B&N Third Quarter: Sales Up 5%; Net Income Down 14.2%

Total sales at Barnes & Noble in the third quarter ended January 28, rose 5%, to $2.4 billion, and net income was $52 million, a 14.2% drop from the net gain of $60.6 million in the same period last year.

Total sales at Barnes & Noble in the third quarter ended January 28, rose 5%, to $2.4 billion, and net income was $52 million, a 14.2% drop from the net gain of $60.6 million in the same period last year.At B&N trade stores, sales rose 2%, to $1.49 billion, and sales at stores open at least a year rose 2.8%. Store "core" sales--which excludes the sale of devices, accessories and warranties--rose 4.2%. B&N College sales fell 3%, to $525 million, "due to a shift from selling new and used textbooks to lower-priced textbook rentals." Sales at college stores open at least a year were flat. B&N.com sales rose 32%, to $420 million, mainly because of the continued growth of Nook e-readers and digital content sales, offset by a decline in sales of printed books online.

B&N CEO William Lynch commented: "In the third quarter, our traffic and sales in stores were the highest we've seen in five years. Our physical book sales at our stores increased more than 4% over last year, and our merchandising changes in our juvenile business and our toys & games department experienced double-digit revenue growth."

B&N predicted that sales for the full fiscal year will be between $7 billion and $7.2 billion. Sales at stores open at least a year should rise 1%, college store sales will be flat and sales at B&N.com should rise 40%-50%. The Nook business will likely have sales of $1.5 billion this fiscal year.

---

In related news, G Asset Management, which describes itself as "a value-oriented investment firm," has bought a 5% stake in B&N, making it the bookseller's fifth-largest investor. In a filing with the Securities and Exchange Commission quoted by Bloomberg Businessweek, G Asset president and chief investment officer Michael Glickstein said B&N is undervalued and supported the idea, first made public by the company in January, of spinning off the Nook business. This places G Asset on the side of John Malone's Liberty Media, which reportedly has pushed for the move. Liberty Media owns 16.6% of B&N and has two representatives on the board.

---

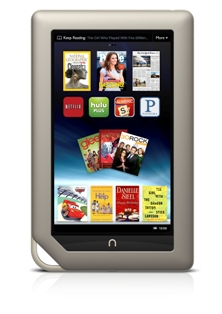

In yet more news, B&N has introduced an 8GB version of the Nook Tablet, which is selling for $199, a price competitive with Amazon's Kindle Fire. "It's a smart, if possibly-overdue move for B&N," Techcrunch said. "Amazon has already been playing up their price advantage with a national marketing campaign, and while it targets the iPad specifically, the message still applies to B&N's slightly pricier tablet."

In yet more news, B&N has introduced an 8GB version of the Nook Tablet, which is selling for $199, a price competitive with Amazon's Kindle Fire. "It's a smart, if possibly-overdue move for B&N," Techcrunch said. "Amazon has already been playing up their price advantage with a national marketing campaign, and while it targets the iPad specifically, the message still applies to B&N's slightly pricier tablet."

IPC.0204.S3.INDIEPRESSMONTHCONTEST.gif)

IPC.0211.T4.INDIEPRESSMONTH.gif)

Patti McCall, co-owner and then owner of

Patti McCall, co-owner and then owner of  When renovations at MainStreet BookEnds, Warner, N.H., are completed in April, the result will be "a dream come true," co-owner Katharine Nevins told the Concord Monitor. The main part of the renovations: the barn that is attached to the store, which is currently devoted to children's toys and books, will become a space for events and other gatherings, have a kitchen, wi-fi and tables.

When renovations at MainStreet BookEnds, Warner, N.H., are completed in April, the result will be "a dream come true," co-owner Katharine Nevins told the Concord Monitor. The main part of the renovations: the barn that is attached to the store, which is currently devoted to children's toys and books, will become a space for events and other gatherings, have a kitchen, wi-fi and tables.

Until March 20, Spoonbill & Sugartown, Brooklyn, N.Y., is offering a 10% discount to "all Pisces." The announcement includes this fine print: "I.D. required, no books placed on hold, in-store purchases only."

Until March 20, Spoonbill & Sugartown, Brooklyn, N.Y., is offering a 10% discount to "all Pisces." The announcement includes this fine print: "I.D. required, no books placed on hold, in-store purchases only." For "Mockingjay-pin possessors," Entertainment Weekly showcased the songs and performers that will be on the

For "Mockingjay-pin possessors," Entertainment Weekly showcased the songs and performers that will be on the  Though most well-known for her fiction (including the Pulitzer Prize-winning Gilead), Marilynne Robinson is also an accomplished essayist. When I Was a Child I Read Books is her fourth collection of essays, carrying forward themes for which she is consistently recognized: faith, culture, patriotism and self-identity. In exploring these ideas--and her ideals--Robinson leaves no subject untouched, from the role of science in explaining our origins to the practical worship of capitalism in the 21st century, from our treatment of the poor to the intertwined nature of religious identity and American patriotism.

Though most well-known for her fiction (including the Pulitzer Prize-winning Gilead), Marilynne Robinson is also an accomplished essayist. When I Was a Child I Read Books is her fourth collection of essays, carrying forward themes for which she is consistently recognized: faith, culture, patriotism and self-identity. In exploring these ideas--and her ideals--Robinson leaves no subject untouched, from the role of science in explaining our origins to the practical worship of capitalism in the 21st century, from our treatment of the poor to the intertwined nature of religious identity and American patriotism.