In the fourth quarter ended April 1, revenue at Indigo Books & Music fell 12%, to C$194.2 million (about US$146.6 million), and the net loss was C$42.5 million (US$32.1 million), compared to a loss of C$23.4 million (US$17.7 million) in the same period a year earlier.

In the fourth quarter ended April 1, revenue at Indigo Books & Music fell 12%, to C$194.2 million (about US$146.6 million), and the net loss was C$42.5 million (US$32.1 million), compared to a loss of C$23.4 million (US$17.7 million) in the same period a year earlier.

For the full fiscal year ended April 1, revenues slipped 0.4%, to C$1.062 billion (US$802 million), and the net loss was C$49.6 million (US$37.5 million), compared to a net gain the previous year of C$3.3 million (US$2.5 million).

Indigo's stock price dropped on the news, down 4.5%, to US$1.27 a share, near its all-time low three years ago, reached when the pandemic had fully hit.

The company said that results in the fourth quarter and for the full year were "heavily impacted by the ransomware attack" that came on February 8, leading to a shutdown of its e-commerce platform for a month, internal operational disruptions, an inability to process electronic payments for three days, the theft of some information about employees, and more. Indigo said that it has cyber insurance coverage and is working with its insurer to make claims under the policy. Business interruption losses cannot be reasonably estimated at this time, Indigo continued, but the company had C$5.2 million (US$3.9 million) of related expenses as of April 1.

Indigo said that "merchandise sales growth was achieved despite the ransomware attack, which compounded the headwinds of an already challenging macro-economic environment. Customers' desire to shop in-store fuelled a rebounding retail channel, which in the company's second quarter drove sales above pre-pandemic levels and in the third quarter delivered a record-breaking Boxing week... The general merchandise business increased 5.8% in the current year, with double-digit growth in the paper, baby and wellness product categories. The print business declined by 3.7%, negatively impacted by system limitations from the ransomware attack which adversely affected the company's ability to replenish its inventory levels."

In a conference call yesterday, Indigo added that online revenue fell, 21%, to C$253 million (US$190.7 million) during the year, partly because more customers were shopping in person in stores again as well as the ransomware attack. Compared to the pre-pandemic fiscal year 2020, however, online channel sales grew 71% through January before the ransomware attack.

Promotional sales were more important during the fiscal year and shoplifting rates rose. Shipping costs fell as online sales slipped, and aid to combat the effects of Covid fell. For a variety of reasons, including supply chain disruptions and the ransomware attack, inventory has fluctuated, and Indigo now has decided to "right size inventory... most notably through a more conservative replenishment strategy."

Not surprisingly, CEO Peter Ruis called this "a turbulent year for Indigo, as the progress gained from our post-pandemic re-emergence was negatively impacted by adverse macro-economic factors." He thanked "our incredible teams, who have been working tirelessly to bring operations back to normal. Through all of this, Indigo customers continued to show their loyalty to our brand, and we are proud to have achieved merchandise sales growth. We are looking forward to injecting momentum back into the business in fiscal 2024 with the exciting launch of a new digital platform in the late Summer and our new flagship store at the Well, Toronto in September."

In other Indigo news, the company announced the appointment of three new board members, including, most notably, Markus Dohle, who resigned as CEO of Penguin Random House last December. The other new board members are Donald Lewtas, former managing director of the Onex Corporation, and Joel Silver, former president of Indigo, both of whom will join the audit committee, which Lewtas will chair.

Earlier this month, four board members had resigned, and founder Heather Reisman announced her retirement, effective in August, after moving from CEO to executive chair last year.

In the fourth quarter ended April 1, revenue at Indigo Books & Music fell 12%, to C$194.2 million (about US$146.6 million), and the net loss was C$42.5 million (US$32.1 million), compared to a loss of C$23.4 million (US$17.7 million) in the same period a year earlier.

In the fourth quarter ended April 1, revenue at Indigo Books & Music fell 12%, to C$194.2 million (about US$146.6 million), and the net loss was C$42.5 million (US$32.1 million), compared to a loss of C$23.4 million (US$17.7 million) in the same period a year earlier. The Publishers Association has noted

The Publishers Association has noted

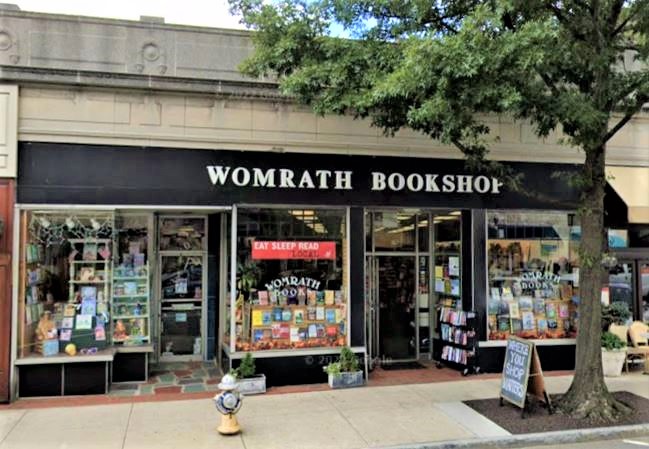

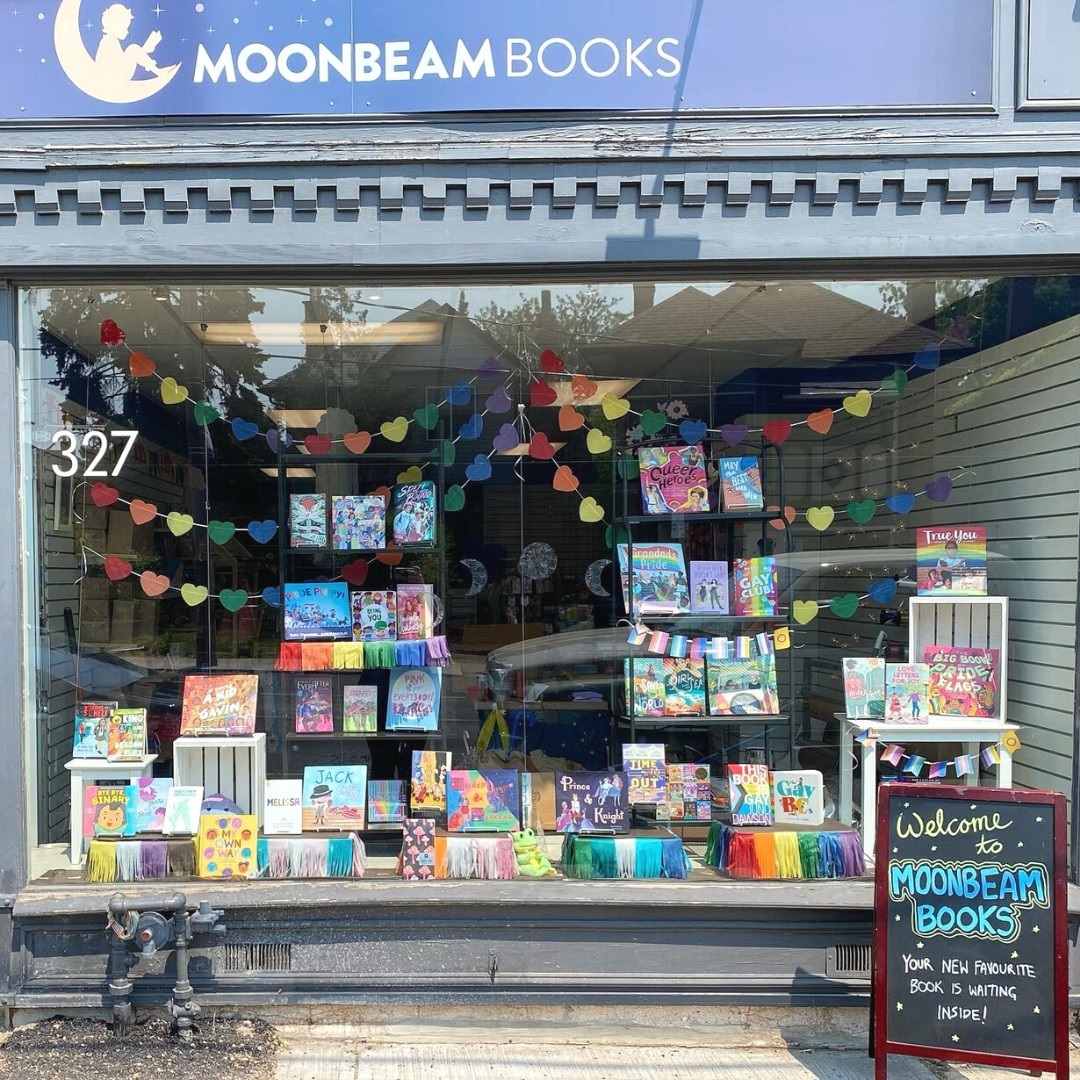

"This edition of #WindowShopping

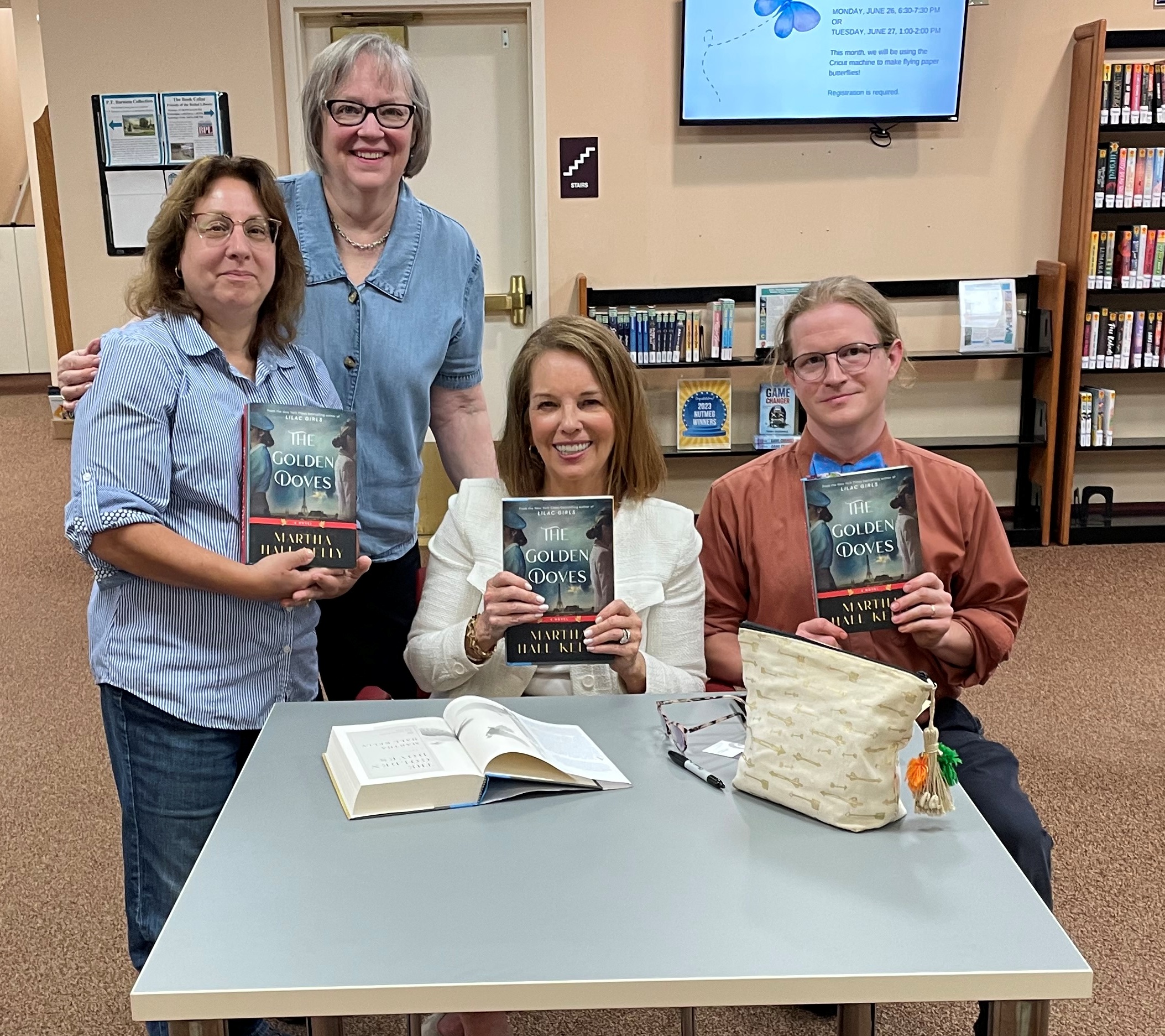

"This edition of #WindowShopping  Byrd's Books, Bethel, Conn., hosted an appearance by Martha Hall Kelly for her novel The Golden Doves (Ballantine) at the Bethel Public Library, across the street from the bookstore. Pictured: Kelly (second from r.) with Byrd's Books and Bethel Public Library staff Sue Morton, Alice Hutchinson, and Tom Borysiewicz.

Byrd's Books, Bethel, Conn., hosted an appearance by Martha Hall Kelly for her novel The Golden Doves (Ballantine) at the Bethel Public Library, across the street from the bookstore. Pictured: Kelly (second from r.) with Byrd's Books and Bethel Public Library staff Sue Morton, Alice Hutchinson, and Tom Borysiewicz. "Nothing like a fresh coat of paint. All the beautiful decorative elements on our

"Nothing like a fresh coat of paint. All the beautiful decorative elements on our  Eerie Tales from the School of Screams

Eerie Tales from the School of Screams With Return of the Bison: A Story of Survival, Restoration, and a Wilder World, naturalist Roger L. Di Silvestro (Theodore Roosevelt in the Badlands) chronicles the history of an iconic species. This exhaustively researched text briefly describes the bison's early massive proliferation across the North American continent, humans' heavy pursuit of them, and their near extinction as a result. But it begins in earnest with the earliest conservation efforts, in the 1880s, through the present. Di Silvestro outlines the stories of the American wood bison (western Canada and Alaska) and the European bison, or wisent, but his focus rests chiefly on the American plains bison, which until the late 1800s covered much of North America in the kinds of extraordinary numbers also associated with the now-extinct passenger pigeon. While the bison population has recovered from just a few hundred into the low hundreds of thousands (most of those in commercial herds), its fate is far from secure; in fact, according to some biologists, the bison is already ecologically extinct ("its numbers are so low, so scattered, that it no longer fulfills any ecological role"). The lessons of this story apply to the conservation of other megafauna worldwide, including giraffes, elephants, rhinos, and wildebeest.

With Return of the Bison: A Story of Survival, Restoration, and a Wilder World, naturalist Roger L. Di Silvestro (Theodore Roosevelt in the Badlands) chronicles the history of an iconic species. This exhaustively researched text briefly describes the bison's early massive proliferation across the North American continent, humans' heavy pursuit of them, and their near extinction as a result. But it begins in earnest with the earliest conservation efforts, in the 1880s, through the present. Di Silvestro outlines the stories of the American wood bison (western Canada and Alaska) and the European bison, or wisent, but his focus rests chiefly on the American plains bison, which until the late 1800s covered much of North America in the kinds of extraordinary numbers also associated with the now-extinct passenger pigeon. While the bison population has recovered from just a few hundred into the low hundreds of thousands (most of those in commercial herds), its fate is far from secure; in fact, according to some biologists, the bison is already ecologically extinct ("its numbers are so low, so scattered, that it no longer fulfills any ecological role"). The lessons of this story apply to the conservation of other megafauna worldwide, including giraffes, elephants, rhinos, and wildebeest.