Revenues for the U.S. book industry fell 2.6%, to $28.1 billion, in 2022, the Association of American Publishers stated in its StatShot Annual report. Still, 2022 results were 8.6% higher than $25.87 billion in 2019, the last full year before the pandemic.

Revenues for the U.S. book industry fell 2.6%, to $28.1 billion, in 2022, the Association of American Publishers stated in its StatShot Annual report. Still, 2022 results were 8.6% higher than $25.87 billion in 2019, the last full year before the pandemic.

"During the year, the publishing industry continued to show considerable resilience, with total revenues still above pre-pandemic levels," AAP chief operating officer Syreeta Swann said. "The fact that the five-year trend also shows consistent growth suggests that the industry is well positioned to weather a challenging economic environment and an evolving marketplace over the long haul."

The AAP StatShot Annual report is "more than the sum of AAP's monthly statistics analyses," the association noted. "Using quantitative methodologies, StatShot Annual estimates the total volume of the U.S. publishing industry by combining annual data submitted by publishers and distributors and by applying market modeling," mainly by estimating data for publishers that don't report their sales to the AAP.

Among highlights from the report:

Trade sales, the industry's largest category, fell 6.6%, to $17.36 billion. The drop in trade sales was attributable mostly to adult nonfiction, which was down 13.2%, to $5.52 billion. Adult fiction was up slightly by 0.6%, to $5.7 billion. Sales of children's/YA fiction and nonfiction were both down, 6.3%, to $3.95 million, and 7.2%, to $917 million, respectively.

For the first time since 2014, paperback sales, which slipped 0.5%, to $6.38 billion, were higher than hardcover sales, which dropped 13.6%, to $6.18 billion.

In trade, print books account for 73.1% of all units sold. Paperbacks account for 40.8% of all trade units sold, hardcovers 24.5%, and mass market 3.6%.

The only general category with a gain was pre-K-12--sales rose an impressive 16.6%, to $5.61 billion. Higher-ed sales dropped 7.2%, to $3.18 billion. Professional books sales dropped 6%, to $1.47 billion. Religious press sales fell 6%, to $1.27 billion. And university press sales dropped 7.7%, to $414 million.

For the seventh consecutive year, publisher sales via online retail channels were higher than sales via physical retail channels. Sales through online retail, which includes printed and digital books, fell 12.4%, to $8.19 billion, and sales through physical retail fell 5.8%, to $5.22 billion. By contrast, direct sales grew 12.3%, to $7.23 billion; "other" channels grew 13.1%, to $1.16 billion; and the intermediary channel was up 0.7%, to $5.05 billion.

In the online retail channel, 51.1% of publishers' sales were print formats; 39.3% were digital formats (including e-books and digital audio); 8% were instructional materials; and 1.6% were physical audio or other formats.

E-book sales fell 6.5%, to $1.95 billion, marking a long-term trend: except for 2020, the first year of the pandemic, e-book sales have fallen every year since 2014.

Digital audio sales rose 2.6%, to $1.81 billion. Digital audio sales have increased steadily since 2012.

"I really try only to shop at indie bookstores. There's something about walking into a space and seeing books that are carefully curated, instead of just the 10 most popular books in the country.

"I really try only to shop at indie bookstores. There's something about walking into a space and seeing books that are carefully curated, instead of just the 10 most popular books in the country.

SHELFAWARENESS.1222.S1.BESTADSWEBINAR.gif)

SHELFAWARENESS.1222.T1.BESTADSWEBINAR.gif)

Revenues for the U.S. book industry fell 2.6%, to $28.1 billion, in 2022, the Association of American Publishers stated in its StatShot Annual report. Still, 2022 results were 8.6% higher than $25.87 billion in 2019, the last full year before the pandemic.

Revenues for the U.S. book industry fell 2.6%, to $28.1 billion, in 2022, the Association of American Publishers stated in its StatShot Annual report. Still, 2022 results were 8.6% higher than $25.87 billion in 2019, the last full year before the pandemic.

"

" Homelands: A Personal History of Europe

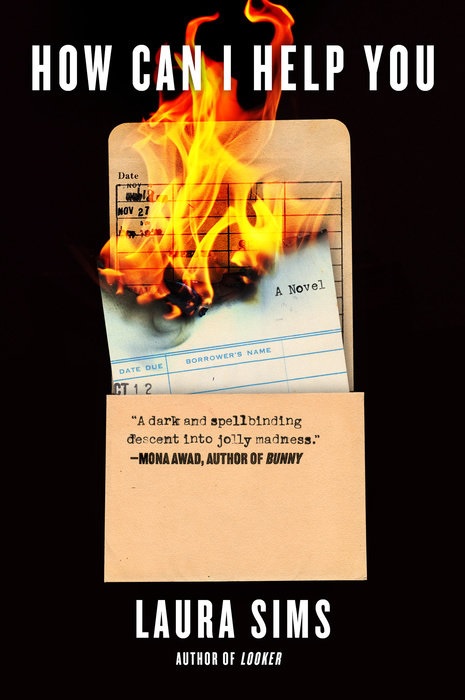

Homelands: A Personal History of Europe Libraries are generally placid places, and that's what makes Laura Sims's decision in the chilling How Can I Help You so ingenious--to create one that's home to a murderous character. Sims (

Libraries are generally placid places, and that's what makes Laura Sims's decision in the chilling How Can I Help You so ingenious--to create one that's home to a murderous character. Sims (