It's Official: KKR Buying Simon & Schuster

Other bidders this year for S&S included News Corporation, which owns HarperCollins and the Wall Street Journal, and investor Richard Hurowitz, who was backed by the Abu Dhabi sovereign wealth fund manager. While the $1.65 billion price for S&S is significantly lower than PRH's offer of $2.2 billion, PRH had to pay a $200 million termination fee when its deal collapsed, and S&S has done well lately: in 2022, sales rose 19%, to $1.18 billion, and operating profit rose 16%, to $248 million.

KKR said that besides investing "in all areas necessary to establish Simon & Schuster as a standalone entity," it will also "support numerous growth initiatives, including extending Simon & Schuster's strong domestic publishing program across various genres and categories, expanding its distribution relationships and accelerating growth in international markets."

In addition, KKR plans to create "a broad-based equity ownership program" at S&S "to provide all of the company's more than 1,600 employees the opportunity to participate in the benefits of ownership after the transaction closes." KKR said that since 2011, its "portfolio companies have awarded billions of dollars of total equity value to over 60,000 non-management employees across more than 30 companies."

|

|

| Jonathan Karp | |

S&S's Jonathan Karp said in a memo to staff, in part, that he is "delighted" with the sale, citing KKR's media and entertainment industry team's "acumen"; the equity ownership program for staff; and the background of KKR chairman of media Richard Sarnoff, a former Random House and Bertelsmann executive as well as former chairman of the Association of American Publishers.

About KKR, Karp said, "in the spring of 2023, we began a series of fascinating and stimulating conversations with members of KKR's Media and Entertainment industry team about every aspect of our business, reflective of their keen interest in acquiring our company. All of us from Simon & Schuster who participated came away from those conversations impressed by KKR's acumen, as well as their team's desire to help our business grow and thrive in the future."

He also highlighted KKR's equity ownership program, saying, "Of all the prospective buyers we spoke to--and there were a lot of them--KKR was the only one that discussed its plans to support Simon & Schuster in creating an equity ownership program to provide all of our employees with the opportunity to participate in the benefits of ownership after the transaction closes. I'm looking forward to sharing those plans after the transaction is complete."

|

|

| Richard Sarnoff | |

Noting that he has "known and admired" Sarnoff for two decades, Karp wrote, "Before joining KKR, Richard was executive v-p and chief financial officer at Random House, where we both worked. Richard understands the nuances of the book business as well as anyone I know. The Simon & Schuster team has enjoyed meeting Richard's colleagues Ted Oberwager, Anne Arlinghaus, Chresten Knaff, Glenda Chan, David Hua, and Kate San, all of whom devoted countless hours to analyzing the intricacies of our business."

Karp concluded: "As I've noted before, in our 99-year history, Simon & Schuster has had seven owners. From these transformations we have always emerged stronger, with each new challenge incorporating the spirit of innovation and entrepreneurship that infused the vision of our founders, and our constant commitment to excellence in publishing. With KKR's support, we can look forward to benefiting from their experience in helping companies to grow, and to new strategies and opportunities that will enhance our ability to provide authors with the best possible publication they can receive."

Ted Oberwager, a KKR partner who leads the gaming, entertainment, media and sports divisions in KKR's Americas Private Equity business, said, "Simon & Schuster's nearly 100-year history is a testament to the enduring value of creative expression through the written and spoken word. We are thrilled to invest behind Jon and the immensely talented organization at Simon & Schuster to support their mission of delivering marquee content to readers around the world."

Richard Sarnoff added, "We see a compelling opportunity to help Simon & Schuster become an even stronger partner to literary talent by investing in the expansion of the company's capabilities and distribution networks across mediums and markets while maintaining its 99-year legacy of editorial independence. We also believe the opportunity to create an ownership culture within one of the world's top publishers has enormous potential to create value for all of Simon & Schuster's stakeholders."

Sarnoff told the Wall Street Journal "we believe in the value of a 99-year-old enterprise that has proven itself to be a successful arbiter of culture, and a successful promoter of the best writers."

IPC.0204.S3.INDIEPRESSMONTHCONTEST.gif)

War on Books

War on Books

IPC.0211.T4.INDIEPRESSMONTH.gif)

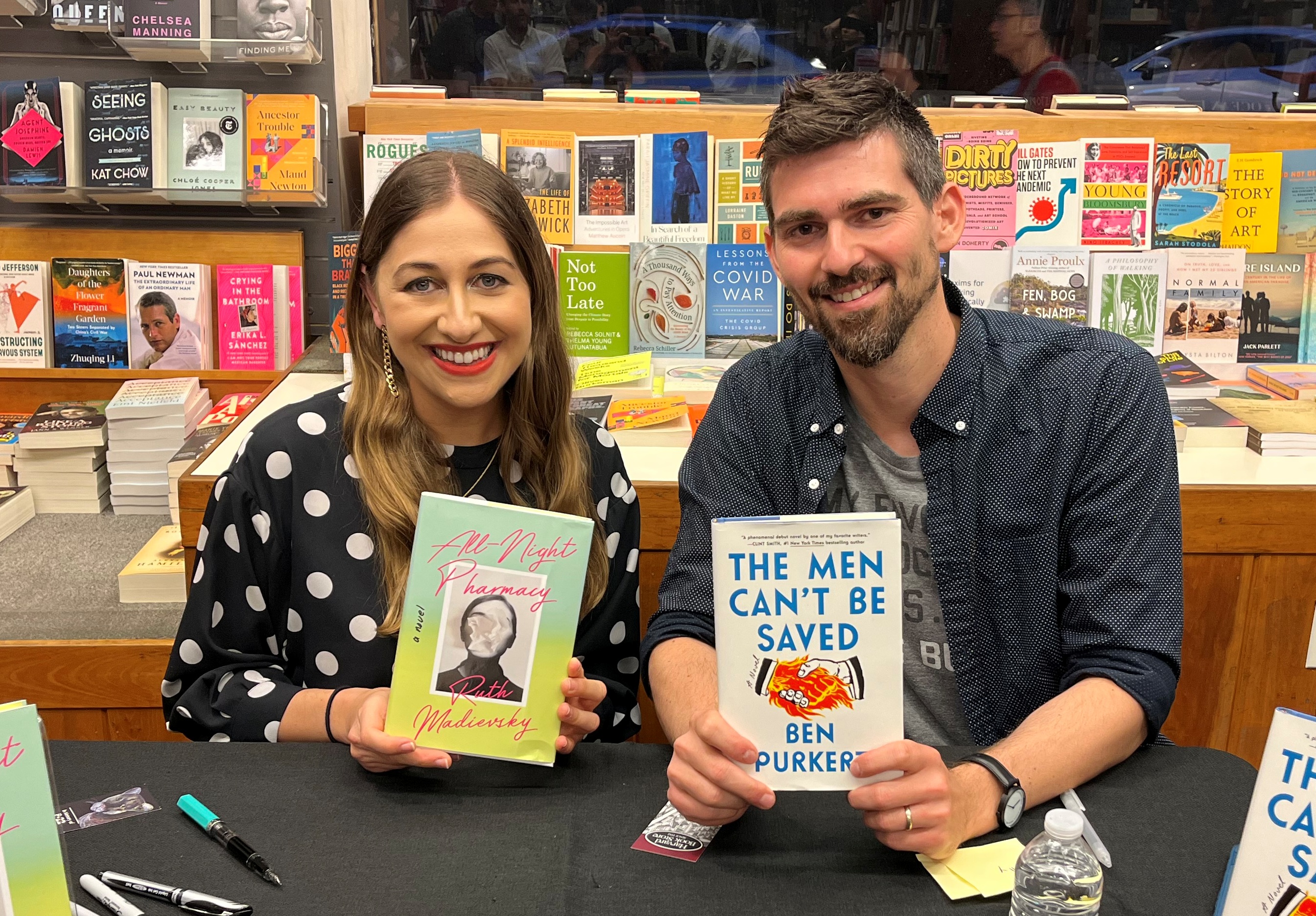

Online friends and debut novelists Ben Purkert (The Men Can't Be Saved; The Overlook Press) and Ruth Madievsky (All Night Pharmacy; Catapult) met in person for the first time at their joint--and packed--launch event at

Online friends and debut novelists Ben Purkert (The Men Can't Be Saved; The Overlook Press) and Ruth Madievsky (All Night Pharmacy; Catapult) met in person for the first time at their joint--and packed--launch event at  "

" "

" There's a Yeti in My Tummy

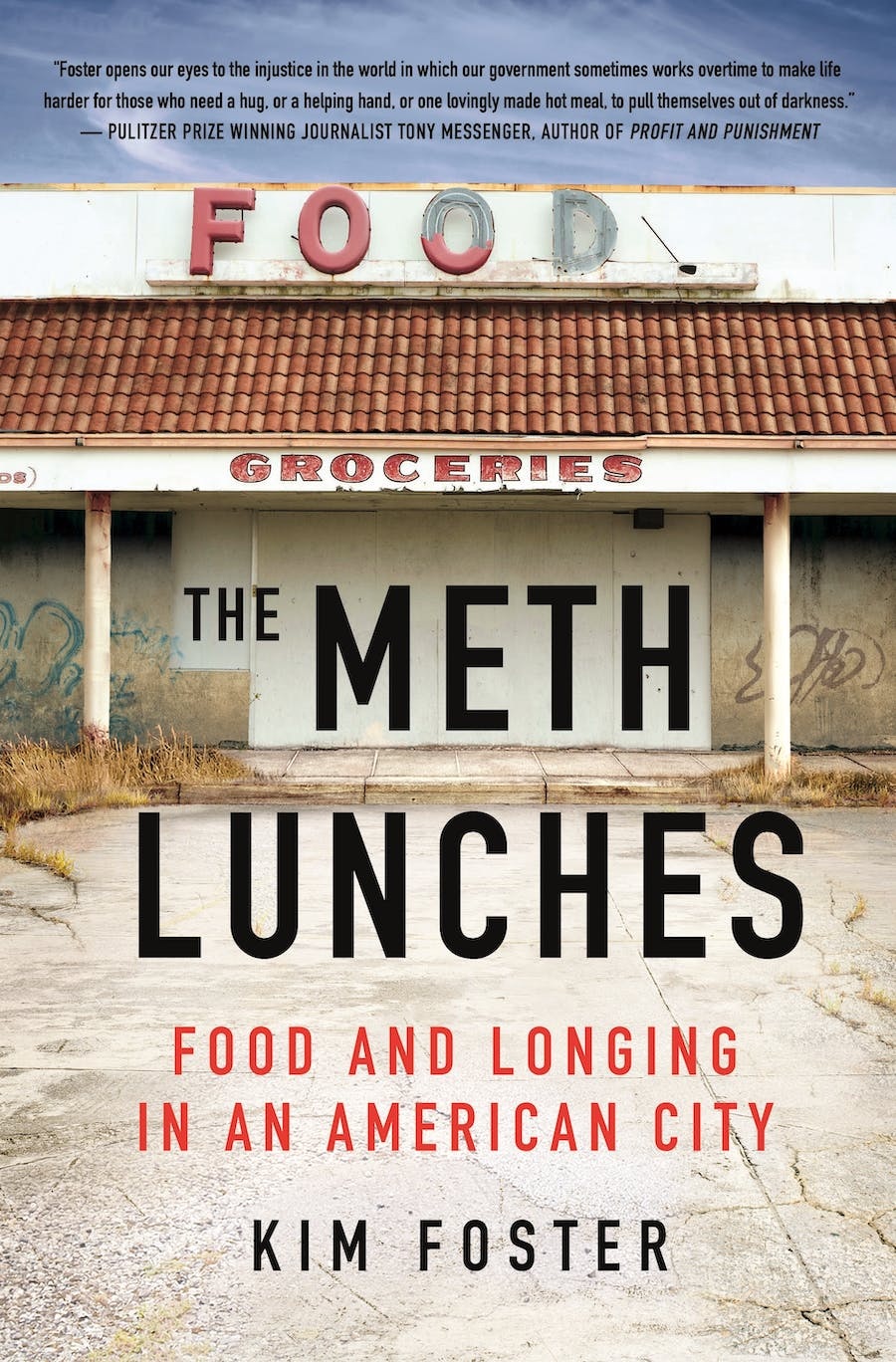

There's a Yeti in My Tummy James Beard Award-winning food writer Kim Foster ("

James Beard Award-winning food writer Kim Foster ("