|

|

| Len Riggio | |

With the completion of the sale of Barnes & Noble to Elliott Advisors, the long bookselling career of Len Riggio, who helped change the face of bookselling in the last 50 years, has effectively come to an end. While a student, in the 1960s, Riggio started out as a bookseller in the New York University bookstore, opened a competing off-campus college store--SBX, Student Book Exchange--then expanded SBX in the New York City area. He entered trade bookselling in a major way in 1971, when he bought the Barnes & Noble store on Fifth Avenue and 18th Street. Soon he opened more B&N stores, also in the New York area, which featured discounted books, a rarity, and were promoted via radio and TV advertising, another rarity. Through its acquisition of Marboro Books, the company also had an extensive mail-order business, which provided a solid foundation for online bookselling.

Riggio became a national bookseller when, in 1987, B&N bought B. Dalton Bookseller, the chain of mall stores that numbered nearly 800 and was second only in size to Waldenbooks. In the following years, B&N bought the Bookstop and Doubleday bookstore chains.

At the end of the 1980s, Riggio began what perhaps is his greatest legacy in his career: creating the Barnes & Noble superstore and expanding it nationwide. The idea of a huge store of 25,000 square feet or more that stocked several hundred thousand titles, had a café, plenty of chairs for customers, with music, video and related sidelines, was new and popular--and aggressively pursued by B&N and competitors that included Borders, Basset and Crown, none of which are still in business. During this time, Riggio also increased his college bookstore management business, which became the second-largest, after Follett.

B&N's superstores, which totalled about 725 at their peak a decade ago (there are now about 625), revolutionized bookselling and led to the closing of many independent bookstores. For most of the 1990s, B&N, along with Borders, seemed to be the behemoth that would dominate bookselling for decades to come.

But, of course, in 1994, Amazon.com opened, initially as a bookstore only, and B&N was slow to appreciate the importance of online bookselling. While B&N eventually expanded its online presence with B&N.com, Amazon grew at a exponential pace and now claims a much larger part of the market than B&N ever had.

The next blow to B&N came in 2007, when Amazon introduced the Kindle. The e-book devices were so popular initially that many industry gurus predicted print books wouldn't exist other than as curiosities by 2015. Two years after the Kindle's launch, B&N introduced the Nook, which had promising sales for a time, but lost steam and is now a major drag on the company financially.

|

|

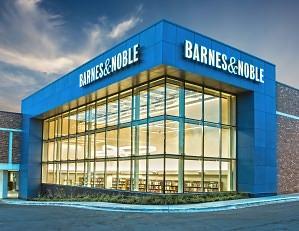

| B&N's new-concept store in Edina, Minn. | |

B&N was late or missed out on other major trends in book retailing after the turn of the century. Most B&N superstores date from the '90s and show their age, especially considering the many changes in general retail in the past 25 years. The company has scrambled to find the right formula for its stores in terms of size and inventory mix. The few "new concept" stores B&N have opened are usually smaller than the older ones, with about 15,000 square feet of space, with fewer books, upgraded cafes and sidelines that focus on educational and children's products. But the company has been slow to open more of these stores or renovate established ones.

Some observers have considered B&N's initial public offering in 1993 a mistake since it seemed to force the company to run operations in a way designed most of all to please institutional investors on Wall Street. Ever more executives at the company were recruited from outside the book industry, which usually meant they spent a lot of time learning the quirks of the book business before they could really begin work--but still sometimes didn't seem to master basic bookselling principles. And when sales declined in the past decade, the company often took standard business approaches, which included, for example, cutting costs by firing its most experienced booksellers and by firing many regional buyers, who often made individual stores more reflective of their areas.

Riggio was fiercely loyal to many people in the business and many employees, and B&N treated publisher and distributor reps well. He also has been a generous philanthropist, promoting the causes of literacy, education, and progressive politics. He helped people who lost their homes in Hurricane Katrina and made major donations to the Dia Center in Beacon, N.Y., New York University, the Langston Hughes Library, the Democratic Party and most recently, 100 incoming students at Kingsborough Community College in Brooklyn, N.Y., whose tuition he's paying. In 2017, he was Grand Marshall of the Columbus Day Parade in New York City (to which he invited more than 100 authors of Italian descent). He also won the Americanism Award from the Anti-Defamation League.

Riggio has loved to wheel and deal. He has bought and sold many companies, taking them public, then going private again or spinning them off and sometimes buying them back. Controlled by Riggio, B&N often bought and sold companies that Riggio owned. The list of such dealings includes B&N.com, B&N Education, MBS Textbook Exchange, GameStop, Software, Etc., Babbage's, Babbage's Etc., Funco and NeoStar. Even this year, he was involved in several of the bids for B&N.

Personally we found Len to be amazingly mercurial. At one meeting, he would be the most charming, charismatic person, extolling literacy, arguing that every American should have easy access to books, that the book world should celebrate the opening of every bookstore "regardless of its pedigree." At the next meeting, he would be combative and suspicious--and argue over such things as whether or not B. Dalton Bookseller, with nearly 800 stores, was a chain. (He maintained that instead it was a "network of booksellers.")

In recent years, after the retirement of his brother Stephen as CEO in 2010, Riggio seemed to have trouble letting go of control of the company. B&N went through four CEOs in five years, and several of them--including Ron Boire and Demos Parneros--exited abruptly after Riggio decided they weren't worthy of the position. But now, with the sale to Elliott, James Daunt, managing director of Waterstones, also owned by Elliott, is the new CEO of B&N, hoping to work the same magic on B&N that he worked on Waterstones. At 78, Riggio is likely relieved that the company he built and nursed along is in good hands. Len, it's been an amazing ride and we wish you well! --John Mutter