Indigo Accepts Buyout Offer and Will Go Private

An independent committee of the Indigo board approved the offer; it must be voted on at a special shareholders meeting in May. If approved, the transaction should be completed in June.

Trilogy Retail Holdings and Trilogy Investments, owned by Gerald Schwartz, who is the husband of Indigo CEO and founder Heather Reisman, is offering C$2.50 (US$1.85) a share for the nearly 40% of the company it doesn't own. This is, Indigo pointed out, 69% higher than Indigo's share price of C$1.48 (US$1.09) on February 1, when Trilogy made its initial offer of C$2.25 (US$1.66) a share.

Markus Dohle, chair of the board and of the special committee, said, "Following careful consideration of a wide variety of factors and negotiations with Trilogy that resulted in a material increase to the price first offered to minority shareholders of Indigo, the special committee has determined that the transaction is in the best interests of Indigo and its minority shareholders."

Dohle added, "Since its inception, Indigo has established itself as a cherished Canadian brand with an important leadership role in the Canadian publishing and bookselling industries. We believe that this transaction will provide minority shareholders with a substantial premium for their shares following some challenging years for the business, while also ensuring a strong future for Indigo with full ownership by a team that has demonstrated a deep commitment to Indigo's mission."

In the last several years, there was turmoil in executive suite and on the board, which included Reisman retiring but then returning when the new CEO resigned, and the resignation of several board members for unexplained reasons. A year ago, a ransomware attack shut down many Indigo systems and its website. And sales have dropped significantly in the last year (down 12.3% in the final quarter of 2023) resulting in major layoffs in January.

Baystreet noted that Indigo's stock price has dropped 80% during the last year and is down nearly 90% since the company went public in 1997, a year after its founding.

The

The  This year's

This year's  In Sandwich, Mass.,

In Sandwich, Mass.,

"

" "

" Pilobolus: A Story of Dance and Life

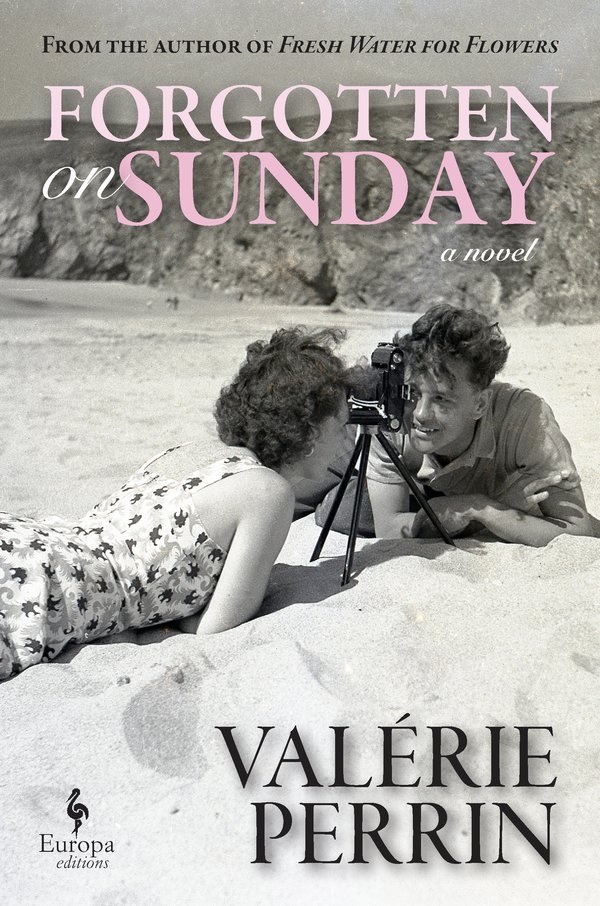

Pilobolus: A Story of Dance and Life An unlikely friendship is forged between two women born generations apart in Forgotten on Sunday, a profound, emotionally complex novel written by Valérie Perrin and translated from the French by Hildegard Serle.

An unlikely friendship is forged between two women born generations apart in Forgotten on Sunday, a profound, emotionally complex novel written by Valérie Perrin and translated from the French by Hildegard Serle.