First the news, then some unfortunate tales from inside Amazon and, finally, detailed analysis:

Amazon has confirmed that it is opening two warehouses in the Czech Republic, one near the airport in Prague, the other in Brno, which is near Vienna, Austria. The company recently announced that it is opening three warehouses in Poland. When the warehouses open next year, the company will have 25 of them in seven European countries.

---

The New York Times pulls a few revolting tidbits from Brad Stone's new book, The Everything Store: Jeff Bezos and the Age of Amazon (Little, Brown). By 2004, Stone recounted, Amazon was squeezing large book publishers, demanding "steeper discounts, longer periods to pay, and better shipping," the Times wrote. Amazon CEO Jeff Bezos "then turned up the heat on the most vulnerable publishers [smaller publishers]--those most dependent on Amazon.

The New York Times pulls a few revolting tidbits from Brad Stone's new book, The Everything Store: Jeff Bezos and the Age of Amazon (Little, Brown). By 2004, Stone recounted, Amazon was squeezing large book publishers, demanding "steeper discounts, longer periods to pay, and better shipping," the Times wrote. Amazon CEO Jeff Bezos "then turned up the heat on the most vulnerable publishers [smaller publishers]--those most dependent on Amazon.

"The company's relationship with those publishers was called the Gazelle Project after Mr. Bezos said Amazon 'should approach these small publishers the way a cheetah would pursue a sickly gazelle.' A joke, perhaps, but such an aggressive one that Amazon's lawyers demanded the Gazelle Project be renamed the Small Publishers Negotiation Program.

"Mr. Stone writes that Randy Miller, an Amazon executive in charge of a similar program in Europe, 'took an almost sadistic delight in pressuring book publishers to give Amazon more favorable financial terms.' Mr. Miller would move their books to full price, take them off the recommendation engine or promote competing titles until he got better terms out of them, the book says.

" 'I did everything I could to screw with their performance,' Mr. Miller told the writer. The program was called Pay to Play until the Amazon lawyers changed it to Vendor Realignment."

---

Several stories this week about Amazon, which reports third-quarter results on Thursday, focus on the $75-billion company's lack of profits, except for a few periods when Wall Street applied short-lived pressure for the company to make money.

Several stories this week about Amazon, which reports third-quarter results on Thursday, focus on the $75-billion company's lack of profits, except for a few periods when Wall Street applied short-lived pressure for the company to make money.

As economist and venture capitalist William H. Janeway told the New York Times: "This isn't supposed to happen. It violates mainstream finance theory. Very few companies have been valued this way outside a systemic bubble."

Consensus appears to be that to make money Amazon would need to raise prices on products and services like below-cost shipping, but that "might alienate customers and slow down [the company's] roaring revenue growth," the Times wrote.

The company likely will continue with its current strategy of seeking to dominate all markets it enters and doing many things customers like--such as allowing many of them to keep products being returned for credit--that other companies would find financially disastrous. It's a simple and unusual model allowed because Wall Street continues to drive up the value of the company's stock. As Colin Gillis, senior tech analyst at BGC Partners, told the Times, "It is easier to sell things and not make money than it is to sell things and make money."

---

In the same vein, Seeking Alpha calls Amazon "a fantastic company: dedicated, innovative, even daring," but says "the moment is approaching when investors may no longer be willing to support the current valuation of the company.

"Shares in Amazon.com are trading at price-to-earnings ratio of 360, or 108 using the next year's expected profits, and the earnings multiple was at these levels for most of 16 years since the company went public. Very few companies in history managed to keep their valuations so high for so long. Investors believe that at some point in the future the company will be able to translate its rapidly growing sales into substantial profits." But Seeking Alpha argues that this won't happen soon:

"Benefits of scale have been realized by now. Growing from 1 warehouse to 5 cuts delivery times dramatically. Adding 7 new facilities (announced plans) to the existing 49 distribution centers in the U.S. will not result in the same rate of improvement. The same logic applies to all the other areas of customer experience and internal operations.

"In fact, Amazon may have reached the point where the economy of scale turns negative, i.e. further growth leads to more expenses, not less. For example, the company has many more markets to support--both in geographical and in product terms, more business units to manage, and more platforms to develop and maintain. It used to sell [only] books [only] in the U.S. Now it sells everything from groceries to paintings, operates on several continents, develops its own hardware and software, streams movies, offers software services, etc. It is a valid growth strategy, but this fragmentation makes it very hard to substantially improve operational efficiencies from the current levels."

Even though Amazon has won some major battles, competition continues to be fierce, Seeking Alpha wrote, and "in many areas the company faces tougher competition today than ever before (e.g. media, tablets). There are hundreds of online retailers, like BHPhotoVideo.com or Tennis-Warehouse.com, that carved out their own niches and seem to be doing fine.

"Any attempt by Amazon.com to raise prices or scale back customer service (including free movies, free delivery, etc.), will give a second wind to all the competitors that collectively represent a formidable threat. Selling merchandise online is a low-margin business, and it will remain so in the foreseeable future."

The Kindle was introduced and sold at a loss with the premise that losses would be "more than offset by sales of digital content to the owners of these devices. This assumption has already proved to be wrong. Most buyers of the original Kindles have already upgraded to the newer versions, so any loss on sales of those units was never recovered. More importantly, by now consumers own tens of millions of Amazon devices, and the company already offers a huge selection of content, but the profits never materialized."

Amazon Web Services likely accounts for more than half of all Amazon profits expected this year, Seeking Alpha wrote, which makes the service "the only bright spot in Amazon's portfolio, and, by extension, means that the situation in other businesses is even worse....

"The bottom-line here is that AWS is a viable growing business, but it will be a few more years before it is big enough to contribute at least $1 billion to Amazon's profits. By that time investors may start questioning the wisdom of moving all these packages around, streaming movies and selling tablets at a loss, when most profits come from the services division."

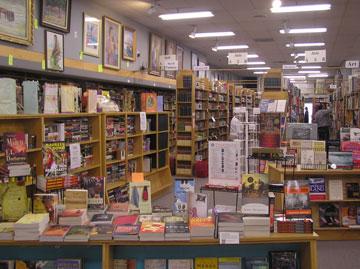

"Many of our customers are families that bring their young children to our large children's section that is stocked with educational children's toys in addition to the books. We have regular author events and host an in-house book club that meets monthly in the store. The owners are looking to retire."

"Many of our customers are families that bring their young children to our large children's section that is stocked with educational children's toys in addition to the books. We have regular author events and host an in-house book club that meets monthly in the store. The owners are looking to retire."

The New York Times pulls a few revolting tidbits from Brad Stone's new book, The Everything Store: Jeff Bezos and the Age of Amazon (Little, Brown). By 2004, Stone recounted,

The New York Times pulls a few revolting tidbits from Brad Stone's new book, The Everything Store: Jeff Bezos and the Age of Amazon (Little, Brown). By 2004, Stone recounted,  Several stories this week about Amazon, which reports third-quarter results on Thursday, focus on the

Several stories this week about Amazon, which reports third-quarter results on Thursday, focus on the

At Elliott Bay Book Company in Seattle last weekend, Arsenal Pulp Press launched David L. Chapman's Universal Hunks. The event featured a posing demonstration by professional body builders Benny Mobley and Michael Landon and amateur Peter Cheah (pictured here with the author--can you guess which one he is?).

At Elliott Bay Book Company in Seattle last weekend, Arsenal Pulp Press launched David L. Chapman's Universal Hunks. The event featured a posing demonstration by professional body builders Benny Mobley and Michael Landon and amateur Peter Cheah (pictured here with the author--can you guess which one he is?). Today is pub date for

Today is pub date for  Congratulations to

Congratulations to  Earlier this month,

Earlier this month,

Chaser: Unlocking the Genius of the Dog Who Knows a Thousand Words

Chaser: Unlocking the Genius of the Dog Who Knows a Thousand Words In The Boy Detective, Roger Rosenblatt transforms a winter night's walk through the streets of New York City into a wide-ranging excursion into the territory of memory that invites comparison to Alfred Kazin's A Walker in the City. Following the tragedy-inspired memoirs Making Toast and Kayak Morning, this book allows Rosenblatt to showcase his capacious intellect and gift for wry humor.

In The Boy Detective, Roger Rosenblatt transforms a winter night's walk through the streets of New York City into a wide-ranging excursion into the territory of memory that invites comparison to Alfred Kazin's A Walker in the City. Following the tragedy-inspired memoirs Making Toast and Kayak Morning, this book allows Rosenblatt to showcase his capacious intellect and gift for wry humor.