors and series supported by BookTok."

BookTok, Connor continued, "is not a fluke." It has been the major driver for growth in fiction over the last two years. 2021 was the year that BookTok sales took off, they "snowballed" in 2022, and so far this year they are up more than 50%. While romance makes up the largest subset of BookTok sales (with Colleen Hoover representing a "good portion" of that), it is not the only subject or genre that benefits from BookTok, with both YA and kids' series seeing growth.

Focusing in on the kids market, Connor said print sales are down 3%, with the decline split about evenly between fiction and nonfiction. Only a few kids' subjects have seen growth compared to last year, with animals, holidays, comics & graphic novels, activity books, and transportation being the standouts. Despite being down compared to 2022 and 2021 especially, all age segments are up over 2019, Connor pointed out.

Among the various age segments, the middle grade segment has seen the largest year-over-year decline. Looking at middle grade paperbacks vs. hardcovers and frontlist vs. backlist, Connor explained that the paperback format is driving more than half of the year-over-year decline, while frontlist is down more than 20% as opposed to backlist's 6%. Connor posited that the frontlist decline is "not necessarily a pricing issue," because if it were, there would be "more hardcover decline." The decline "raises more questions than answers," with Connor saying it is unclear whether it is driven by readers or retailers.

Middle grade was also affected by a "break" in the "chain of peer to peer discovery." Prior to the pandemic, there was a "diversified" children's market, with "many points of discovery," including bookstores, book fairs, and word of mouth. The pandemic changed that, and when sales surged in 2021, it was established authors and major publishers that benefited from that boost in sales. At the same time, children who were at the middle grade age in 2019 have by now "aged out" into higher reading levels (this could be a contributing factor to the increase in YA sales in 2023).

As for what's next for the children's market, Connor said she expects volume to stick "somewhat close" to 2022, with sales likely softer compared to last year "by a few percentage points." Middle grade "remains challenged," and Connor encouraged booksellers to "think about what's next" for the category, particularly "new voices and new stories." Touching on licensed books, Connor remarked on a "lack of newness" there; in general, there is a "conservative approach" to content and an emphasis on things already proven.

As for macro economic trends, Connor said affordability is and will remain a factor for consumers, and discretionary spending has already dipped in the face of rising costs for groceries and other essentials. However, there are opportunities to be had in smaller markets around the country that have seen population growth since the beginning of the pandemic, and there is "greater importance" for bricks-and-mortar retail. --Alex Mutter

After a nine-month investigation, the European Commission has approved the purchase of Lagardère, owner of Hachette, France's largest publisher, by Vivendi, with several conditions. Vivendi must sell its Editis publishing house, the second largest publisher in France, as well as Gala, the celebrity magazine, according to the

After a nine-month investigation, the European Commission has approved the purchase of Lagardère, owner of Hachette, France's largest publisher, by Vivendi, with several conditions. Vivendi must sell its Editis publishing house, the second largest publisher in France, as well as Gala, the celebrity magazine, according to the

WGBH's "Shelf Life" profiled

WGBH's "Shelf Life" profiled SHELFAWARENESS.1222.T1.BESTADSWEBINAR.gif)

At

At

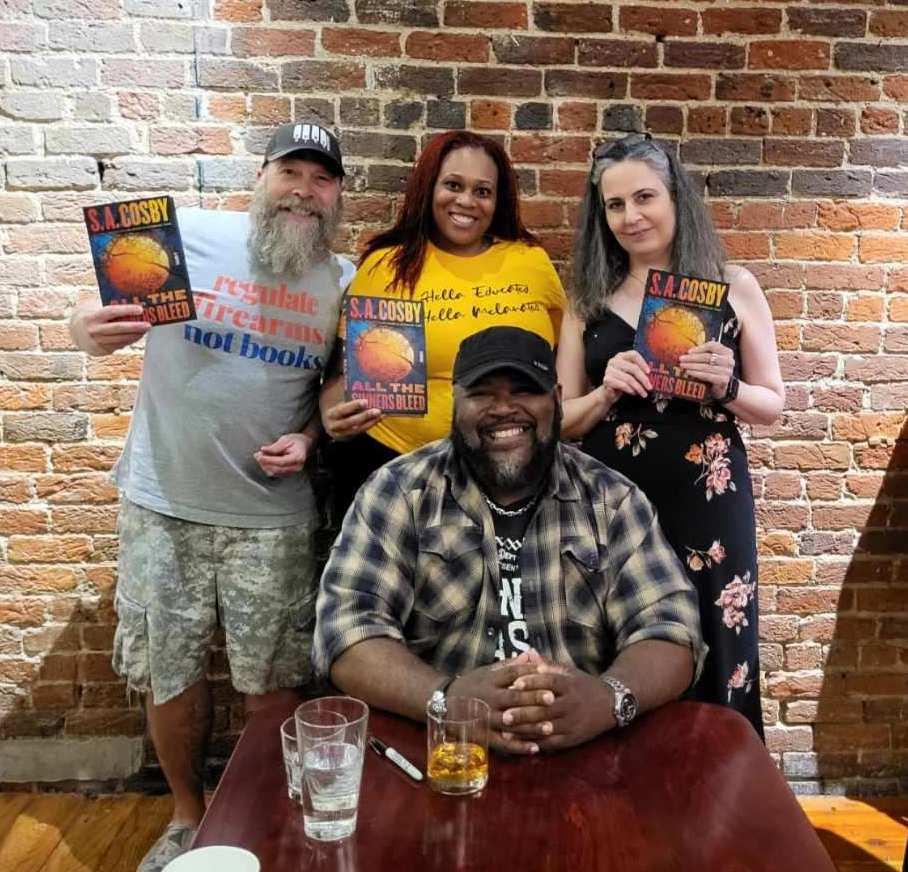

More than 100 people came out to meet author S.A. Cosby at an event hosted by Fountain Bookstore, Richmond, Va., for his new thriller,

More than 100 people came out to meet author S.A. Cosby at an event hosted by Fountain Bookstore, Richmond, Va., for his new thriller,

Rocky Mountain High: A Tale of Boom and Bust in the New Wild West

Rocky Mountain High: A Tale of Boom and Bust in the New Wild West Under the Influence, Noelle Crooks's first novel, follows a young woman into a work opportunity that offers the chance for great success--or a total loss of self.

Under the Influence, Noelle Crooks's first novel, follows a young woman into a work opportunity that offers the chance for great success--or a total loss of self.