Australia's Parliament has passed legislation imposing a 10% goods and services tax on low-value imports, including books, purchased from online overseas sellers, effective July 1, 2018. Vendors with less than AU$75,000 (about US$59,250) turnover are exempt. Amazon was among the companies opposing the law. Books+Publishing reported that "the government first announced its intention to repeal the AU$1,000 [about US$790] GST-free threshold on online imports in 2015. The Australian Booksellers Association has long campaigned on the issue and advocated a zero threshold on overseas purchases."

Australia's Parliament has passed legislation imposing a 10% goods and services tax on low-value imports, including books, purchased from online overseas sellers, effective July 1, 2018. Vendors with less than AU$75,000 (about US$59,250) turnover are exempt. Amazon was among the companies opposing the law. Books+Publishing reported that "the government first announced its intention to repeal the AU$1,000 [about US$790] GST-free threshold on online imports in 2015. The Australian Booksellers Association has long campaigned on the issue and advocated a zero threshold on overseas purchases."

In a recent speech at the Booksellers NZ Conference in Auckland, ABA CEO Joel Becker said that from the beginning, the organization's campaign was largely based on two main contentions: "When the GST was introduced in Australia, everyone was fairly clueless about eCommerce. The most radical thing happening was being able to order your pizza online, and had little to do with global commerce. Over the last 15 years or so, billions of dollars have been lost to the economy as people buy cameras and books and bicycles and cosmetics and everything else imaginable online and offshore. Those billions of dollars [didn't go] to paying for schools, hospitals, roads, social services police and essential infrastructure. A great black hole was created.

"The second issue was one of a level playing field. In effect, in the name of free enterprise and a global economy, the free marketeers assisted in the creation of a virtual protection racket; and those being protected were off-shore global entities, who had a 10% (15% in N.Z.) head start. On top of that, because of the International Postal Union Treaty, companies like Amazon's baby brother, BookDepository, could ship to Australia with advantageous postal rates from Royal Mail and ridiculous tax concessions."

Two years ago, Joe Hockey, who was Federal Treasurer at the time, announced the government would legislate to close the loophole. Earlier this year, with legislation proposed to take effect on July 1, 2017, "there were hearings which featured a team of tax lawyers from Google, eBay, Ali Baba, and--guess who--Amazon, telling a parliamentary committee that it was all too complex. They suggested didn't have sophisticated enough systems to deliver," Becker noted.

At the time, Kevin Willis, Amazon's director of global trade services, told the Sydney Morning Herald the collection model was "unworkable" and the bill as it stood might destroy competition and raise prices. He added that he had never seen a tax of this magnitude and complexity.

"Here I'll admit that the 'gag reflex' started to take hold," Becker recalled. "Imagine that--the most sophisticated tech companies in the world didn't have the capacity to do what every business in Australia and New Zealand does every day! And they got their way... for a while. The government decided that they needed to give them 12 months to do what I suspect they could have done in 24 hours. However--and this is the good news, they did move forward!"

"I believe that fiction can change people's hearts and minds. About 90% of the correspondence I received after writing The Storied Life of A.J. Fikry ended with the reader telling me, 'I am now off to visit my independent bookstore.' Surely, these people had noticed that there were fewer bookstores in their communities before reading A.J. Fikry. Surely, they'd come across the ubiquitous think pieces about the end of the American bookstore. And yet, a story can do what a think piece cannot. This is why I write books. And maybe this is why you sell them, too. We aren't in the book business; we are in the hearts and minds business."

"I believe that fiction can change people's hearts and minds. About 90% of the correspondence I received after writing The Storied Life of A.J. Fikry ended with the reader telling me, 'I am now off to visit my independent bookstore.' Surely, these people had noticed that there were fewer bookstores in their communities before reading A.J. Fikry. Surely, they'd come across the ubiquitous think pieces about the end of the American bookstore. And yet, a story can do what a think piece cannot. This is why I write books. And maybe this is why you sell them, too. We aren't in the book business; we are in the hearts and minds business."

IPC.0204.S3.INDIEPRESSMONTHCONTEST.gif)

"A new business unlike any other is making its way" to downtown Sweetwater, Tex., KTAB noted in reporting that

"A new business unlike any other is making its way" to downtown Sweetwater, Tex., KTAB noted in reporting that

The

The

Australia's Parliament has

Australia's Parliament has IPC.0211.T4.INDIEPRESSMONTH.gif)

At the Running Press office in Philadelphia, sibling authors Tenaya and André Darlington practiced for the publication of their book Booze & Vinyl: A Spirited Guide to Great Music and Mixed Drinks, in May 2018.

At the Running Press office in Philadelphia, sibling authors Tenaya and André Darlington practiced for the publication of their book Booze & Vinyl: A Spirited Guide to Great Music and Mixed Drinks, in May 2018. During its 90 years,

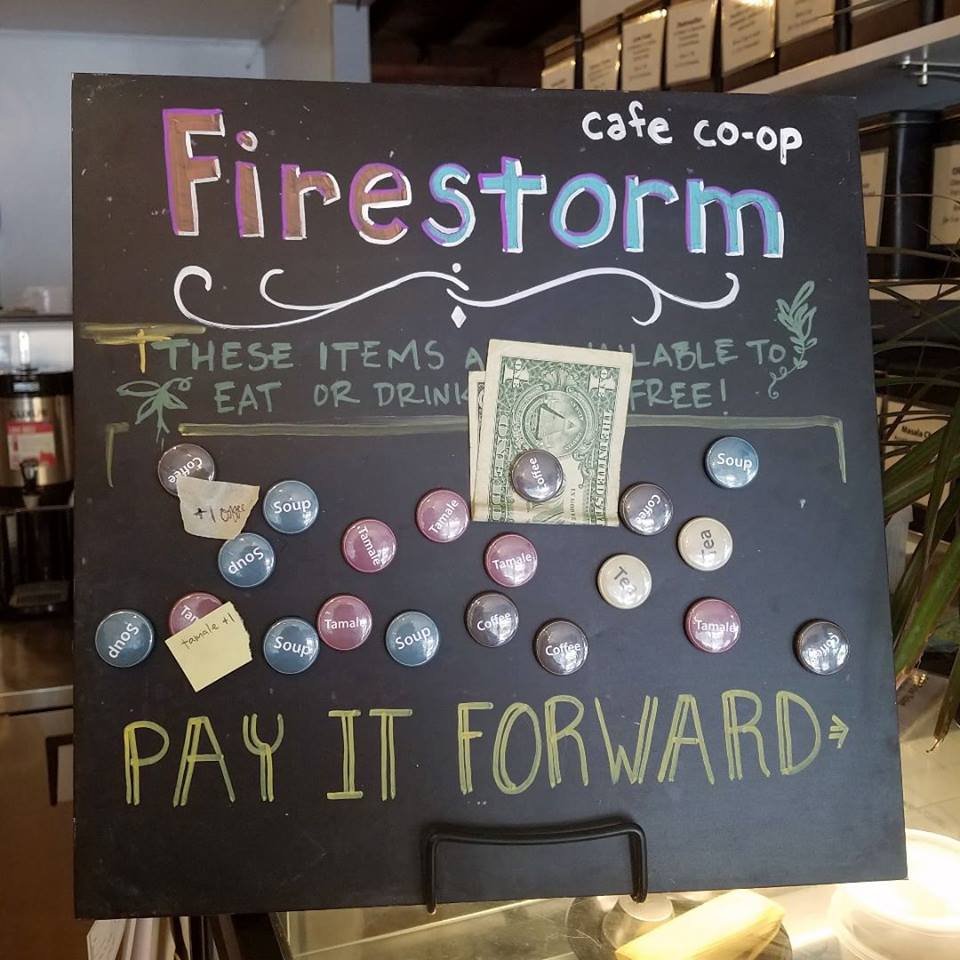

During its 90 years,  Pay it forward board. "In the past couple days, we've had

Pay it forward board. "In the past couple days, we've had  Mycroft Holmes and the Apocalypse Handbook

Mycroft Holmes and the Apocalypse Handbook Miami native Daniela Carolina Roger is the merchandiser for the flagship location of

Miami native Daniela Carolina Roger is the merchandiser for the flagship location of

Five books you'll never part with:

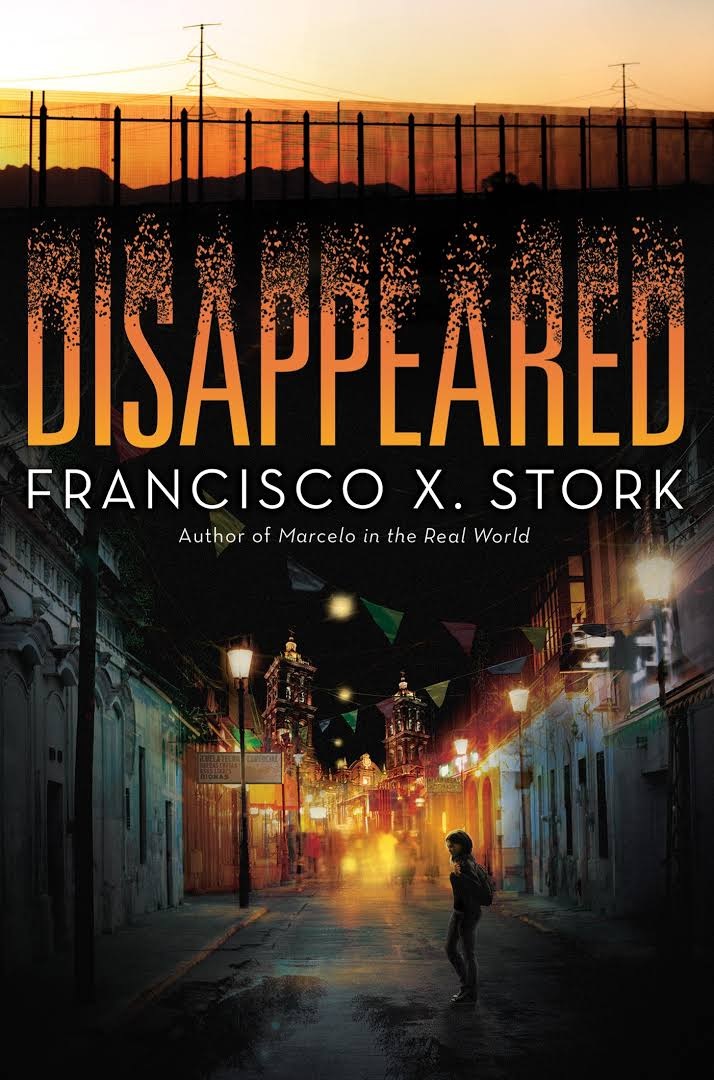

Five books you'll never part with: "Maybe in other cities in the world, a young woman can be one hour late and it isn't a cause for worry. In Juárez, that is simply not possible." In Juárez, Mexico, the bodies of girls who don't come home often are found months later. Sara Zapata's best friend, Linda, went missing four months ago. She's now one of the Desaparecidas, the Disappeared. Sara is determined not to give up on Linda and uses her position at a local newspaper, El Sol, to tell Linda's story and the stories of countless other Desaparecidas throughout Juárez. Though Sara has been threatened for her journalism before, she is shaken when the latest threat comes in to her bosses at El Sol: "If you publish anything of Linda Fuentes we will kill your reporter and her family." For the first time, she realizes her journalism may also put her mother and little brother, Emiliano, in danger. Still, Sara hasn't published a story about Linda since her first article after Linda's disappearance. Why would someone threaten her now?

"Maybe in other cities in the world, a young woman can be one hour late and it isn't a cause for worry. In Juárez, that is simply not possible." In Juárez, Mexico, the bodies of girls who don't come home often are found months later. Sara Zapata's best friend, Linda, went missing four months ago. She's now one of the Desaparecidas, the Disappeared. Sara is determined not to give up on Linda and uses her position at a local newspaper, El Sol, to tell Linda's story and the stories of countless other Desaparecidas throughout Juárez. Though Sara has been threatened for her journalism before, she is shaken when the latest threat comes in to her bosses at El Sol: "If you publish anything of Linda Fuentes we will kill your reporter and her family." For the first time, she realizes her journalism may also put her mother and little brother, Emiliano, in danger. Still, Sara hasn't published a story about Linda since her first article after Linda's disappearance. Why would someone threaten her now?