'I Always Get Such a Surge of Joy When I See My Books Stocked at Indies'

"I love my indie bookstores. My favorites here in Baltimore are Charm City Books and Greedy Reads! I think indies are the most important players in the book world right now.

"Especially with all the book banning, corporate bookstores might feel the need to play it safe in terms of what they stock. Indie bookstores are doing the critical work of maintaining our communities, uplifting marginalized voices, and doing the tough work--the important work. They're never just a bookstore. They're a community center of education and resources. I also work a lot with East City Bookshop for my pre-order campaigns. They're down in D.C. and they're phenomenal. The work they do is incredible.

"Especially with all the book banning, corporate bookstores might feel the need to play it safe in terms of what they stock. Indie bookstores are doing the critical work of maintaining our communities, uplifting marginalized voices, and doing the tough work--the important work. They're never just a bookstore. They're a community center of education and resources. I also work a lot with East City Bookshop for my pre-order campaigns. They're down in D.C. and they're phenomenal. The work they do is incredible.

"As for me and for my career, I always get such a surge of joy when I see my books stocked at indies because it feels so intentional. It feels personal. If I introduce myself to the bookseller, they'll point out exactly which staff member recommended that book. It's a real community. It feels like you read a book, you liked it, and you want to share it with your neighbor. I love being a part of it."

Next Monday, March 16, at 8 p.m. Eastern,

Next Monday, March 16, at 8 p.m. Eastern,

"The teeniest weeniest bit of snow--

"The teeniest weeniest bit of snow-- The End of My Life Is Killing Me

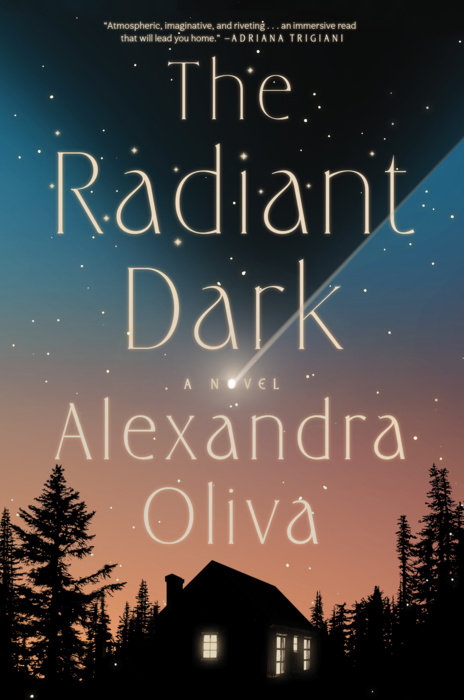

The End of My Life Is Killing Me Alexandra Oliva explores the tangled bonds between mothers and daughters, and the implications of generational cycles, in her thought-provoking third novel, The Radiant Dark.

Alexandra Oliva explores the tangled bonds between mothers and daughters, and the implications of generational cycles, in her thought-provoking third novel, The Radiant Dark.