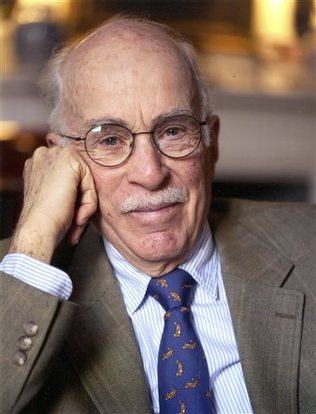

Riggio Unloads B&N Stock

Barnes & Noble's chairman Leonard Riggio sold two million shares in the company for $13.81 per share, lowering his stake as largest shareholder to 26.3%, according to a filing yesterday with the SEC. Reuters reported that the sale, "coupled with a donation of 160,000 shares Riggio made to a foundation that bears his name, leaves him with some 15.75 million shares." Earlier this year, Riggio had explored the possibility of buying out B&N.

Barnes & Noble's chairman Leonard Riggio sold two million shares in the company for $13.81 per share, lowering his stake as largest shareholder to 26.3%, according to a filing yesterday with the SEC. Reuters reported that the sale, "coupled with a donation of 160,000 shares Riggio made to a foundation that bears his name, leaves him with some 15.75 million shares." Earlier this year, Riggio had explored the possibility of buying out B&N.

The filing described the sale as a "privately negotiated block trade" for tax purposes. The Wall Street Journal reported that Riggio realized a loss of about $40 million, but would use the losses to offset gains from other investments, adding he doesn't have "any intentions of selling more shares."

The two million shares "appear to be part of a total of about 3.3 million shares in Barnes & Noble he acquired between the summer of 2007 and spring of 2008, with the bulk bought between $26 and $32," the Journal wrote, adding: "The period of his buying coincided with aggressive acquisitions by activist hedge fund Pershing Square Capital Management, which accumulated a stake of 11.3% by April of 2008."

Riggio said he plans to hold on to his remaining shares: "I intend to be a big owner for a long time."

SHELFAWARENESS.1222.S1.BESTADSWEBINAR.gif)

SHELFAWARENESS.1222.T1.BESTADSWEBINAR.gif)

In a review of Brad Stone's book The Everything Store: Jeff Bezos and the Age of Amazon in the December issue of Harper's, deputy editor James Marcus reported on what

In a review of Brad Stone's book The Everything Store: Jeff Bezos and the Age of Amazon in the December issue of Harper's, deputy editor James Marcus reported on what  The

The  Winning the Nobel Prize in Literature proved to be a sales bonanza for Alice Munro.

Winning the Nobel Prize in Literature proved to be a sales bonanza for Alice Munro.  After closing in October for renovations, the Books-A-Million store on Laurens Road in Greenville, S.C., has reopened as one of BAM's

After closing in October for renovations, the Books-A-Million store on Laurens Road in Greenville, S.C., has reopened as one of BAM's  Amy Tan and 500 of her fans posed with their copies of her new novel, The Valley of Amazement (HarperCollins), at an event Monday night sponsored by

Amy Tan and 500 of her fans posed with their copies of her new novel, The Valley of Amazement (HarperCollins), at an event Monday night sponsored by  Anne Waters

Anne Waters

Last month at the Mohegan Sun Casino in Uncasville, Conn., somewhere "beyond the blackjack tables, Jimmy Buffett's Margaritaville and Michael Jordan's Steakhouse,

Last month at the Mohegan Sun Casino in Uncasville, Conn., somewhere "beyond the blackjack tables, Jimmy Buffett's Margaritaville and Michael Jordan's Steakhouse,  Snapshot

Snapshot

The GBO described the book this way: "Back to Back begins in 1954 and centers on a single family living in Berlin in the socialist East. The mother, Käthe, is a sculptor of Jewish heritage who has been leveraging her party connections in order to get more important and significant commissions. Devoted entirely to becoming a success in the socialist state, she is a cruel and completely unaffectionate mother, putting the party above her children, who she treats like adults--there is no bourgeois coddling in her household. Thomas and Ella's father emigrated to West Germany after World War II, and they deeply long to see him again, dreaming of the kind of childhood other children enjoy. But Käthe's hard-nosed brutality--a reflection of the materialistic, unsentimental state in which she lives--means that Thomas and Ella are unable to live the lives they want to. Instead of his dream of becoming a writer, Thomas is forced to study geology and do hard labor at a quarry as the practical part of his education. And Ella, meanwhile, is becoming increasingly introverted and strange.

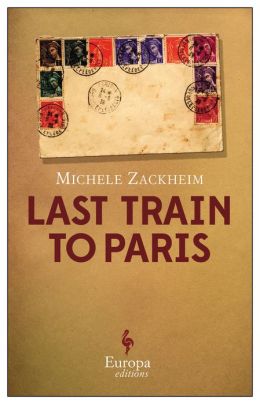

The GBO described the book this way: "Back to Back begins in 1954 and centers on a single family living in Berlin in the socialist East. The mother, Käthe, is a sculptor of Jewish heritage who has been leveraging her party connections in order to get more important and significant commissions. Devoted entirely to becoming a success in the socialist state, she is a cruel and completely unaffectionate mother, putting the party above her children, who she treats like adults--there is no bourgeois coddling in her household. Thomas and Ella's father emigrated to West Germany after World War II, and they deeply long to see him again, dreaming of the kind of childhood other children enjoy. But Käthe's hard-nosed brutality--a reflection of the materialistic, unsentimental state in which she lives--means that Thomas and Ella are unable to live the lives they want to. Instead of his dream of becoming a writer, Thomas is forced to study geology and do hard labor at a quarry as the practical part of his education. And Ella, meanwhile, is becoming increasingly introverted and strange. In Michele Zackheim's The Last Train to Paris, an oddly personal and touching novel of a half-Jewish woman learning to be herself in a world gone mad with hate, an 87-year-old woman tending her garden in upstate New York decides to go through her newsroom notes from the 1930s, when she was a foreign correspondent in Europe.

In Michele Zackheim's The Last Train to Paris, an oddly personal and touching novel of a half-Jewish woman learning to be herself in a world gone mad with hate, an 87-year-old woman tending her garden in upstate New York decides to go through her newsroom notes from the 1930s, when she was a foreign correspondent in Europe.