Books Inc. Files for Chapter 11 Reorganization

Books Inc., which has 11 stores in the Bay Area in California, has filed for Chapter 11 reorganization in federal bankruptcy court, seeking to continue operations while it "establishes a sustainably solid financial footing." It will close its Berkeley store, whose lease was not extended at the end of last year after negotiations to reduce the rent were unsuccessful. Some of the Berkeley store staff will move to the other Books Inc. stores, and apart from that, Books Inc. intends to keep its 122 employees, whom it called "critical to its business operations." Besides the 11 stores, Books Inc. has a corporate office and warehouse, both located in the same building as its San Leandro store.

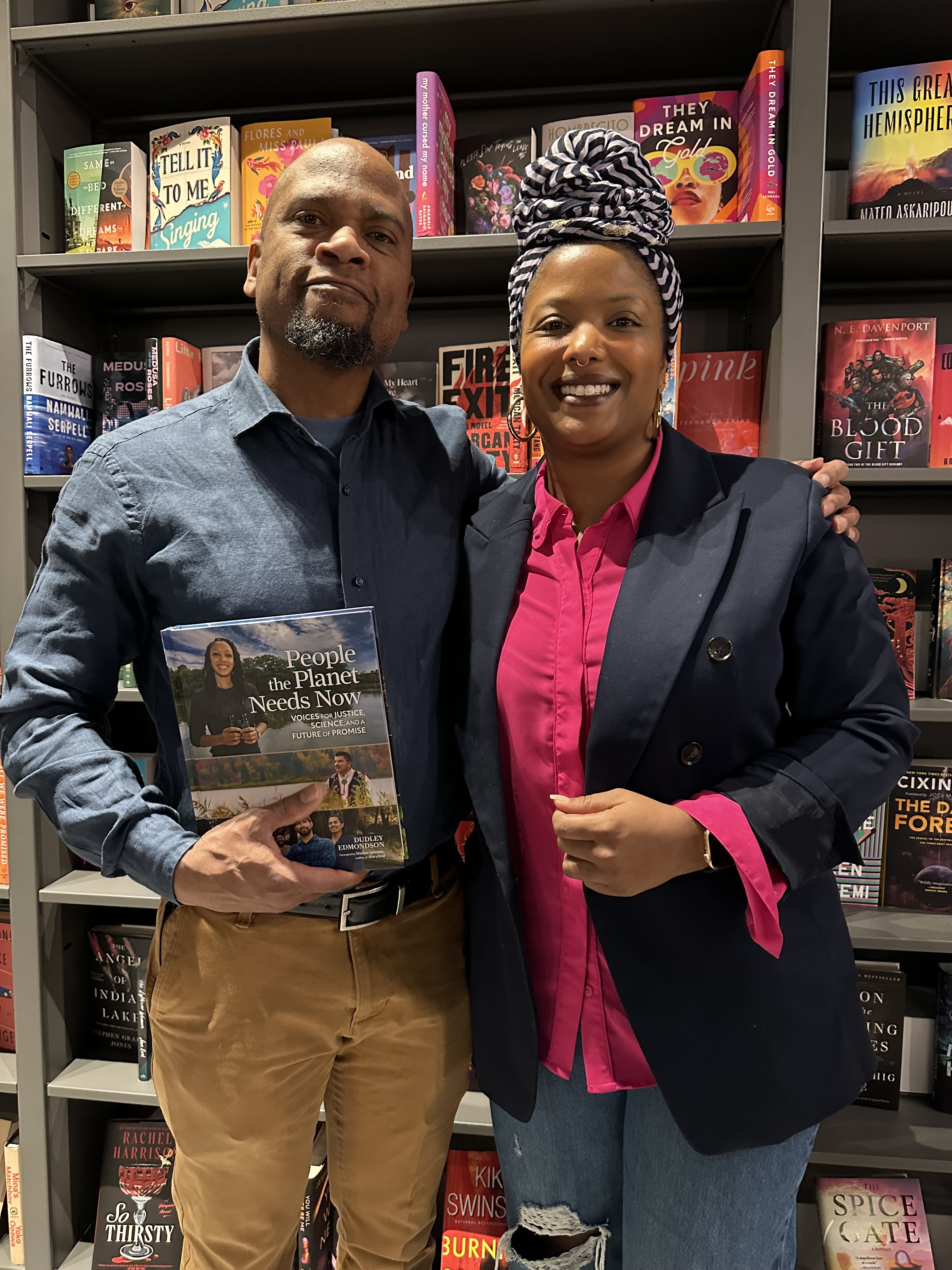

|

|

| Books Inc. in Berkeley | |

CEO Andy Perham said in a statement, "Books Inc. is not going away. Our board, investors, senior managers and key partners agree that reorganizing with the tools afforded us by Chapter 11 is the fastest path toward putting our company on a smaller, financially stronger platform from which we can continue our long legacy of serving California readers.

"Restructuring Books Inc. for long-term viability will require we make some very difficult decisions that affect our people and business partners, and we intend to do everything we can to minimize these impacts. The experience and dedication of our booksellers and management is the foundation on which we feel confident in our ability to transition Books Inc. to its next successful era."

Books Inc. was founded in 1851 and boasts of being the oldest independent bookstore in the West. It's noted for having stores that are quite different from each other in look and inventory, reflecting their differing cities and neighborhoods. The company has regularly expanded and contracted during its history. Thirty years ago it filed for Chapter 11 reorganization after longtime owner Lew Lengfeld died and Borders and Barnes & Noble superstores were expanding across the country. At that point, Books Inc. closed all but two of its stores, but then rebounded under the leadership of former CEO Michael Tucker and Stephen Mayer, both of whom remain directors and equity owners.

The main cause for the company's current problems, it said in its Chapter 11 filing, are "dramatic changes to consumer buying patterns" during and after the pandemic. The lockdowns and then the prevalence of hybrid and remote work have led to lower foot traffic and thus lower sales. At the Civic Center store in San Francisco, for example, foot traffic has declined to less than half of pre-pandemic levels. At the same that sales declined, Books Inc. has had to deal with "significant increases in operating costs, including higher payroll and rental expenses" as well as higher interest rates on its debts.

Sales dropped from $20.9 million in 2019 to $11.3 million in 2020, the first year of the pandemic. Sales improved in 2021, rising to $15.1 million, and to $17.7 million in 2022, then to $18.9 million in 2023. But last year, sales fell to $17.1 million--$3.75 million below 2019. Some 95% of revenue comes from in-store sales. The rest of sales is evenly split between online and event programming.

Books Inc.'s inventory is worth about $2.5 million. Secured debts amount to about $1.75 million. Unsecured debts, including money owed publishers, amount to about $3 million. Debts include unpaid California sales tax of $427,123.

Books Inc. described efforts it has taken to cut costs and return to profitability, including cutting store hours and shifting staff hours to reflect the changes in foot traffic. At the height of the pandemic, it also negotiated rent forgiveness and rent reductions. In addition, Books Inc. began a customer rewards program "to promote sales growth and customer loyalty" and moved its book fair programs, children's event programs, and community outreach programs--none of which were profitable--to its nonprofit Reading Bridge entity.

Under Chapter 11, Books Inc. intends "to work with its landlords to adjust lease costs to align with the current levels of foot traffic and sales" in its stores. If it can't negotiate changes at "underperforming" stores, it will close them.

Book sales in France decreased

Book sales in France decreased

A rare snowy day in New Orleans prompted this photo and succinct comment from Blue Cypress Books: "

A rare snowy day in New Orleans prompted this photo and succinct comment from Blue Cypress Books: " The Acceptance and Commitment Therapy Skills Workbook: Cope with Emotional Pain, Connect with What Matters, and Transform Your Life

The Acceptance and Commitment Therapy Skills Workbook: Cope with Emotional Pain, Connect with What Matters, and Transform Your Life

Book you're an evangelist for:

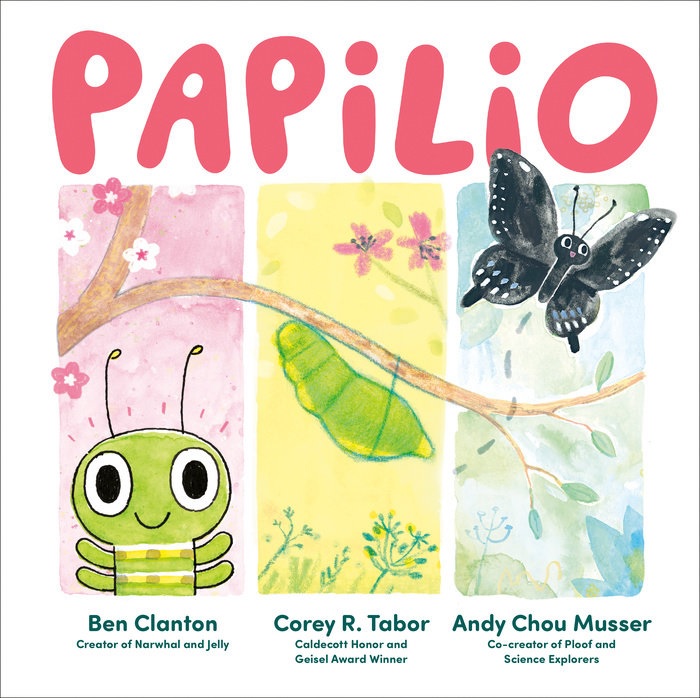

Book you're an evangelist for: Ben Clanton (

Ben Clanton (