Federal Judge Rules Against Penguin Random House Purchase of Simon & Schuster

PRH responded, "We strongly disagree with today's decision, which is an unfortunate setback for readers and authors, and we will immediately request an expedited appeal. As we demonstrated throughout the trial, the Department of Justice's focus on advances to the world's best-paid authors instead of consumers or the intense competitiveness in the publishing sector runs contrary to its mission to ensure fair competition. We believe this merger will be pro-competitive, and we will continue to work closely with Paramount and Simon & Schuster on next steps."

Assistant Attorney General Jonathan Kanter of the Justice Department's Antitrust Division said, "Today's decision protects vital competition for books and is a victory for authors, readers, and the free exchange of ideas. The proposed merger would have reduced competition, decreased author compensation, diminished the breadth, depth, and diversity of our stories and ideas, and ultimately impoverished our democracy. The decision is also a victory for workers more broadly. It reaffirms that the antitrust laws protect competition for the acquisition of goods and services from workers."

Judge Florence Y. Pan issued only a short order and did not release the full order, which remains under seal until the parties make redactions of confidential information. The $2.2 billion purchase offer was announced in November 2020; the Justice Department filed suit in November 2021. In its original complaint, the Justice Department said that if the sale is completed, PRH "would be, by far, the largest book publisher in the United States, towering over its rivals. The merger would give Penguin Random House outsized influence over who and what is published, and how much authors are paid for their work. The deal... would likely harm competition in the publishing industry and should be blocked." It focused in particular on how the joint company would affect offers for "anticipated top-selling books."

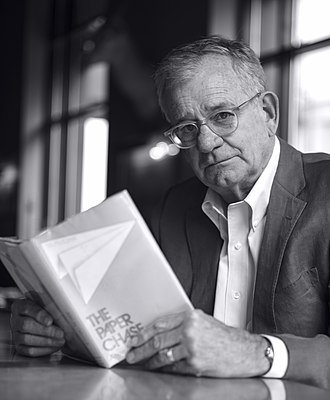

In the August trial, a range of people from the industry, including authors, agents, even the heads of PRH and S&S competitors, and others testified. Among them, Stephen King, published by S&S's Scribner imprint, spoke against the purchase, saying, "I came because I think that consolidation is bad for competition." Despite his personal successes, he said he was an exception: "It becomes tougher and tougher for writers to find money to live on."

Penguin Random House said that it would allow PRH and S&S imprints to bid against each other, seemingly negating the Justice Department's argument. In its pre-trial brief, the company said that the Justice Department "has narrowed its focus down to one very small segment of the market to acquire U.S. book rights: the set of about 1,200 books acquired annually for advances of at least $250,000, or about 2% of all books published by commercial publishers. The government treats this tiny price segment as a 'sub-market' and gives it a label--the market for the rights to 'anticipated top-selling books'--that is entirely unknown to industry participants.

"But even then, the government does not allege the merger will adversely affect all advances within that small price segment. Its focus tightens even further, narrowing down to advances paid when either PRH or S&S acquires the book. And yet according to the mathematical model the government invokes to prove harm, not even advances for all of those books will decline. By its terms, the model applies only to a specific kind of transaction--one very uncommon in the publishing industry. Based on the best available data, the type of transaction modeled by the government accounts for only approximately 85 books acquired annually, out of more than 55,000 total books published annually, and out of approximately 1,200 books acquired annually for advances of $250,000 or more."

PRH also emphasized that the Justice Department "has not alleged that the acquisition would harm competition in the sale of books," thus not affecting consumers, and that the company had not planned "any reduction in the number of books acquired or in amounts paid for those acquisitions."

Speculation will increase now about other possible suitors for S&S, which parent company Paramount Global wants to sell. Among the most logical: HarperCollins and Hachette Book Group.

SHELFAWARENESS.1222.S1.BESTADSWEBINAR.gif)

Pamela Pescosolido is selling the

Pamela Pescosolido is selling the

SHELFAWARENESS.1222.T1.BESTADSWEBINAR.gif)

Jenna and Nat Bowman, owners of

Jenna and Nat Bowman, owners of

The crew at

The crew at  Posted on Instagram yesterday by

Posted on Instagram yesterday by  "Thank you to everyone who came to

"Thank you to everyone who came to  Courage Under Fire: Under Siege and Outnumbered 58 to 1 on January 6

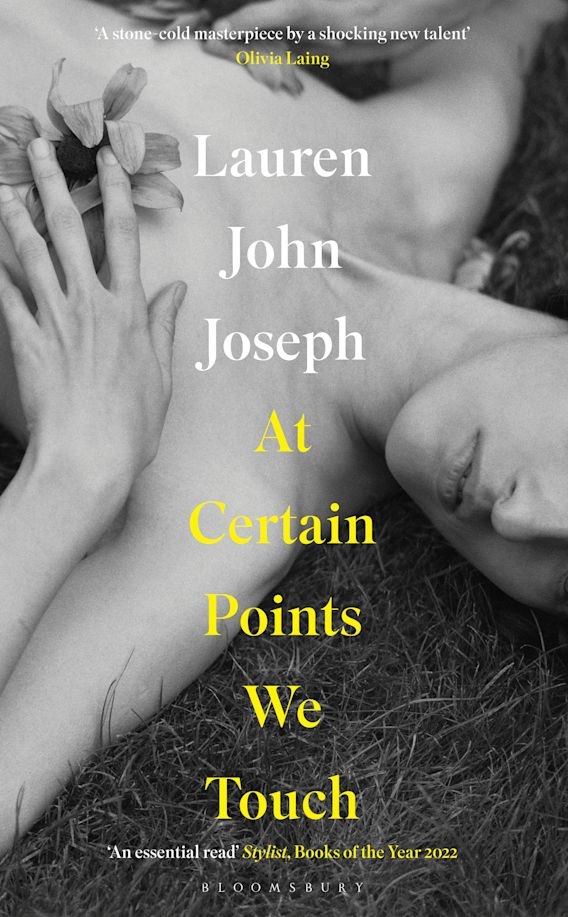

Courage Under Fire: Under Siege and Outnumbered 58 to 1 on January 6 Lauren John Joseph is extraordinarily talented on many fronts, having written plays, films and pop music (as Alexander Geist), as well as prose. At Certain Points We Touch, their first proper novel (after the experimental work Everything Must Go), distills those talents into a queer, autofictional love story both haunting and hilarious, and crystallizes Joseph as a literary artist of the highest caliber.

Lauren John Joseph is extraordinarily talented on many fronts, having written plays, films and pop music (as Alexander Geist), as well as prose. At Certain Points We Touch, their first proper novel (after the experimental work Everything Must Go), distills those talents into a queer, autofictional love story both haunting and hilarious, and crystallizes Joseph as a literary artist of the highest caliber.